Capturing Dividend Growth Requires a Nimble Responsiveness

Key Takeaways

- Dividends and buybacks are two ways companies can return cash to shareholders.

- Dividend-growth ETFs are popular among investors interested in companies that consistently raise their dividends over time, but it is typical to require constituents to demonstrate 5, 10 or even 20 years of historical growth.

- DGRW, without any historical dividend-growth requirements for constituents, has consistently outperformed other Funds like VIG, SDY, DVY and DGRO.

- Related Products WisdomTree U.S. Quality Dividend Growth Fund

In 2024, we have seen Meta Platforms, Salesforce.com and Booking Holdings (parent company of Priceline.com) initiating dividend payments.1 Many technology companies have accumulated significant amounts of cash, with more calls to return this cash to shareholders by initiating dividends.

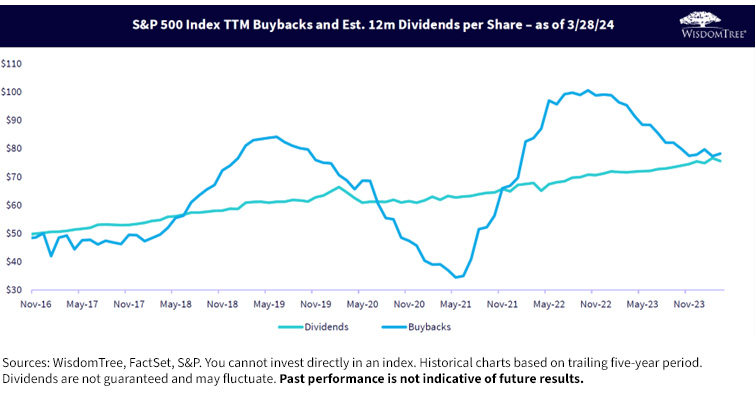

Of course, dividends are not the sole way cash can be returned to shareholders. In the U.S. equity landscape, buybacks can often be even larger.

- The psychology with which the investment world treats dividends feels more like an ongoing arrangement between the shareholders and the company and, once declared, expectations are to continue and even moderately increase over time. True, no dividend payment is ever ‘guaranteed’, but if a dividend is reduced or curtailed, it can be headline news amongst certain large companies—news these companies would prefer to avoid.

- Buybacks are less transparent. Boards of directors can announce buybacks that could occur over specific time frames, but they are not known as they are happening and are only visible in hindsight where one can confirm them on the quarterly statement of cash flows.

This chart on dividends versus buybacks shows the stability versus cyclicality and volatility of buyback streams—the two are hardly comparable if one wants a predictable stream of cash flows from stocks.

Figure 1: S&P 500 Index Trend of Dividends and Buybacks on a Per-Share Basis

One of the biggest categories—reflecting all the demand for this concept—is for dividend-growth ETFs. Investors love the idea of a company raising its dividend over time, and they love the idea of a stream of income that has the potential to grow over timeover time. Here are five of the largest such ETFs in the ecosystem:

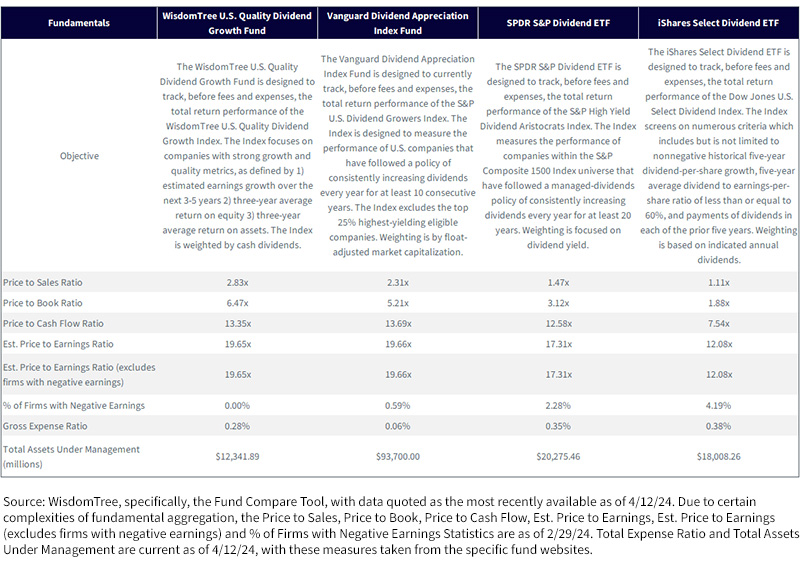

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW): The WisdomTree U.S. Quality Dividend Growth Fund is designed to track, before fees and expenses, the total return performance of the WisdomTree U.S. Quality Dividend Growth Index. The Index focuses on companies with strong growth and quality metrics, as defined by 1) estimated earnings growth over the next 3–5 years, 2) three-year average return on equity and 3) three-year average return on assets. The Index is weighted by cash dividends.2

- Vanguard Dividend Appreciation Index Fund (VIG): The Vanguard Dividend Appreciation Index Fund is designed to track, before fees and expenses, the total return performance of the S&P U.S. Dividend Growers Index. The Index measures the performance of U.S. companies that have followed a policy of consistently increasing dividends every year for at least 10 consecutive years. The Index excludes the top 25% of the highest-yielding eligible companies. Weighting is by float-adjusted market capitalization.3

- SPDR S&P Dividend ETF (SDY): The SPDR S&P Dividend ETF is designed to track, before fees and expenses, the total return performance of the S&P High Yield Dividend Aristocrats Index. The Index measures the performance of companies within the S&P Composite 1500 Index universe that have followed a managed-dividends policy of consistently increasing dividends every year for at least 20 years. Weighting is focused on dividend yield.4

- iShares Select Dividend ETF (DVY): The iShares Select Dividend ETF is designed to track, before fees and expenses, the total return performance of the Dow Jones U.S. Select Dividend Index. The Index screens on numerous criteria, which include, but are not limited to, 1) nonnegative historical five-year dividend-per-share growth, 2) a five-year average dividend-to-earnings-per-share ratio of less than or equal to 60% and 3) payments of dividends in each of the prior five years. Weighting is based on indicated annual dividends.5

- iShares Core Dividend Growth ETF (DGRO): The iShares Core Dividend Growth ETF is designed to track, before fees and expenses, the total return performance of the Morningstar U.S. Dividend Growth Index. The Index screens on numerous criteria, which include, but are not limited to, 1) a positive forecast of consensus earnings, 2) a dividend payout ratio less than 75% and 3) five years of dividend payments and uninterrupted annual dividend growth. The Index is dividend-dollar-weighted.6

To summarize one critical point involving historical dividend-growth requirements for each of the indexes tracked by these ETFs:

- DGRW—no historical dividend-growth requirement.

- VIG—10 consecutive years of historical dividend growth.

- SDY—20 consecutive years of historical dividend growth.

- DVY—nonnegative dividend per share growth for five years.

- DGRO—five years of dividend payments and uninterrupted annual dividend growth.

The reason we underline that point is simple: on February 1, 2024, Meta Platforms initiated a regular cash dividend.7

WisdomTree initiated a special rebalance to add this immediately substantial dividend payer to its appropriate Indexes, including the one tracked by DGRW, whereas these other approaches will have to wait varying numbers of years before Meta Platforms becomes eligible.

Of course, these dividend-growth requirements in a vacuum don’t mean much—we believe that what investors really care about are returns. If waiting 20 years to include companies that grow their dividends has been a route to strong performance—that’s great. If not, it’s a very stringent criterion that investors aren’t being compensated for.

Where the Rubber Meets the Road: Total Returns

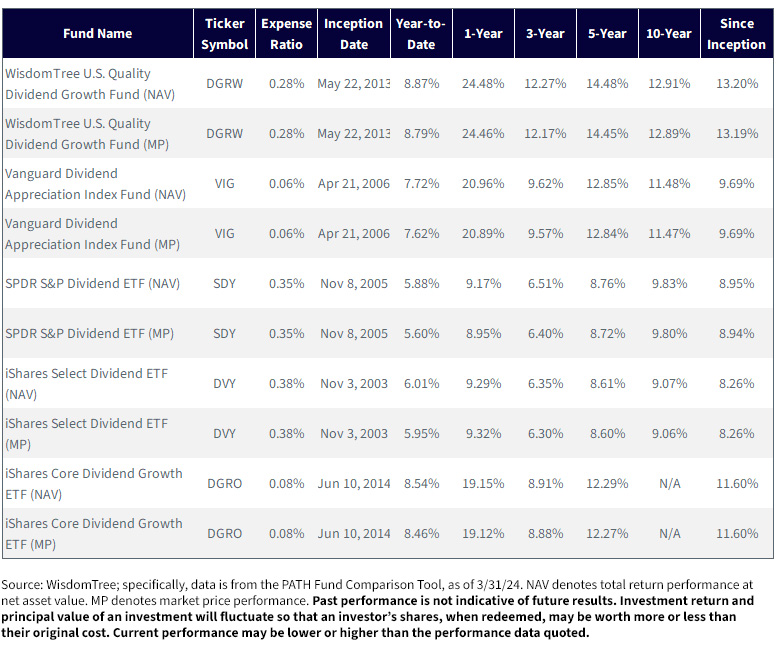

Many view the 10-year period as the most valid proof point in terms of returns. Being around for 10 years in the competitive investment management industry is impressive, and there is an implicit assumption that one should experience a few ups and downs in equity markets during a 10-year period. In figure 2a:

- DGRW had the strongest annualized 10-year return. VIG is in second place, even with its fee of 0.06%—we note that these results are net of fees. SDY is third, and DVY is last. DGRO did not quite have 10 full years of history as of this writing.

- We find it telling that—on an after-fee basis—DGRW actually had the strongest returns of the ETFs shown year-to-date, 1-year, 3-year, 5-year and 10-year. Remember, it is the only Fund whose underlying index does not have a requirement for historical dividend growth.

Figure 2a: Standardized Returns

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: DGRW, VIG, SDY, DVY and DGRO.

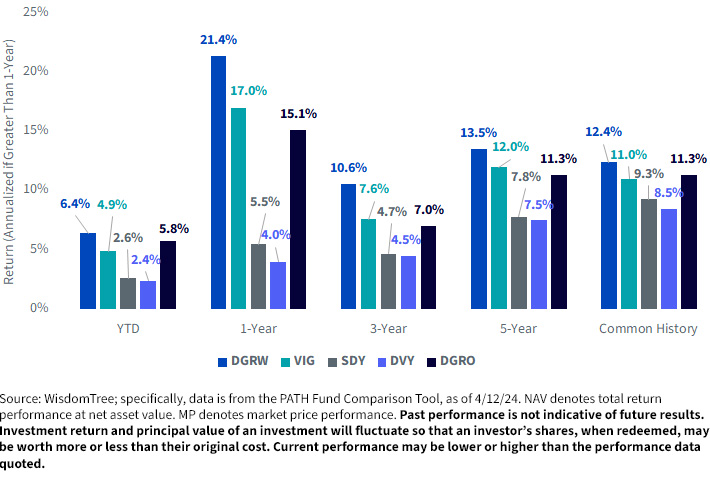

If we remove the need to look only at standardized returns (as of the end of a given quarter) and look as of April 12, 2024:

- DGRW was the strongest across the board, again. VIG and DGRO were the two top competitors in each of these periods. SDY and DVY were the relative laggards in each of these periods.

Figure 2b: Periodic Returns

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: DGRW, VIG, SDY, DVY and DGRO.

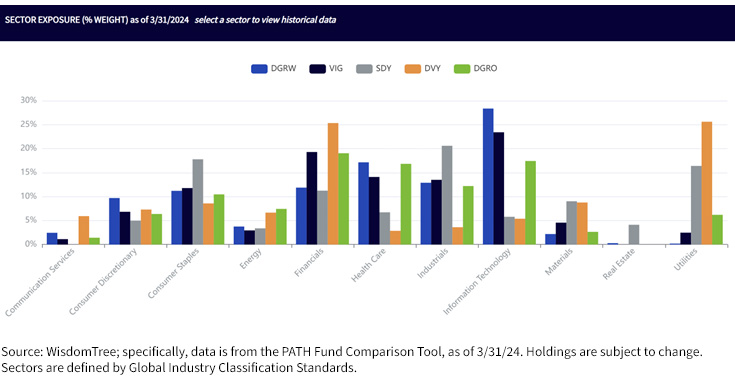

Sector Exposure: The Foundation of Understanding Dividend-Oriented ETFs

Different sectors have different relationships to dividend payments. Typically, one of the starkest comparisons involves looking at Utilities versus Information Technology:

- Utilities tend to have a high current dividend yield, but Utility companies are not growing their earnings very quickly and, therefore, tend not to grow their dividends very quickly.

- Information Technology companies have been the engine of growth for the U.S. equity market since the global financial crisis of 2008–2009. Many of the largest companies in this sector are paying extremely large dividends, buying back lots of their own stock and STILL accumulating massive amounts of cash on their balance sheets. However, many of these firms may not have been paying dividends for 10 or 20 years, and we believe waiting for 10 or 20 years is an arbitrary requirement that, for example, would have disqualified Apple from 2012 (dividend initiation)8 to 2022 if one was looking for 10 years.

When we look at figure 3:

- SDY and DVY emphasized weight to Utilities ahead of the other strategies. Similarly, they tilted away from the Information Technology sector.

- DGRW, VIG and DGRO placed more weight in the Information Technology sector and de-emphasized weight to the Utilities sector.

We think that contrast ultimately says a lot in terms of how different strategies are generating different performances.

Figure 3: A Comparison of Sector Exposures

Figure 4: Important Information Regarding Funds Compared in This Report

For definitions of terms in the table above, please visit the glossary.

If you are interested in diving more into the comparison of these Funds, please check out our Fund Comparison Tool.

1 Source: Paul R. La Monica, “In a Wobbly Market, Look for Dividend Growth,” Barron’s, 4/11/24.

2 Source: WisdomTree U.S. Quality Dividend Growth Index, WisdomTree, https://www.wisdomtree.com/investments/index/wtdgi

3 Source: S&P Dividend Growers Index Series Methodology, S&P Dow Jones Indexes, updated as of April 2024.

4 Source: S&P Dividend Aristocrats Indexes Methodology, S&P Dow Jones Indexes, updated as of January 2024.

5 Source: Dow Jones U.S. Select Dividend Index. S&P Dow Jones Indexes.

6 Source: Construction Rules for the Morningstar Dividend Growth Indexes, updated as of November 2023.

7 Source: Press release: “Meta Reports Fourth Quarter and Full Year 2023 Results; Initiates Quarterly Dividend,” 2/1/24.

8 Source: Press release: “Apple Announces Plans to Initiate Dividend and Share Repurchase Program,” 3/19/12.

Related Products

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

All funds are managed differently and do not react the same to economic or market events. The investment objectives, strategies, policies or restrictions of other funds may differ and more information can be found in their respective prospectuses. Therefore, we generally do not believe it is possible to make direct fund to fund comparisons in an effort to highlight the benefits of a fund versus another similarly managed fund.