Between the Lines

Key Takeaways

- The NFIB Small Business Survey has consistently shown pessimistic expectations for sales, the economy and earnings, but the U.S. economy has performed well despite this pessimism.

- Adjusting sales for inflation is considered nonsensical, and mentions of “inflation-adjusted revenues” are unlikely to appear in earnings reports.

- Small businesses have not fully participated in the post-COVID-19 recovery, and their potential involvement could be a significant economic catalyst.

Ignoring data can be useful. Because not all data is, in fact, useful. As the number of datasets has proliferated, so too has the noise created by them. But there can also be signals buried in the noise, particularly when it comes to survey-based soft data.

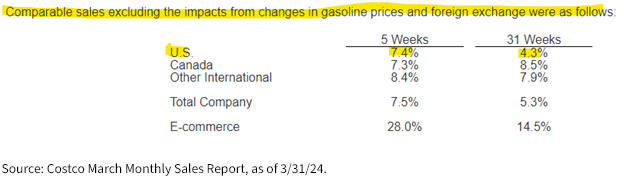

Enter the NFIB Small Business Survey.1 It could easily be argued that it should be ignored, given the rampant, near-permanent pessimism embedded in the survey. Will the economy improve? Probably not. Expect sales to improve? A solid maybe. That has been the general story for the past decade—excepting the 2016 to early 2020 period.

NFIB Expectations for Real Sales and Economy

The NFIB economic outlook has been and remains dismal. There is no way around it. But the U.S. economy has not succumbed to the gloom. Instead, it has powered through an on-again, off-again inflation cycle, with unemployment sitting at less than 4% and resilient GDP growth. All with a Federal Reserve bent on breaking inflation with elevated interest rates.

There are some oddities to the data, one being the question about “real” sales. After all, revenues are nominal, not adjusted for inflation. That injects two sources of error into the dataset: the outlook for sales and inflation. With earnings season beginning to pick up steam, mentions of “inflation-adjusted revenues” are likely to continue their long-term trend of around zero.

Costco adjusting sales for fluctuations in foreign exchange and gasoline prices? Of course. Adjusting for inflation? No. Because adjusting revenues or sales to inflation is nonsensical. Not to mention, Costco saw its same-store sales accelerate in March even when stripping out the roughly half percentage point boost from a shift in the timing of Easter.

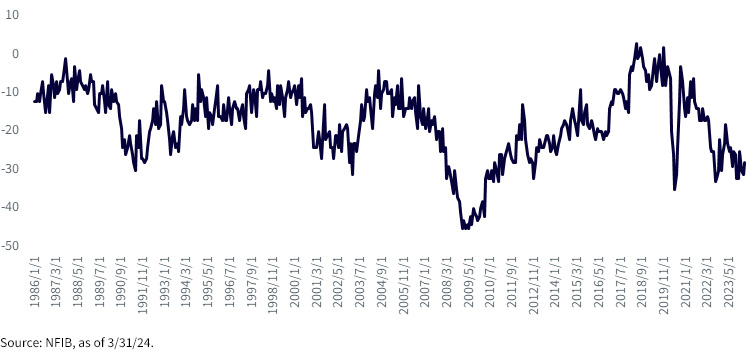

NFIB "Earnings Trends"

And then there is the question about earnings. According to the survey, there has only been a brief window of positivity in the past 38 years. In fact, recent readings are only marginally better than the figures seen in the immediate aftermath of the COVID-19 lockdowns. And—apparently—hiring has never bounced back.

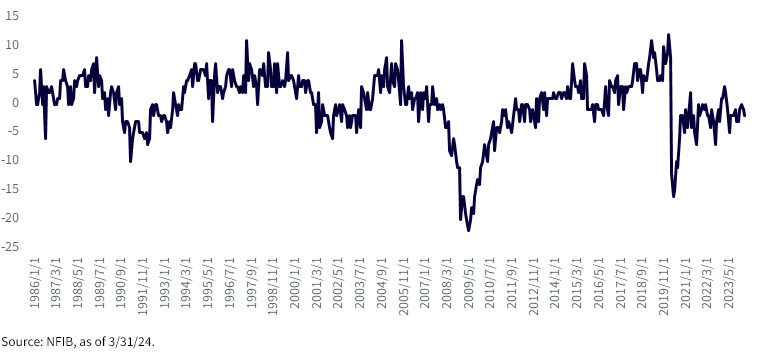

Actual Employment Changes

Why does any of this matter?

Partly, it reinforces the “handoff to normal.” If the economy has done this well with this much pessimism, what happens if and when the pessimism begins to fade? If—as the NFIB Survey suggests—small businesses have not participated in the post-COVID-19 recovery, what does the economy look like when they do?

In other words, pervasive skepticism can be viewed in a couple of ways. Superficially, it appears as a headwind to the U.S. economy. But that is already in the system. It is not “new news” for the U.S. economic outlook. Instead, it should be viewed as a potential economic catalyst. The handoff to normal could be a surprising revelation to those not paying attention.

1 NFIB sales and economy expectations are based on a question concerning the “next 6 months” and are reported on a net of “better” or “worse” answers.

NFIB earnings are based on a question regarding the last three months being “better” or “worse” than the previous three months.

NFIB actual employment based on a question regarding actual employment changes in the last three months.