Keeping up with the Nasdaq 100 Index

Key Takeaways

- The WisdomTree U.S. Quality Growth Fund (QGRW) has outperformed the Invesco QQQ Trust Series 1 (QQQ) in the first quarter of 2024, with a significant gap in terms of returns.

- The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) has roughly kept up with QQQ in the same period, indicating a shift in the primary drivers of U.S. equity market performance.

- The sector exposures of QGRW and QQQ are very similar, while DGRW has notable differences in sector exposure compared to QQQ.

The Nasdaq 100 Index, designed to represent the largest 100 nonfinancial companies listed on the Nasdaq exchange,1 has delivered incredibly strong performance since the global financial crisis of 2008–09. When investors think about U.S. Tech or U.S. growth they frequently think first about this widely followed benchmark.

The Invesco QQQ Trust Series 1 (QQQ) is an investment vehicle designed to track the returns of this index, and it had more than $257 billion in assets under management as of April 3, 2024.2

Targeting the Leader

With such a large base of assets and a history of more than 20 years, we are reminded of how, in different sports leagues, the team exhibiting longstanding strength, possibly referred to as a “dynasty,” creates a target for all other competitors to measure against. At WisdomTree, we are seeking to measure the performance of our strategies against the most widely followed competing funds and benchmarks in order to truly assess whether they are bringing value to investors.

In 2024, even if the Nasdaq 100 Index is not a fund’s official benchmark, you can expect that investors are going to compare different investment options back to it, given its strong performance and the proliferation of such terms as the Magnificent 7.

Toward the end of the first quarter, we noticed something interesting:

- While the so-called Magnificent 7 was being mentioned all the time in 2023, the first quarter of 2024 has seen more dispersion. Nvidia has continued to drive its share price higher, but other companies like Tesla and Apple have exhibited greater volatility. Even if large companies are still doing well, naively holding all seven of these stocks has not been as strong a strategy as it was in 2023.

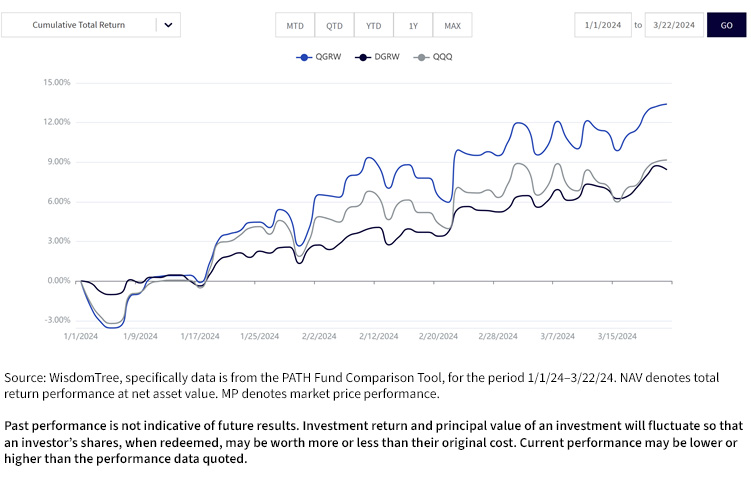

- The WisdomTree U.S. Quality Growth Fund (QGRW) has opened up a significant gap over QQQ in terms of outperformance. This is a short period of roughly three months, but the more curious thing to us was that during much of 2023 the returns of QQQ and QGRW were very close to each other. We don’t know if any gap will be maintained, but it’s important to dig into what happened that was different from the prior period to contribute to this difference in returns.

- The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) is roughly keeping up with QQQ. Again, this is a short period, and we don’t want to read too much into it, but the important detail here is that a strategy that includes only dividend-paying companies has tended to lag in upward-trending growth markets. Some of the largest U.S. companies represented in QQQ do not pay dividends. If DGRW starts to keep pace, we believe this tells us that we have seen a shift in the primary drivers of U.S. equity market performance relative to 2023, when DGRW's performance significantly lagged that of QQQ.

Figures 1a and 1b allow us to start seeing the numbers behind this story.

Figure 1a represents the standardized return comparison of QGRW, DGRW and QQQ, with data as of the most recent quarter-end, December 31, 2023. This is useful because we can look at the one-year figure, which is actually the calendar year 2023 figure. QGRW and QQQ were similar, in that the NAV return figures were in the range of 55%–56%, roughly speaking. DGRW, on the other hand, did not crack 20%.

Figure 1b represents the year-to-date 2024 NAV return of QGRW, DGRW and QQQ, specifically from January 1, 2024, to March 22, 2024, nearly the full first quarter. QGRW’s return is in the region of 13% over this period, whereas QQQ and DGRW are sitting around 9%, roughly speaking. This is still just a short period of time, but we wanted to explore “why” in order to start thinking through how this might or might not continue during the remainder of the year.

Figure 1a: Standardized Performance Comparison

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: DGRW, QGRW and QQQ.

Figure 1b: Cumulative Performance Comparison

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: DGRW, QGRW and QQQ.

Attribution: The Story behind the 2024 Return Difference

As we flipped the calendar from 2023 to 2024, many of us expected to see a greater dispersion in the performance of the largest companies. This has happened in the first part of 2024. Below, we detail the primary aspects of QGRW versus QQQ and DGRW versus QQQ.3

- QGRW vs. QQQ: The biggest positive contributor was that Nvidia’s average weight in QGRW was 7.53% compared to 5.07% in QQQ, and we are all familiar with the strength of Nvidia’s returns over this period. Meta Platforms was another over-weight allocation that helped QGRW relative to QQQ, and we can note that SuperMicro Computer was included in QGRW but not in QQQ, albeit at a very small weight. It was interesting to see that Intel was not included in QGRW and this exclusion of one of Nvidia’s rival chip companies was also a positive contributor. To be fair and recognize there are positives and negatives in any period, the two largest detractors for QGRW relative to QQQ were over-weight positions in Apple and to Tesla.

- DGRW vs. QQQ: On the other side of the coin, the two biggest drivers of positive attribution for DGRW relative to QQQ are the 1) exclusion of Tesla, since it is not a dividend-paying company and 2) under-weight allocation to Apple, since DGRW’s index is weighted by cash dividends and not market capitalization. Intel, even though it does pay a dividend, was also excluded from DGRW, and this helped relative performance. Elly Lilly and Abbvie were included from DGRW but not QQQ, and this also helped DGRW's relative performance. On the other hand, the three biggest drivers of negative attribution for DGRW relative to QQQ were 1) an under-weight position in Nvidia, 2) an under-weight position in Meta Platforms, even though WisdomTree did run a special rebalance in March 2024 based on Meta initiating a dividend payment, and 3) the exclusion of Amazon.com as a non-dividend-payer.

How Similar Is QGRW or DGRW to QQQ?

We know that there is a high degree of familiarity with QQQ among U.S. investors—not many ETFs have lasted more than 20 years and generated assets under management of more than $200 billion. However, when we note that this strategy is tracking the return of the Nasdaq 100 Index and think about what that index is designed to do, many that we have spoken to have been surprised.

The methodology really is just to include the 100 largest nonfinancial stocks listed on the Nasdaq exchange. A common assumption is that it is a tech index and it is true that the Magnificent 7 of 2023 were included within the top 10, but this is more coincidental than intentional.

The Sector Discussion

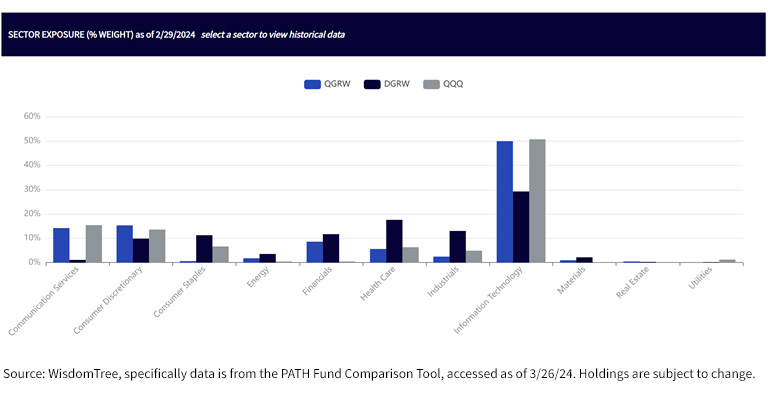

Figure 2 shows the sector exposures of QGRW, DGRW and QQQ.

- QQQ and QGRW were very similar from the standpoint of Telecommunication Services, Consumer Discretionary, Energy, Health Care, Industrials, Information Technology, Materials, Real Estate and Utilities. In this context, “similar” could also mean that neither strategy had any significant exposure. Consumer Staples was a notable difference, in that QGRW had nearly zero exposure, whereas QQQ had some. Financials was a notable difference—we remember in the Nasdaq 100 Index methodology is does indicate ‘nonfinancial’. So, out of 11 sectors, two had significant differences and nine were very similar.

- QQQ and DGRW had differences in sector exposure across the board. DGRW had almost zero exposure to Telecommunication Services and was very under-weight in Information Technology compared to QQQ. DGRW had more exposure to Consumer Staples, Health Care, Financials and Industrials.

In the end, it is clear that those looking for more similarity to the sector distribution in QQQ could be happier with QGRW, whereas DGRW is a notably different strategy almost across the board from a sector perspective.

Figure 2: Sector Exposures

Conclusion: Matching Strategy with Outlook

It was clear that when 2024 began, most were expecting a different sort of equity market performance thank in 2023. As a reminder—2023 was the year of the Magnificent 7, where the largest companies led the way. The Nasdaq 100 Index, tracked by QQQ, captured this beautifully.

If 2024 is a year of greater dispersion and it’s not as simple as the largest companies delivering the strongest returns, then focusing on “better” companies—defined as having better fundamental metrics—could provide something useful and lead to at least possible performance differentiation. If equity market volatility were to tick up, the dividend orientation of DGRW could be particularly notable. In our opinion, even if we do not know the future with certainty, we can emphasize the importance of having evolving market outlooks match up with investment strategies that capture those ideas.

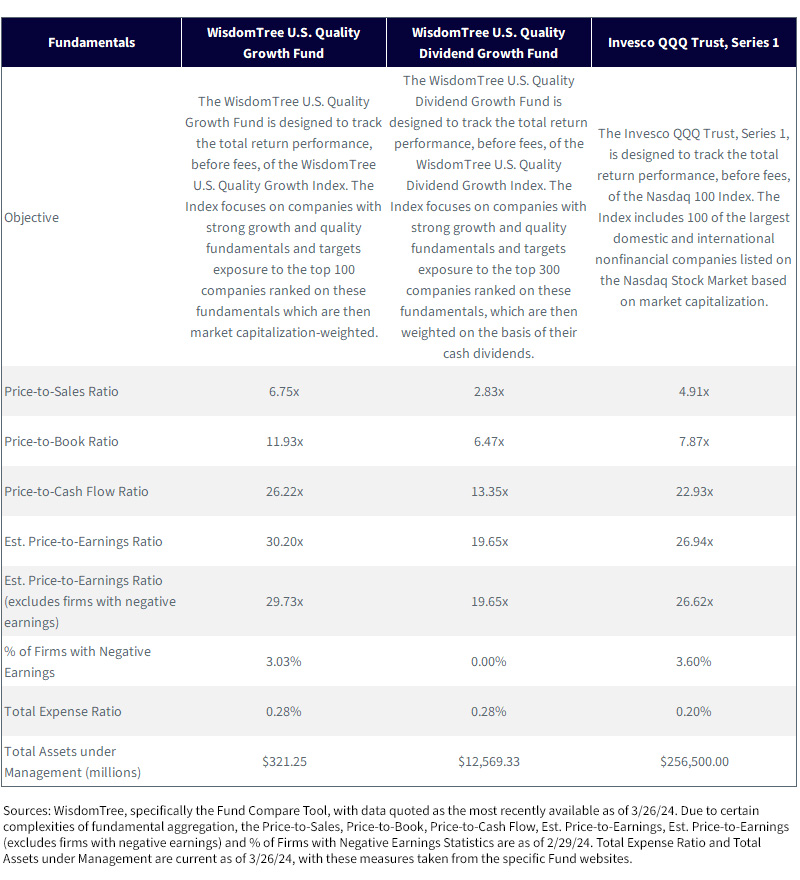

Figure 3: Important Characteristics of Funds in this Comparison

If you are interested in diving more into the comparison of these Funds, please check out our Fund Comparison Tool.

1 Source: Nasdaq 100 Index, Nasdaq. https://indexes.nasdaq.com/docs/Methodology_NDX.pdf

2 Source: Invesco QQQ fund detail page. https://www.invesco.com/qqq-etf/en/about.html

3 Source for attribution details: Bloomberg, specifically the PORT function, with time period specified 12/29/23–3/22/24. Holdings are subject to change.

Related Products

Important Risks Related to this Article

For current Fund holdings, please click the respective ticker: DGRW, QGRW. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DGRW: Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.

QGRW: Growth stocks, as a group, may be out of favor with the market and underperform value stocks or the overall equity market. Growth stocks are generally more sensitive to market movements than other types of stocks. The Fund is non-diversified and, as a result, changes in the market value of a single security could cause greater fluctuations in the value of Fund shares than would occur in a diversified fund. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit. The Fund does not attempt to outperform its Index or take defensive positions in declining markets and the Index may not perform as intended.