Consider harvesting losses from this year’s core bond funds

Large core bond funds did poorly this year. Since the lion’s share of their returns is distributed through income, their price returns have been particularly affected— creating an opportunity for tax loss harvesting. Acting to deploy a tax loss harvesting strategy can potentially turn those losses into a tax benefit in April.

Sources: Morningstar Essentials, WisdomTree as of 10/31/23

Performance is historical and does not guarantee future results. Visit AGGY for fund risk and other important information.

Identifying client assets that have lost value since their initial investment, can create opportunities to:

- Offset capital gains elsewhere in their portfolios. Subject to IRS (Internal Revenue Services), stipulations regarding netting gains and losses.

- Lower their taxable income. Investors who harvested losses but don’t have enough gains to fully offset, may have an opportunity to lower their year-end tax bill with a reduction of up to $3,000 of ordinary income per year.

- Maintain allocation strategies by redeploying funds from the loss into an ETF or other vehicle that satisfies the SEC’s "wash sale" rule. The IRS “wash-sale” rule generally prevents investors from recognizing a tax loss on the sale of an investment if the investor repurchases the same or a “substantially identical” security for the period beginning 30-days before and ending 30-days after the sale.

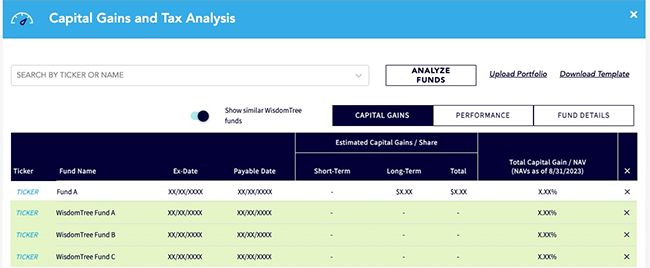

Try our Capital Gains and Tax Analysis tool

Explore potential tax loss harvesting opportunities with our interactive tool. Consider deploying the WisdomTree Yield Enhanced Aggregate Bond Fund (AGGY) after harvesting losses from core bond funds.

For illustration purpose only.