A (un)Certain Framework

Key Takeaways

- The FOMC has been using a varied set of targets for monetary policy, but the relevance of these data points is questioned.

- The FOMC has shifted away from specific metrics and adopted a more ambiguous strategy, focusing on caution and confidence.

- Inflation risks are seen as skewed higher, leading to a cautious approach by the FOMC in their pursuit of achieving inflation targets.

When it comes to articulating data related to monetary policy outcomes, the FOMC has conveyed an awkwardly varied set of targets. In mid-2022, then Vice-Chair Lael Brainard articulated the labor market needed to come into “better balance” before rate hikes would cease. Later in the year, Chair Powell brought “core services ex-shelter” to prominence in the pursuit of taming inflation. Call them the “intertwined two” guideposts for monetary policy.

But the question remains—do any of the myriad data points the FOMC has pointed to as guideposts still matter? The answer is no.

“Nominal wage growth has been easing, and job vacancies have declined.” That was the sole mention of job openings in the March FOMC press conference. Core services? Not a single mention. The rise and fall of the FOMC’s preferred data points is rather remarkable.

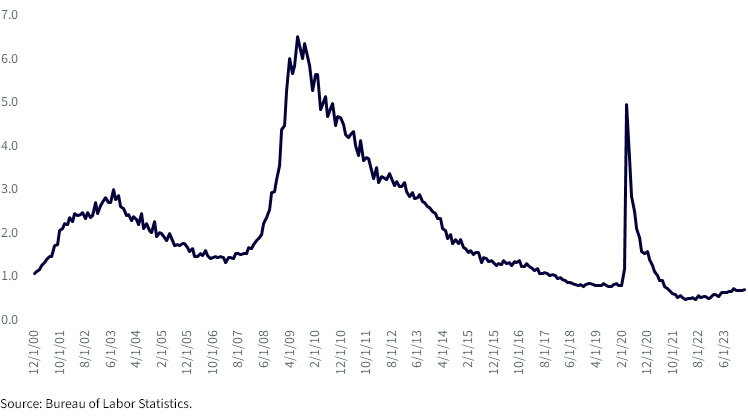

Unemployed Persons per Job Opening

And you cannot really blame the FOMC for pivoting away from these metrics. As Chair Powell stated in the same press conference, “As labor market tightness has eased and progress on inflation has continued, the risks to achieving our employment and inflation goals are moving into better balance.” Better balance with fewer workers than job openings would be a difficult to reconcile statement of monetary policy.

But it does not matter.

The FOMC infatuation with the intertwined two was short-lived. Both were set aside in favor of the more amorphous “caution for confidence” strategy. Growth above trend? Check. Strong labor market? Check. Inflation receding? Maybe.

"In the meantime, the economy is strong, the labor market is strong, inflation has come way down, and that gives us the ability to approach this question carefully and feel more confident that inflation is moving down sustainably…"

— Powell, March 20, 2024

In the collective opinion of the FOMC, there is little reason to guide markets to specific data points. As the previous 18 months have shown, it is convenient to be able to strategically drop the “data of the moment” in favor of a more ambiguous methodology.

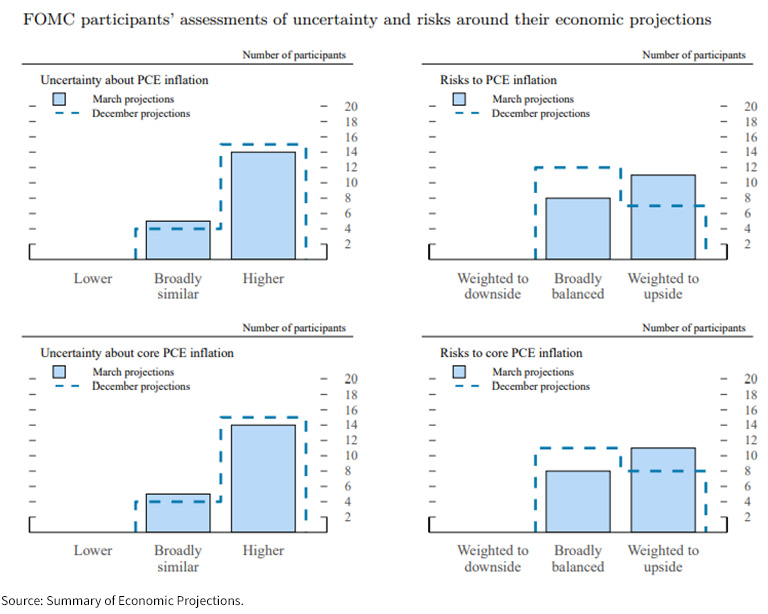

And the ambiguous methodology makes sense. Between December 2023 and March 2024, the FOMC’s outlook for inflation has become increasingly tilted to the upside with uncertainty remaining elevated. More risk and greater uncertainty makes injecting vagueness into the monetary policy narrative prudent.

Simply, the FOMC is not going to be pushed by a data point into cutting rates. The intertwined two have been ditched in favor of further confidence. Luckily, there is a data point for that from the FOMC. And—for those paying attention—it did not improve in the first quarter of the year. In fact, the FOMC is projecting the quiet thing out loud. Inflation risks are skewed higher, not lower, from current levels.

That is a reason for caution. Not because the U.S. economy or the labor market is suddenly falling apart. Instead, the lack of a slowing economy gives the FOMC room to worry singularly about inflation. And, more specifically, their confidence around inflation returning to target. That confidence? So far, it has been fleeting. The FOMC’s (un)certain framework should not be ignored.

Related Products