New Spot Bitcoin ETFs Are Crushing the Supply/Demand Balance

Key Takeaways

- The launch of 11 distinct spot bitcoin ETF strategies in the first quarter of 2024 has resulted in approximately $60 billion in assets under management, a historic success for ETF launches.

- The upcoming bitcoin halving event in April 2024, where the block reward paid to miners will decrease, suggests a potential shift in the supply/demand balance toward demand outpacing supply, which could lead to upward pressure on the price of bitcoin.

- ETF buying has outpaced the creation of new bitcoin since the launch of the ETFs, indicating increased investor interest in gaining exposure to bitcoin through familiar brokerage platforms.

One of the biggest stories of the first quarter of 2024 in U.S. ETFs has been the launch of 11 distinct spot bitcoin strategies. January 11, 2024, is truly a date that will go down in ETF history, similar to the launch of SPDR’s gold trust in 20041 or even SPDR’s S&P 500 Index trust in 1993.2

As we write these words, roughly $60 billion in assets under management are represented by these 11 spot bitcoin ETF strategies.3 As is often the case, this $60 billion represents a wide dispersion, with a few quite large strategies, some mid-sized and some smaller.

The Halving

In April 2024, an event referred to as “the halving” will occur within the bitcoin protocol. This is widely anticipated, in that it is written into the code that the block reward paid to bitcoin miners will shift from 6.25 bitcoin to roughly 3.13 bitcoin. Bitcoin’s protocol has a so-called “halving cycle” of about four years, so we have seen these events before—rewards started at 50, dropping first to 25, then 12.5 and then 6.25. This will keep happening between now and 2140, when all 21 million bitcoin slated to ever be created will exist.

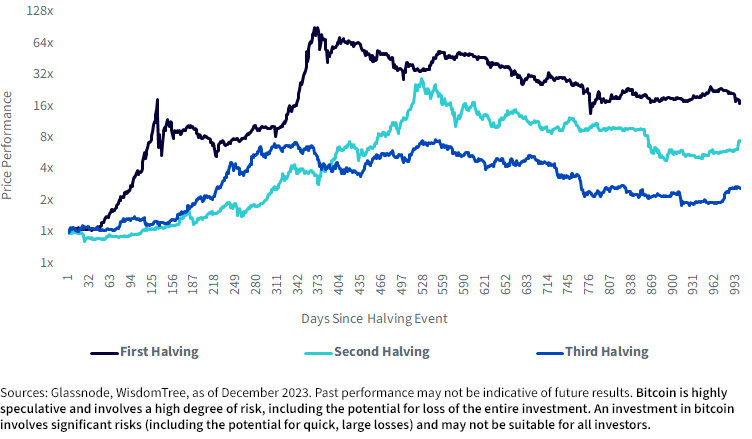

Figure 1 is a chart that we have shown before, noting that if we scale bitcoin’s price on the day of a past halving to 1.0, we see that over the subsequent roughly 2.5-year period, there was further appreciation in each of the three cases.

- On the one hand, we can think about bitcoin on a supply/demand basis. If demand is outpacing supply, there should be upward pressure on the price. The halving indicates that there is less new bitcoin supply coming into the world, so if demand merely remains the same, the supply/demand balance immediately shifts more toward demand outpacing supply.

- To be balanced, we have to also recognize that many things influence the behavior of investors across the overall bitcoin market. Prior halving cycles being associated with bitcoin’s price appreciation cannot tell us with certainty what will occur in the future.

Figure 1: Bitcoin’s Price Behavior after Three Halving Cycles So Far

Spot Bitcoin ETFs: A New Source of Demand

One of the most-loved attributes of bitcoin regards the certainty of supply based on the protocol’s code over time. For instance, we know that in 2140, there will be 21 million bitcoin, and we know that nothing can occur to change this. We know, as stated with the halving, the minting of new supply coming online is being reduced, by half, roughly every four years.

This is in direct contrast to fiat currency systems where governments can decide to print more units of currency on an unlimited basis. Throughout history, we’ve seen examples of fiat currencies losing their value and primacy due to further and further printing. We have seen the U.S. dollar lose value over time after breaking the link to gold in 1971,4 allowing the U.S. government to print more and more currency without needing it to be backed by units of gold.

It was hypothesized that, if the Securities and Exchange Commission approved spot bitcoin ETFs, new sources of demand to hold bitcoin would open up. In 2004, a new option opened up for investors who did not want to go through the hassle of acquiring and storing physical gold bars. In a similar fashion, in 2024, an option opened up to allow investors to gain exposure to spot bitcoin through familiar brokerage platforms on which they trade ETFs backed by other types of assets.

Now, a little more than two months into the journey, we can review how the supply/demand story has been evolving in bitcoin and whether we can clearly see any influence from the ETFs.

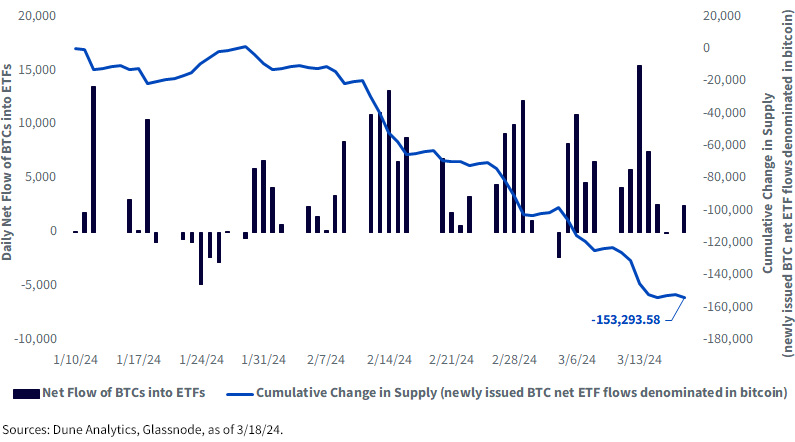

Figure 2 shows us:

- It looks like many are interested in bitcoin: One hypothesis advanced before the ETFs launched regarded an increase in investor types—those that were precluded from setting up their own crypto wallets, for example—being able to gain exposure. The daily net flow of BTCs into ETFs is absolutely skewed to the positive end of the spectrum, and we note that there were still many investors working at firms where central home offices have not yet issued blanket approvals to use these products across the board.

- ETF buying has outpaced bitcoin issuance: Bitcoin purchases by ETFs has outpaced the creation of new bitcoin, over this specific period, by roughly 153,294 units. This may not always be the case, and we note that the overall value of the bitcoin market is over $1 trillion, as we write, but there are large volumes of bitcoin that are proven to not trade with a high frequency. The space is transparent—we can see the ETF buying, we can see the wallets, we can see how long it has been since individual units have moved. The only thing we do not know is exactly when or why owners may trade.

Figure 2: ETF Demand vs. Bitcoin Issuance

Conclusion: Bitcoin Is about Supply and Demand

There is no shortage of different models that can create a potential price or range of price levels that might be appropriate for bitcoin. The space is so new, only starting in 2009, that there is not yet a universally accepted valuation methodology—as opposed to, for instance, discounted cash flows for stocks or bonds.

While investors continue to search and refine better ways to develop price targets, we find it more informative to consider supply and demand. Right now, it appears that ETF demand is high, and we also know that the halving is coming. Now, ETF demand can change quickly—this is the beauty of the structure—but this will be visible and transparent, and we (as well as others) will be able to monitor these trends in nearly real time.

1 The SPDR Gold Shares Strategy (GLD) launched on 11/18/04. As of 3/19/24, it had more than $58 billion in assets under management.

2 The SPDR S&P 500 ETF Trust (SPY) launched on 1/22/93. As of 3/19/24, it had more than $526 billion in assets under management.

3 Source: Bloomberg, with data, as of 3/19/24.

4 Source: Sandra Kollen Ghizoni, “Nixon Ends Convertibility of U.S. Dollars to Gold and Announces Wage/Price Controls,” Federal Reserve History, 11/22/13. https://www.federalreservehistory.org/essays/gold-convertibility-ends

Related Products

Important Risks Related to this Article

Crypto assets, such as bitcoin and ether, are complex, generally exhibit extreme price volatility and unpredictability, and should be viewed as highly speculative assets. Crypto assets are frequently referred to as crypto “currencies,” but they typically operate without central authority or banks, are not backed by any government or issuing entity (i.e., no right of recourse), have no government or insurance protections, are not legal tender and have limited or no usability as compared to fiat currencies. Federal, state or foreign governments may restrict the use, transfer, exchange and value of crypto assets, and regulation in the U.S. and worldwide is still developing.

Crypto asset exchanges and/or settlement facilities may stop operating, permanently shut down or experience issues due to security breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your customer/anti-money laundering) procedures, non-compliance with applicable rules and regulations, technical glitches, hackers, malware or other reasons, which could negatively impact the price of any cryptocurrency traded on such exchanges or reliant on a settlement facility or otherwise may prevent access or use of the crypto asset. Crypto assets can experience unique events, such as forks or airdrops, which can impact the value and functionality of the crypto asset. Crypto asset transactions are generally irreversible, which means that a crypto asset may be unrecoverable in instances where: (i) it is sent to an incorrect address, (ii) the incorrect amount is sent, or (iii) transactions are made fraudulently from an account. A crypto asset may decline in popularity, acceptance or use, thereby impairing its price, and the price of a crypto asset may also be impacted by the transactions of a small number of holders of such crypto asset. Crypto assets may be difficult to value and valuations, even for the same crypto asset, may differ significantly by pricing source or otherwise be suspect due to market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto assets generally rely on blockchain technology and blockchain technology is a relatively new and untested technology which operates as a distributed ledger. Blockchain systems could be subject to internet connectivity disruptions, consensus failures or cybersecurity attacks, and the date or time that you initiate a transaction may be different then when it is recorded on the blockchain. Access to a given blockchain requires an individualized key, which, if compromised, could result in loss due to theft, destruction or inaccessibility. In addition, different crypto assets exhibit different characteristics, use cases and risk profiles. Information provided by WisdomTree regarding digital assets, crypto assets or blockchain networks should not be considered or relied upon as investment or other advice, as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network or any particular strategy.