How to Navigate the Ever-Changing Bond Landscape: The Barbell

Key Takeaways

- Investors can employ the time-tested barbell strategy to navigate the current bond market landscape and prepare for what lies ahead. This approach involves balancing short-term and long-term bonds, potentially providing both stability and higher returns.

- Recent shifts in U.S. Treasury yields highlight the dramatic changes in the interest rate backdrop. While a complete round trip hasn’t happened yet, understanding rate movements is crucial. The barbell strategy can help mitigate uncertainties arising from interest rate fluctuations.

- Keep an eye on upcoming Fed policy decisions. The initial expectation of six rate cuts has shifted, and there’s talk that no rate cuts may occur in 2024 if labor market and inflation data remain strong. Staying informed and adaptable is essential for bond investors.

The first three months and change of 2024 has brought with it a rather noteworthy shift in bond market sentiment. With Federal Reserve policy decision-making remaining data dependent for the foreseeable future, investors have been left to wonder how to position their fixed income portfolios for these changing interest rate landscapes. In our opinion, investors can use the time-tested barbell strategy to navigate not only the current setting, but more importantly, what potentially lies ahead.

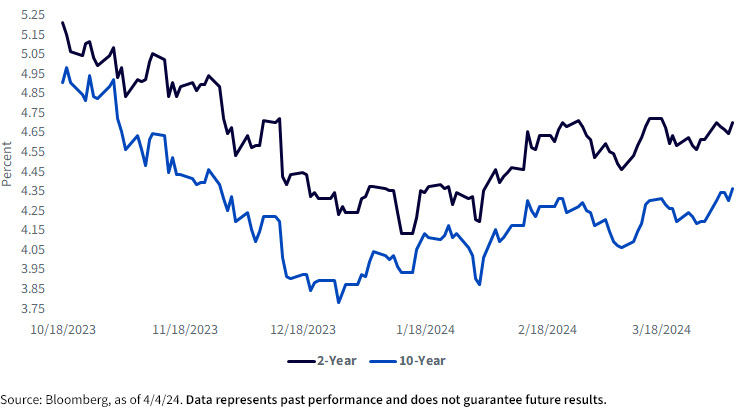

Let me provide a quick perspective of how rates and rate expectations have changed recently. One only needs to see the movement in U.S. Treasury (UST) yields over the last six months to highlight how the rate backdrop has shifted dramatically. After essentially hitting the 5% threshold, if not higher, the UST 2- and 10-Year yields fell by more than 100 basis points during the Q4 rally before reversing course and retracing more than 50% of that decline. While it hasn’t been a complete round trip, the story isn’t over yet.

U.S. Treasury Yields

While a repeat performance of this type of rate movement is not expected any time soon, this episode underscores the importance of using a strategy that can help navigate the uncertainties that still exist in the money and bond markets. What do I mean by uncertainties? Let’s begin and end with upcoming Fed policy decisions to keep it simple. Coming into the year, the expectation was for six rate cuts, with the initial move pegged for March. As I write this post, the implied probability for Fed Fund Futures has now slipped to about two rate cuts as compared to the Fed’s dot plot projection for three moves. In fact, there has been increasing talk that if the labor market and inflation data continues to come in as we’ve seen up to this point, perhaps there will be no rate cuts in 2024. For what it’s worth, I’m now in the two camp.

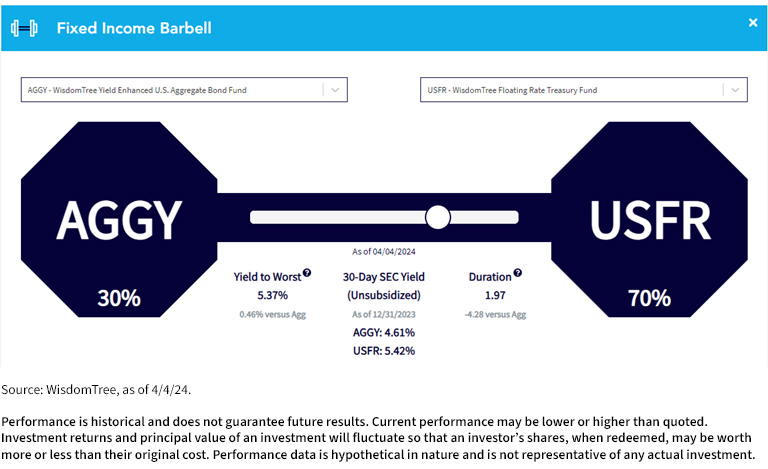

For each Fund’s full standardized performance, month-end data, risks and other important information, click the respective ticker: AGGY, USFR.

So, how can investors prepare their bond portfolios for this looming uncertainty, which, by the way, will likely carry into 2025? Back to the intro: the barbell strategy.

We believe the barbell strategy I’m going to discuss here allows investors the flexibility to begin adding duration in a deliberate fashion while still taking advantage of the income available in the ultra-short/short portion of the inverted yield curve. The “adding duration” aspect is designed to not only begin locking in yield outside of shorter-dated maturities, but also offers the ability to try and take part in a bond market rally if rates were to reverse course and fall again.

For illustrative purposes, the WisdomTree in-house barbell uses our Floating Rate Treasury Fund (USFR) for the ultra-short/short position and our Yield Enhanced U.S. Aggregate Bond Fund (AGGY) for the duration counterweight. As you can see, a 70 (USFR)/30 (AGGY) allocation provides a yield to worst of 5.37%, while bringing duration to just under two years (1.97). To sum up, this hypothetical barbell potentially offers a yield advantage of almost 50 basis points versus the benchmark Agg, but with only one-third of the duration risk.

Conclusion

With uncertainty surrounding Fed policy and bond yields, the barbell approach provides investors with a time-tested, flexible strategy to navigate the road ahead without making an outright rate call.

To see the barbell tool for yourself, please visit our Fixed Income Strategy page.

Related Products

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

USFR: Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs.

AGGY: Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs.