Bond Diversification Is Falling: Portfolio Implications

One of the most important market relationships in 2024 is the rising, positive correlation between stocks and bonds. A rising correlation between these two primary asset classes has profound implications not just for total portfolio diversification in multi-asset portfolios but also forward-looking bond yields.

Why Rising Correlations Leads to Higher-for-Longer Yields over the Medium Term

For much of the last few decades, bonds acted as a good hedge to equity risk. Bad news for the economy, which can impact earnings, cash flows and often cause equity prices to fall, was generally good news for bond prices, as interest rates would typically decline.

Higher economic growth, on the other hand, should lead to higher interest rates. But if bonds act as a negative beta asset that hedges stock risk, investors are willing to pay a premium for that asset and accept a lower real return in exchange for the hedge quality. This is like buying standard insurance: we are willing to pay premiums for car or home insurance to protect from bigger, more catastrophic losses. Bonds historically served that role for equity risk and investors were paying for it by accepting lower yields.

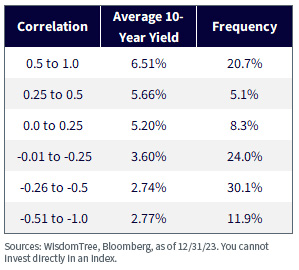

We can see this relationship pretty clearly in the average yields over the last 40 years. A higher correlation between stocks and bonds corresponded with much higher average yields, and the lowest yields occurred when bonds had most negative correlations.

The average 10-Year Treasury yield when correlation was positive was 6.06% but when the correlation was negative, it was 300 basis points lower.

Rolling 3-Year Correlations: Bonds Become a Worse Hedge, and The Dollar a Better Diversifier

When inflation became the primary market concern in the post-pandemic environment, correlations between stocks and bonds skyrocketed. We believe this is one of the primary factors that will lead to rates staying higher for longer.

The market now looks like one trade, and as bond price declines/yield spikes become a primary risk for equity markets, investors should start looking for alternative portfolio diversifiers.

Interestingly, the U.S. dollar has become a much better hedge over this period and shows the opposite pattern, with correlations to the U.S. equity markets becoming more negative.

Another way of looking at it: a rising dollar is one of the key risks to U.S. markets.

Is this just an historical accident apparent in the data or is there something more fundamental driving this negative relationship?

There is a real earnings impact at play. Over 40% of revenue from the S&P 500 comes from overseas. The profit percentage from international business is not a required disclosure or regularly reported in company reports, but our sense is that the profit impact is even greater from overseas business than from domestic revenues, as profit margins are often higher in global jurisdictions.

Some of our work on long-term earnings growth showed most of the earnings growth in the S&P 500 over the last 50 years occurred when the dollar was declining—and when the dollar was rising, the average earnings growth was much lower.

Diversification from Dollars

Some believe a primary reason to invest abroad is because you can get an easy way to fund foreign currency exposure on top of your international stock exposure.

I have long argued that being currency-hedged helps you neutralize your exchange rate risk and that in the developed world, you also get the benefit of relative interest rate differentials between the U.S. and foreign markets on top of the local equity market return.

Because the U.S. has significantly higher interest rates than Japan (which still has negative rates) you are paid between 5% and 6% to hedge yen exposure. U.S. investors who are hedged can earn 5% more than a local Japanese investor.

For a broad international basket, the aggregate net interest rates you are paid to hedge today is about 2.5%.

If you start with a baseline exposure of unhedged ETFs—that have both stock and weak currency beta already embedded—switching to a hedged ETF can be viewed as adding a U.S. dollar hedge on top of your prior portfolio.

And our view is that a strong U.S. dollar overlay contrasts with the prior portfolio because hedging your currency exposure will lower overall portfolio risk levels.

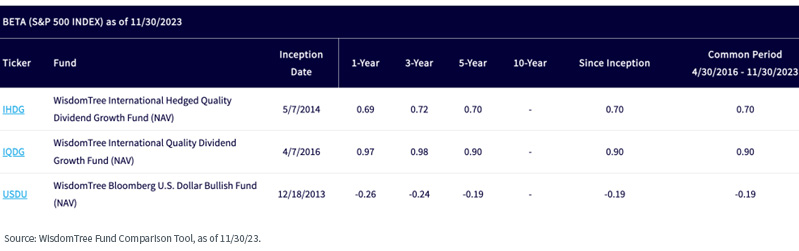

You can see this by comparing the betas of a fully-hedged international quality basket, an unhedged version of the same stocks and a strong dollar fund—all with betas in respect to S&P 500. For illustrative purposes, we’ll use the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), the WisdomTree International Quality Dividend Growth Fund (IQDG) and the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) as the respective proxies.

Over the last five years, the strong dollar Fund had a negative beta, and the international hedged equity basket (IHDG), which is effectively adding long dollar exposure on top of an unhedged position, had a beta that is very close to the addition of the U.S. dollar Fund (USDU) to the unhedged international equity ETF (IQDG).

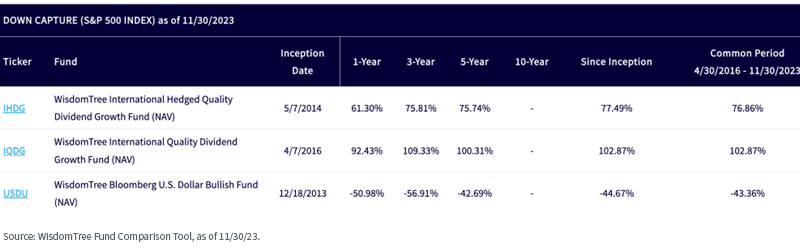

This was particularly true on the downside, where the U.S. dollar had a negative downside capture (it went up), while the downside capture of the hedged strategy was considerably improved compared to the unhedged ETFs.

Many are hesitant to make a call on the dollar’s direction. But the correlation dynamics presented here—with bond diversification falling and U.S. dollar diversification to U.S. equity risk newly rising—argue that currency-hedged ETFs should have a long-term role in portfolio allocations, less for tactical views on currency directions and more for lowering overall risk levels.

Important Risks Related to this Article

IHDG/IQDG: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

USDU: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in specific regions or countries, thereby increasing the impact of events and developments associated with the region or country, which can adversely affect performance. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. The Fund’s investment in repurchase agreements may be subject to market and credit risk with respect to the collateral securing the repurchase agreements and may decline prior to the expiration of the repurchase agreement term. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting such issuers. Unlike typical exchange-traded Funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Although the Fund invests in very short-term, investment grade instruments, the Fund is not a "money market" Fund, and it is not the objective of the Fund to maintain a constant share price. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.