January 2024 Month in Review: U.S. Spot Bitcoin ETFs approved!

Spot Bitcoin ETFs Likely to Expand the Investor Base

Ten years after the first spot Bitcoin exchange-traded fund application was filed in the U.S., the Securities and Exchange Commission (SEC) finally approved spot Bitcoin ETFs on January 10, 2024.

While the European markets have been offering crypto exchange-traded products (ETPs) since 2019, this is the first time U.S. investors can access the spot price of Bitcoin in a brokerage account via a familiar ETF structure. We believe this approval will help to expand the investor base for bitcoin in the U.S. and encourage regulators in other countries to reconsider their position in digital assets.

The most obvious target market for spot bitcoin ETFs is the U.S. wealth management client assets, which would be approximately $44 trillion in size.1 Many of these investors were not able or willing to set up procedures to hold bitcoin directly.

Increasing Demand for Bitcoin Facing a Cut in New Supply

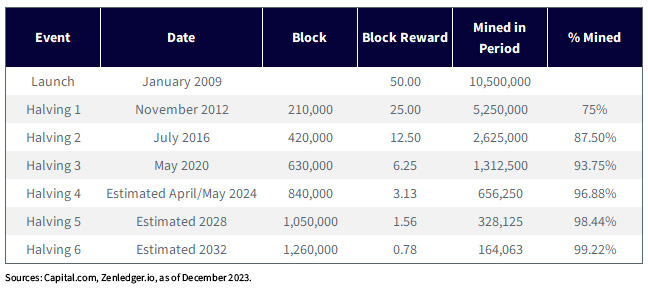

When Bitcoin was created in 2009 partly as a response to the global financial crisis, continuous money printing and devaluation of fiat currencies, the creators of the bitcoin blockchain wanted to limit the supply of bitcoin to 21 million. This supply limit is hard-coded into the bitcoin cryptocurrency. More than 94% of these bitcoins have already been mined.2 Some bitcoin has been lost forever, but it is difficult to estimate the exact number, as there must be some early investors who have not transacted on their bitcoin for several years.

In roughly the April/May 2024 timeframe, the issuance of new bitcoin, in the form of Bitcoin block rewards awarded to miners, will be cut in half, and miners will receive 3.1 Bitcoin every 10 minutes or so.3 Normally, bitcoin miners need to sell part of their Bitcoin in the market to cover some of their operational expenses, such as energy costs and computing equipment upgrades. As miners will have less Bitcoin to sell in the market, this could mean a lower supply of Bitcoin in the market overall.

Chart 1: Bitcoin “Halving,” Estimated April/May 2024

Historically, this “halving” event has led to an initial increase in the price, and although the price increase multiple has declined over time, this time around, there is an additional factor—a U.S. spot bitcoin ETF available in the U.S. In normal circumstances, when the demand increases while the supply declines or stays the same, the price should move upward.

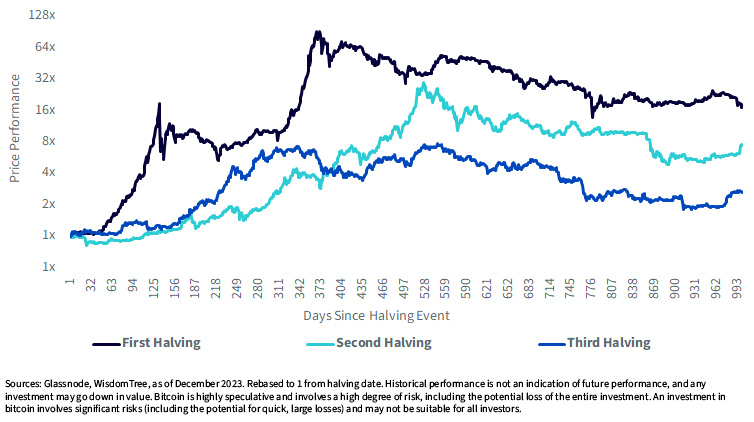

We see within chart 2:

- The original bitcoin price on the day of each halving is represented by “1.0x.” If the price was originally $1,000 and then you see in the vertical axis it goes to “2.0x,” this would mean it went from $1,000 to $2,000. The entire chart can be read analogously.

- The first halving occurred the earliest in bitcoin’s historical trajectory. In a relative sense, at earlier points in bitcoin’s history, there was greater risk and greater price volatility. The third halving is the most recent. Over time, bitcoin has become known by more and more people, the market capitalization has largely been increasing, and the price volatility has been trending lower rather than higher, even if it is still high relative to other asset classes. This doesn’t mean that this trend will persist—it just relates to chart 2 in the sense that roughly 990 days after the third halving, the price had gone from 1.0x to somewhere between 2.0x and 4.0x. In comparison, 990 days after the first halving, the price had gone from 1.0x to about 16.0x.

Chart 2: Bitcoin’s Price Performance Post Historical Halving Events

Long-Term Store of Value Emerging as the Most Prominent Use Case for Bitcoin

While the use case of Bitcoin as digital money, a potential digital payment layer for the internet, could materialize in the future, for the moment, our view is that the most accepted use case for Bitcoin is a form of digital gold, a long-term store of value that acts as a hedge against the debasement of currencies and geopolitical uncertainty. We specifically say “long-term” in recognition of the historically high price volatility that bitcoin has exhibited. A longer period could allow for:

- More use cases to emerge, particularly in the payments space.

- More time to analyze global central banks and note if they continue to print money, increasing future inflationary risks.

- No technology is “immediately adopted”—many users will not develop much interest the first or second time they hear about it. Continuing to hear about bitcoin in a more and more diversified array of contexts will naturally inject it into the public’s consciousness and give people more comfort that all sorts of things have happened, but it is still there.

1 Source: Euart et al., “US Wealth Management: Amid market turbulence, an industry converges,” McKinsey, 1/24. Year-end U.S. wealth manager client assets for 2022, includes retail assets with wealth intermediaries. Excludes directly held securities and institutional assets.

2 Bitcoin mining = a way new bitcoins are entering circulation; a process via which bitcoin transactions are verified on the bitcoin blockchain. New bitcoin is issued to bitcoin miners as a reward for validating transactions. Actual “mining” uses software and hardware to solve complex mathematical puzzles and guess a cryptographic number that matches a set criterion.

3 Source: John Stec, “Why 2024 Will be Bitcoin’s Year,” Coindesk, 1/17/24.

Important Risks Related to this Article

Crypto assets, such as bitcoin and ether, are complex, generally exhibit extreme price volatility and unpredictability, and should be viewed as highly speculative assets. Crypto assets are frequently referred to as crypto “currencies,” but they typically operate without central authority or banks, are not backed by any government or issuing entity (i.e., no right of recourse), have no government or insurance protections, are not legal tender and have limited or no usability as compared to fiat currencies. Federal, state or foreign governments may restrict the use, transfer, exchange and value of crypto assets, and regulation in the U.S. and worldwide is still developing.

Crypto asset exchanges and/or settlement facilities may stop operating, permanently shut down or experience issues due to security breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your customer / Anti-Money Laundering) procedures, non-compliance with applicable rules and regulations, technical glitches, hackers, malware or other reasons, which could negatively impact the price of any cryptocurrency traded on such exchanges or reliant on a settlement facility or otherwise may prevent access or use of the crypto asset. Crypto assets can experience unique events, such as forks or airdrops, which can impact the value and functionality of the crypto asset. Crypto asset transactions are generally irreversible, which means that a crypto asset may be unrecoverable in instances where: (i) it is sent to an incorrect address, (ii) the incorrect amount is sent, or (iii) transactions are made fraudulently from an account. A crypto asset may decline in popularity, acceptance or use, thereby impairing its price, and the price of a crypto asset may also be impacted by the transactions of a small number of holders of such crypto asset. Crypto assets may be difficult to value and valuations, even for the same crypto asset, may differ significantly by pricing source or otherwise be suspect due to market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto assets generally rely on blockchain technology and blockchain technology is a relatively new and untested technology which operates as a distributed ledger. Blockchain systems could be subject to internet connectivity disruptions, consensus failures or cybersecurity attacks, and the date or time that you initiate a transaction may be different then when it is recorded on the blockchain. Access to a given blockchain requires an individualized key, which, if compromised, could result in loss due to theft, destruction or inaccessibility. In addition, different crypto assets exhibit different characteristics, use cases and risk profiles. Information provided by WisdomTree regarding digital assets, crypto assets or blockchain networks should not be considered or relied upon as investment or other advice, as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network or any particular strategy.

To view the prospectus, please click here.

Bitcoin and, accordingly, the WisdomTree Bitcoin Fund, which holds bitcoin, are highly speculative and involve a high degree of risk, including the potential for loss of the entire investment. An investment in the WisdomTree Bitcoin Fund involves significant risks (including the potential for quick, large losses) and may not be suitable for all shareholders. You should carefully consider whether your financial condition permits you to invest in the WisdomTree Bitcoin Fund, and you should be willing to accept more risk than may be involved with other exchange-traded products or ETFs that do not hold bitcoin.

Extreme volatility of trading prices that many digital assets, including bitcoin, have experienced in recent periods and may continue to experience, could have a material adverse effect on the value of the Shares and the Shares could lose all or substantially all of their value. The value of the Shares is dependent on the acceptance of digital assets, such as bitcoin, which represent a new and rapidly evolving industry. Digital assets such as bitcoin were only introduced within the past two decades, and the medium-to-long term value of the Shares is subject to a number of factors relating to the capabilities and development of blockchain technologies and to the fundamental investment characteristics of digital assets. Regulatory changes or actions may affect the value of the Shares or restrict the use of Bitcoin, mining activity or the operation of the Bitcoin Network or the Digital Asset Markets in a manner that adversely affects the value of the Shares. Digital Asset Markets may experience fraud, business failures, security failures or operational problems, which may adversely affect the value of Bitcoin and, consequently, the value of the Shares.

The WisdomTree Bitcoin Fund is not a fund registered under the Investment Company Act of 1940, as amended (“1940 Act”), and is not subject to regulation under the 1940, unlike most exchange- traded products or ETFs. The WisdomTree Bitcoin Fund is also not a commodity pool for purposes of the Commodity Exchange Act of 1936, as amended, and the sponsor is not subject to regulations by the Commodity Futures Trading Commission as a commodity pool operator or commodity trading advisor. The WisdomTree Bitcoin Fund’s shares are neither interests in nor obligations of the sponsor or the trustee or any of their affiliates.

The WisdomTree Bitcoin Fund has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the WisdomTree Bitcoin Fund has filed with the SEC for more complete information about the WisdomTree Bitcoin Fund and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the WisdomTree Bitcoin Fund will arrange to send you the prospectus if you request it by calling toll-free at 866.909.9473.

Neither WisdomTree, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided on this site are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.

Foreside Funds Services, LLC, is the Marketing Agent for the WisdomTree Bitcoin Fund (BTCW). Foreside Fund Services, LLC, is not affiliated with WisdomTree, Inc. nor any other entities mentioned.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.