Build Your Core (Portfolio) the Right Way

Key Takeaways:

1. In a soft-landing scenario, core fixed income is an attractive option for investors to extend duration and prepare for the next phase of the monetary cycle.

2. However, there could be changes made to plain-vanilla, core U.S. aggregate portfolios to benefit from valuations as well as get ready for this year’s election.

3. BBB corporate issuers are cheap compared to their higher-quality, A-rated counterparts.

4. Industries with lower exposure to China and foreign trade tend to do well during times in which trade wars are on top of investors’ minds.

5. AGGY is well-positioned to benefit from these conditions.

As the Fed is nearing the end of its once-in-a-generation tightening cycle, investors have rightfully started to wonder about the next phase of the monetary cycle. While this is not our base case, some investors have been thinking about moving out the yield curve and adding duration to their fixed income portfolios. There are multiple options that can be used here. One group prefers the safety of Treasury notes and bonds. Others might not be satisfied with the income and yield levels offered by Uncle Sam and want to foray into the riskier part of the market, e.g., investment-grade credit, high-yield corporates or a more diversified option, U.S. aggregate portfolios (Core).

By definition, any asset class with a spread above risk-free interest rates is exposed to some type of credit risk. Depending on one’s view about the future of the economy and whether the Fed will be able to manage a soft landing, the choice for adding duration and moving out of money market funds changes. We believe that the economy will slow down in 2024. However, the Fed will be able to manage a soft landing like it did in the 1990s. As a result, we are in the camp that investors should benefit from spread products, though they need to be selective. Higher-quality IG issuers and agency mortgages are a couple of asset classes that we like. And what better option than core U.S. aggregate-type products to have both asset classes and, at the same time, be diversified? In this post, we will look at whether the plain-vanilla core portfolio is the best option or if there are some changes that can be made in order to benefit from current valuations as well as prepare for the year ahead.

BBBs… Time for the Silent Majority to Shine

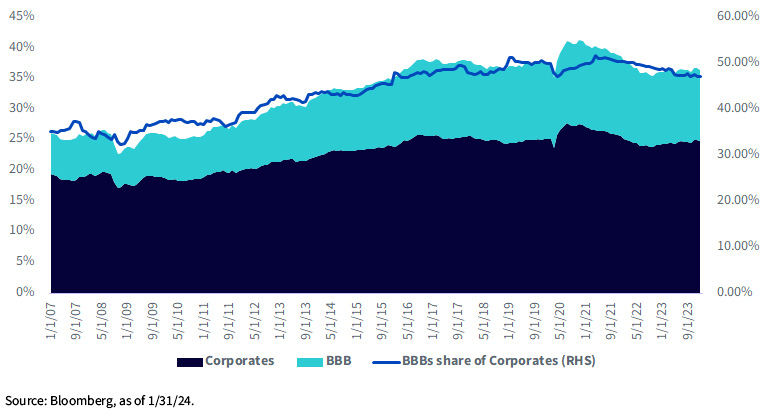

Since the global financial crisis, the share of BBB corporate issuers within the Bloomberg U.S. Aggregate Index has gone up. As of January 31, 2024, BBBs make up about 47% (almost half) of corporates within the Index.

MV%

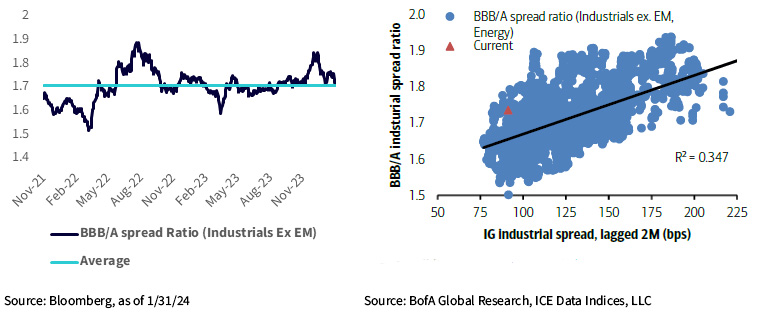

Following a decline to some of the lowest levels in December 2023, BBB-rated industrials spread to A-rated bonds and have tightened in 2024. This shift likely reflects diminishing concerns about a hard-landing scenario driven by positive surprises in U.S. economic data. Despite the substantial contraction year-to-date, the spread ratio between BBB and single-A bonds still trails the significant rally observed since October. As a result, BBBs remain attractive on a relative value basis.

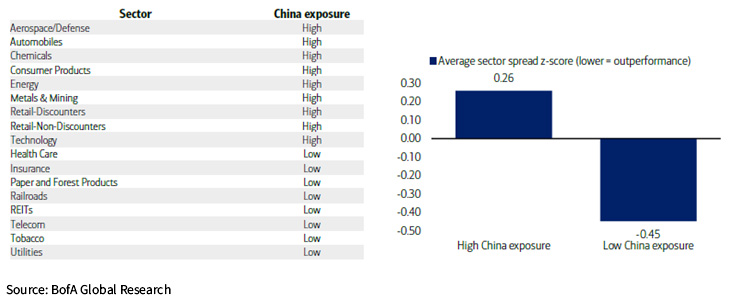

As we get closer to Election Day in November, the market will have to digest a lot of policy rhetoric and its impact on different asset classes and industries from both sides of the aisle. There is an abundance of policy differences between the two major candidates. However, there is one clear common ground: China. Both candidates would like to approach trade issues with China with an iron fist policy. Hence, it is prudent to look at the last time the trade war was on top of investors’ minds and examine how different industries behaved during that period.

The last time a trade war was a big concern for investors was after the 2016 election. From 2016 until 2019, when these fears peaked, sectors with a larger exposure to China underperformed.

AGGY to the Rescue

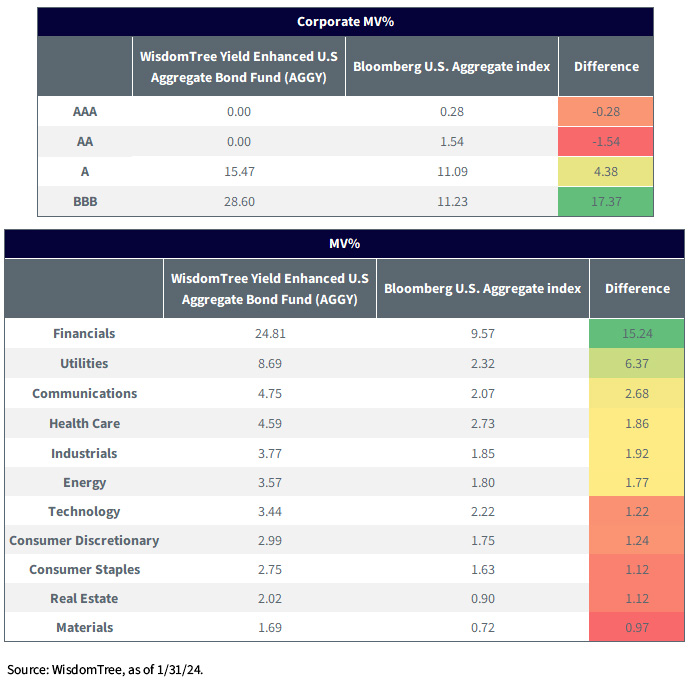

Historically, the main advantage of investing in the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) has been the added yield/income compared to the U.S. Aggregate Index, while taking lower duration risk. However, looking under the hood, AGGY also has higher allocations to BBB corporates and higher over-weights (OWs) to low-China-exposed industries.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.