Don’t Compound a Weak Dollar Bet

We recently wrote about the rising correlations between stocks and bonds, as well as the increasingly negative correlation between the U.S. dollar and stocks.

To rephrase the negative correlation between the U.S. dollar and the S&P 500, an investment in U.S. equities is, in part, a bet against a strong dollar.

For global asset allocators, this raises an important question: Why double down on a weak dollar exposure in U.S. equities when investing internationally?

In our view, currency-hedged positions should be considered more as a default and strategic allocation that is neutral on the dollar’s direction, while unhedged investments compound an existing weak dollar bet investors already have within U.S. equities.

No Diversification from Being Unhedged

One of the most common arguments we hear in favor of unhedged international allocations is that there are diversification benefits from currency exposure.

The data does not support this greater diversification theory.

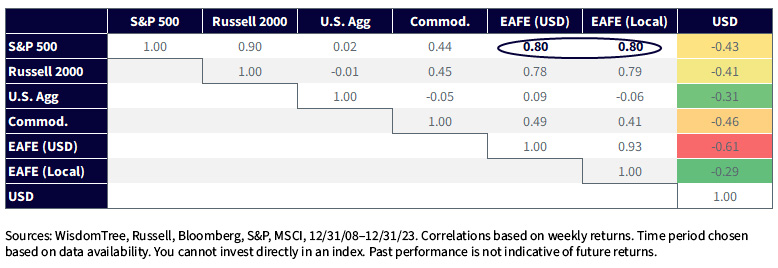

The correlation between U.S. dollar investments in the EAFE (Europe, Australasia and Far East) region (representative of unhedged) and local currency EAFE investments (representative of hedged) with respect to the S&P 500 is an identical 0.80. In other words, there is no significant diversification effect from having currency exposure.

Looking at the right-most column, we observe the correlations of each index with U.S. dollar returns.

- The S&P 500 and the Russell 2000 exhibit correlations of -0.43 and -0.41, respectively. This shows the weak dollar bias of core U.S. equities exposures, even in small caps that have lower overseas earnings.

- The MSCI EAFE (USD) shows an even greater weak dollar bet during this period, with a -0.61 correlation to the dollar.

- The MSCI EAFE (Local) also has a negative correlation to the dollar, but its correlation of -0.29 is only half that of the MSCI EAFE (USD)

In summary, we believe that investing internationally without the currency hedge compounds the existing weak dollar bet that investors already have with their U.S. equities exposure.

Correlation Matrix: 12/31/08–12/31/23

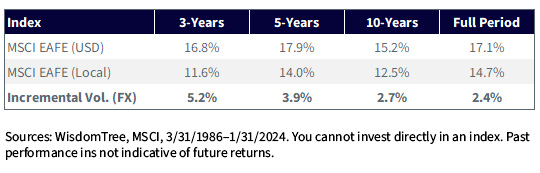

Over the long-run, returns are similar between the MSCI EAFE Index in USD and local currency—justifying the belief among many investors that currency returns are a wash over time.

Though returns are similar, we see higher volatility in every standard period from being unhedged, with the incremental volatility from FX increasing to more than 5% in the most recent three-year period.

Index Standard Deviation

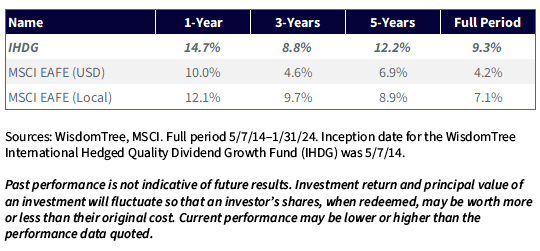

For investors considering a currency-hedged allocation for international exposure, the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) has nearly 10 years of live track record.

The Fund has outperformed both the MSCI EAFE (USD) and MSCI EAFE (Local) indexes since its inception, doing so with 3% lower volatility than the MSCI EAFE (USD).

Performance as of 1/31/24

For the most recent month-end and standardized performances and to download the Fund prospectus, click here.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.