Harvesting Losses into a Field of Opportunity

As the calendar pages continue to dwindle here in 2023, investors may want to take stock of their fixed income portfolio and consider how to position for the new year. One input to consider is whether any of your holdings could be headed for a loss for the current year. While we are not tax advisors, a strategy that investors have employed in the past and may want to consider now is tax-loss harvesting, if applicable, and then reinvesting into solutions that can help position your bond portfolio for what may lie ahead in 2024.

Go to the Core

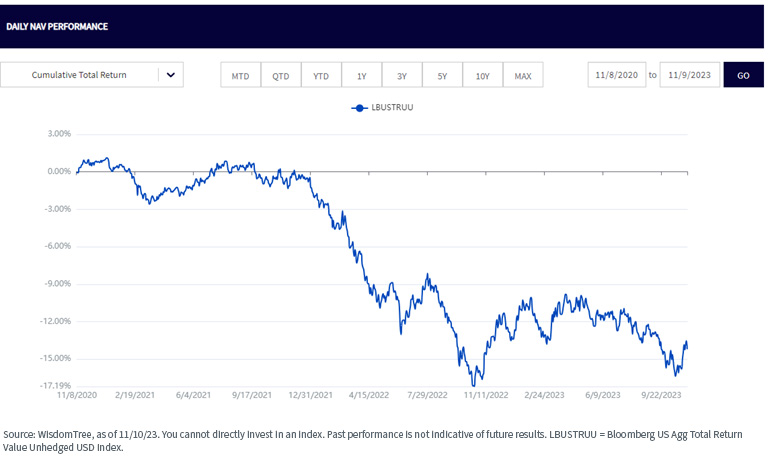

Specifically, within the fixed income arena, a good place to start the portfolio review process is with one’s core holding. Typically, this core holding is either the Bloomberg U.S. Aggregate Index (the Agg) or somehow tied or referenced to it. During pre-COVID-19 days, the Agg enjoyed many years of positive performance, but more recently, the string of years in the plus column has come to an end. In fact, calendar year 2022 was arguably its worst year on record in terms of performance.

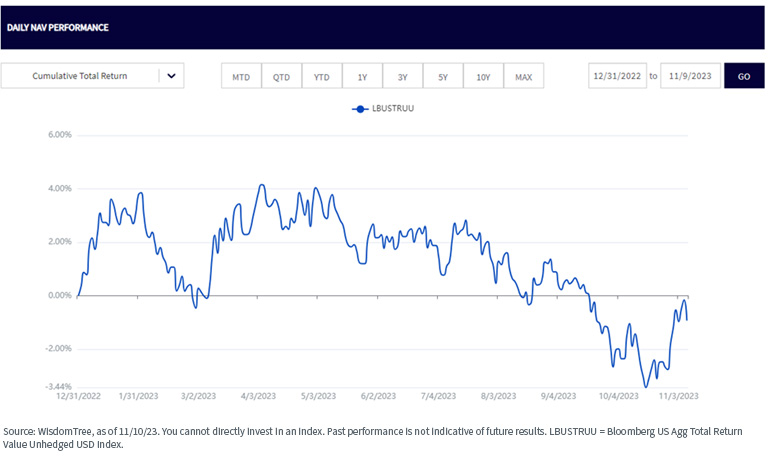

That brings us to where the Agg stands thus far in 2023. As you can see, after a volatile first eight or nine months to begin this year, performance has once again dipped into negative territory, and unless there is a bond market rally of consequence to end this year, it would appear as if the Agg could be in the negative column yet again.

So, What’s a Bond Investor to Do?

This is where repositioning for 2024 comes into play, where an investor could consider selling their current “Agg-like” position for tax loss harvesting and reallocate the funds accordingly. Based on our rate outlook of “high for longer” and the attendant heightened uncertainty that surrounds Fed policy, the time-tested barbell strategy comes into play. The barbell approach offers bond investors flexibility on the “rate call” while also providing potential income opportunities, given the “new” regime for fixed income yields.

What Should the Barbell Look Like?

In my opinion, investors should be using the “barbell” to achieve their overall fixed income duration and income needs. As a result, a combination of intermediate/core and ultra-short/short duration seems appropriate.

Our “in-house” barbell consists of the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) at one end and the WisdomTree Floating Rate Treasury Fund (USFR) as the other “weight.” This barbell offers a core strategic solution designed to help fixed income investors navigate the uncharted waters ahead without making a high-conviction bet on where Treasury yields may ultimately be headed.

Important Risks Related to this Article

AGGY: There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

USFR: There are risks associated with investing, including possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile

Neither WisdomTree nor its affiliates nor Foreside Fund Services, LLC, nor its affiliates provide tax advice. All references to tax matters or information provided here are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.

Related Content