A Time-Tested Strategy for the New Rate Regime: Laddered Treasury Solutions

The new rate regime has presented investors with a fixed income backdrop that hasn’t been witnessed in more than a decade and a half. Against this backdrop, bond portfolio decision-making has been presented with a new, or shall we say “old,” opportunity for positioning. With income back in fixed income and uncertainty surrounding the macro outlook, investors can now turn to a time-tested strategy to help navigate the potentially choppy waters in the bond market going forward: laddered Treasury solutions.

Certainly, a key benefit from the rise in U.S. interest rates from their COVID-19-related historical lows is that investors are now clearly presented with a better risk-return profile in the fixed income markets. As a result, more income has become available per unit of interest rate risk, with potential returns exceeding inflation. This bond market landscape stands in stark contrast to the zero interest rate policy (ZIRP) that was adopted and maintained by many central banks (including the Fed) for much of the 2010–2022 period.

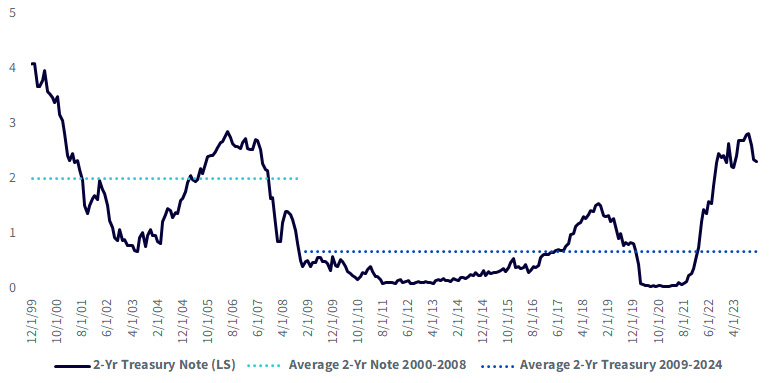

Yield/Duration for 2-Yr Treasury Note, 2000–2024

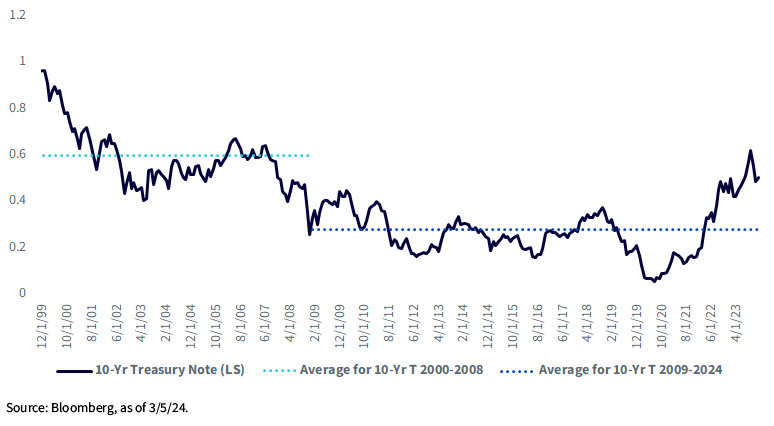

Yield/Duration for 10-Yr Treasury Note, 2000–2024

This point can be underscored by the relationship between yield and duration from a historical perspective, as illustrated in the above graphs. In other words, investors are now able to achieve a visibly higher yield as it relates to the underlying duration of a Treasury security, whether it’s a 2- or a 10-year maturity. This development has brought a “return to normalcy” for the U.S. Treasury (UST) market that didn’t exist following the great financial crisis and through COVID-19.

So, How Can Investors Take Advantage of This New (Old) Rate Regime?

WisdomTree has created laddered Treasury strategies to take advantage of the opportunities that may now exist in the money and bond markets. We believe this time-tested approach offers diversified risk exposures around key parts of the yield curve and involves equal-weighted market exposures laddered across the maturity range.

- WisdomTree 1-3 Year Laddered Treasury Fund

- Investors who are looking to manage interest rate risk while also positioning their fixed income portfolio for shifts in Federal Reserve policy may consider the WisdomTree 1-3 Year Laddered Treasury Fund (USSH). USSH seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Treasury 1-3 Year Laddered Index.

- WisdomTree 7-10 Year Laddered Treasury Fund

- Investors who are looking to moderately add duration and position their bond portfolio for changes in growth and inflation expectations may consider the WisdomTree 7-10 Year Laddered Treasury Fund (USIN). USIN seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Treasury 7-10 Year Laddered Index.

Both strategies focus on the most recently issued securities that mature for a designated month or quarter to preserve a high level of liquidity within the strategy. Both strategies focus on a subset of available Treasury securities within the maturity bands, selecting the most recently issued securities that mature for a designated month or quarter. This focus seeks to further enhance the high degree of liquidity already present in investment in Treasury securities.

There will be a monthly rebalancing for each Fund, where the 1–3-year Index rotates securities monthly while the 7–10-year Index reconstitutes quarterly, in line with the Treasury issuance of the new 10-Year note every February, May, August and November.

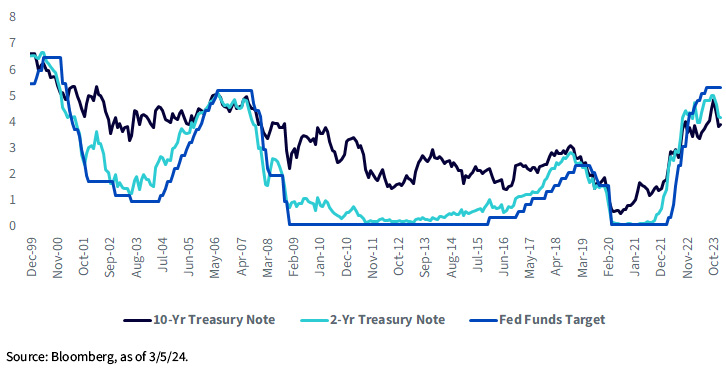

Fed Funds Target Rate and Treasury Yields

What Role Can Laddered Exposures to Short and Intermediate Treasuries Play in Investor Portfolios?

Laddered Treasury strategies provide critical building blocks that we believe are straightforward, intuitive and disciplined while serving a variety of functions within investor portfolios. At their core, this approach may offer a source of high-quality income, with each strategy providing the ability to position around key points of the curve. As highlighted by the above graph, the shorter-dated UST sector of the yield curve is highly sensitive to expectations about Federal Reserve policy, while the intermediate part is more sensitive to changes in long-term growth and inflation expectations.

Conclusion

With the addition of these new Laddered Treasury Funds (USSH and USIN) to our Floating Rate Treasury Fund (USFR), WisdomTree now offers investors a suite of Treasury products that can act as a powerful toolkit to effectively manage a variety of interest rate scenarios.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Because the Fund is new, it has no performance history. U.S. Treasury obligations may provide relatively lower returns than those of other securities. Changes to the financial condition or credit rating of the U.S. government may cause the value to decline. Fixed income securities are subject to interest rate, credit, inflation and reinvestment risks. Generally, as interest rates rise, the value of fixed income securities falls. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.