Cybersecurity: Too Hot to Handle after 2023?

Investing is funny. If an investor posed the question, what was the best-performing exchange-traded Fund at WisdomTree during 2023, the answer would be the WisdomTree Cybersecurity Fund (WCBR), which returned 66.40% in NAV total return terms.1

Current performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For the most recent month-end and standardized performance, click here.

Is that viewed positively? In my 20 years of experience in financial services, I see investors avoiding areas of the market that recently delivered particularly negative performance. But does that mean they favor what has gone up?

It is not so simple—and when you hear a market was up more than 60% for a single year, yes, investors tend to be impressed with the big number, but then they become worried they missed all of the return and need to wait for a correction.

Thematic Equities—Why Bother?

To me, any divergence from simply “owning the market”2 has to be accompanied by a rationale as to why that divergence may generate stronger performance. Thematic equity strategies take the big ideas that many discuss all the time—artificial intelligence, cloud computing, renewable energy—and focus on companies in these specific areas.

If these areas “work” and transition from “cool idea” to full adoption, similar to how we currently have full adoption of smartphones, many of these companies can go from developing new ideas and concepts to having, in some cases, hundreds of millions of users.

There are two important layers in a given “thematic equity” decision.

- Layer 1: There are a lot of themes. WisdomTree does its own analysis of thematic equity ETFs listed in the United States, and we have found that month-to-month, there are 40–45 themes at present.3 Selecting a given theme is an important decision, without question.

- Layer 2: Themes are not sectors. Sectors have a fairly standardized and central authority that we all align against a given benchmark. In thematics—and take cybersecurity as an example—three different strategies can have three very different lists of companies. Determining what list best aligns with a particular view of an investor, in our opinion, is not necessarily about coming up with unassailable definitions of what is or isn’t a cybersecurity company. Instead, we seek to unearth the pros and cons of different types of companies that approach cybersecurity in different ways.

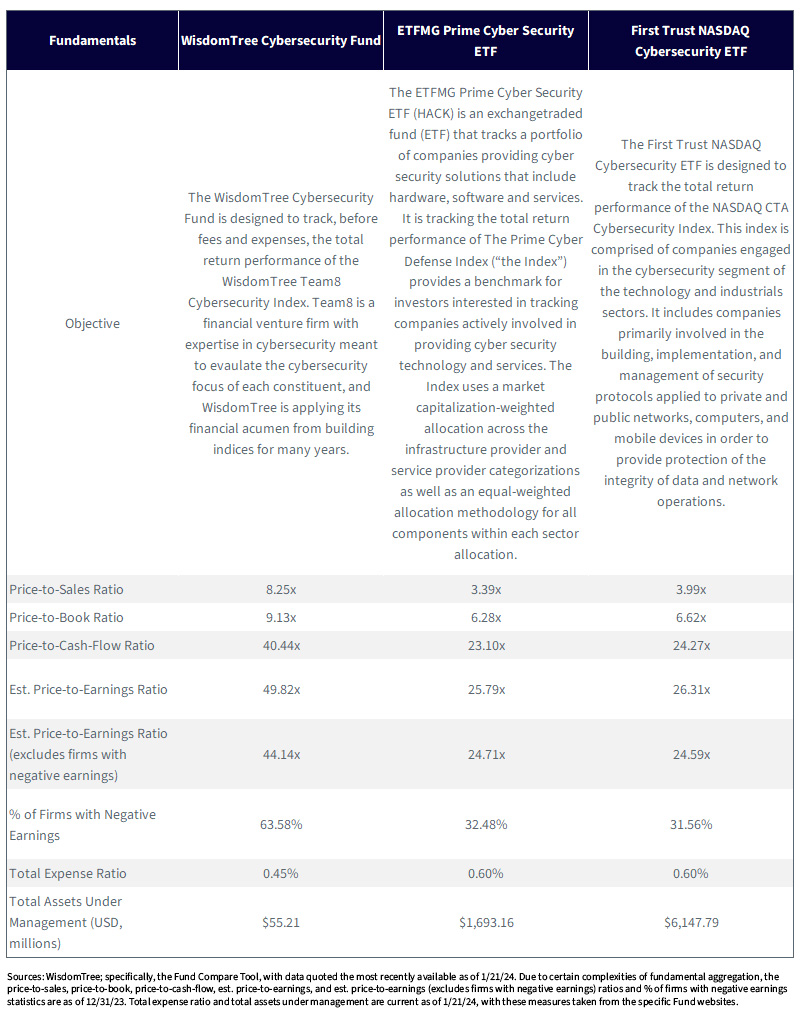

Cybersecurity Funds in Three Charts, One Table

The two largest cybersecurity-focused ETFs by assets under management in the United States are the ETFMG Prime Cybersecurity ETF (HACK) and the First Trust NASDAQ Cybersecurity ETF (CIBR). We can put a few simple statistics on the table to just get investors thinking about the pros and cons of the very different ways these strategies are constructed versus how WisdomTree’s strategy is constructed.

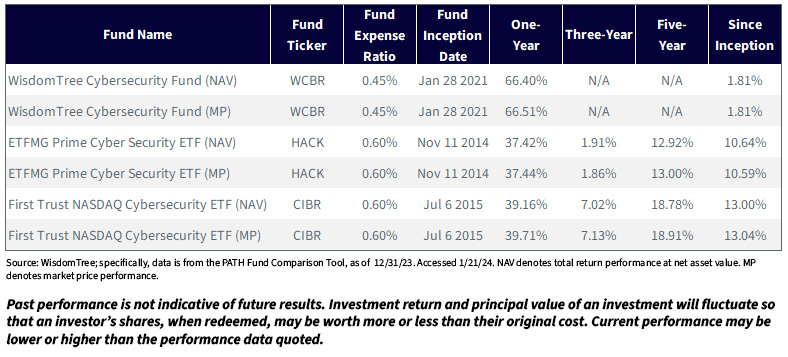

In table 1:

- We have indicated the required performance disclosure of the different ETFs in our analysis in both NAV total return and market price terms as of the most recent quarter-end, December 31, 2023.

- If we focus on the one-year time frame, since the WisdomTree Fund does not yet have three or five years of history, we can see that WCBR delivered better than 66% in NAV terms. HACK delivered 37.42%, and CIBR delivered 39.16%.

This sets the table as one past period when there was very different performance. As we evolve in the future, the picture could look very different. However, what can we learn about the positioning of the strategies that led to this result?

Table 1: Standardized Performance

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WCBR, HACK, CIBR.

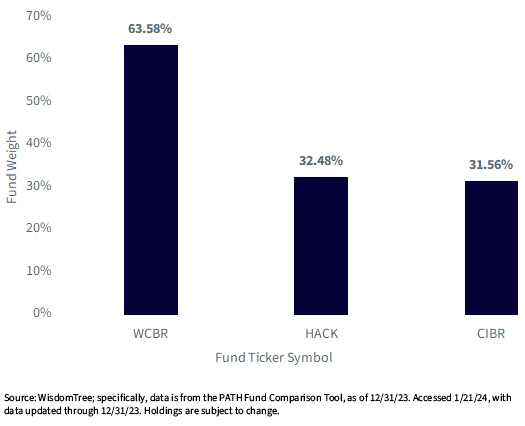

In figure 1:

- We showcase the percentage weight of each Fund in companies with negative earnings. This is because, in the current market paradigm, there is a lot of focus on profitability. Companies that are not profitable, in the current paradigm, tend to see their performance accelerating when interest rates, like the U.S. 10-Year Treasury note, are trending down. Similarly, when interest rates are trending up, this has created a headwind for unprofitable growth companies.

- As of December 31, 2023, WCBR had nearly two-thirds of its weight in firms with negative earnings. HACK and CIBR were closer to one-third of their exposure in unprofitable firms. This tells us that if the market paradigm continues—and there is no guarantee it will—WCBR may behave with a greater degree of interest rate sensitivity than either HACK or CIBR.

Figure 1: Percentage Weight in Companies with Negative Earnings

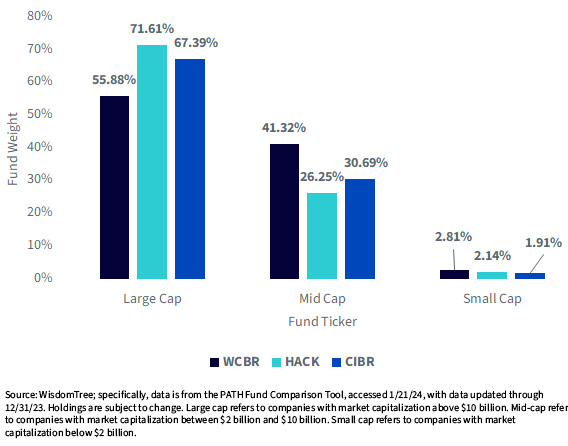

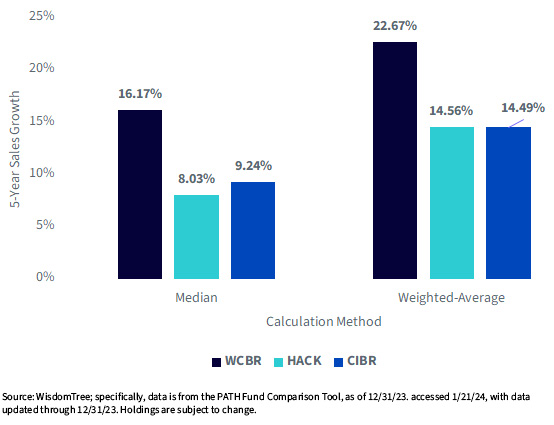

In figure 2:

- 2023 was “the year of large-cap tech.” How do we know this? We created yet another name for a group of firms—in this case, the “Magnificent 7,” to help give investors a snappy way to quickly reference an important engine of the U.S. equity market.

- If investors are thinking that 2024 might be different, meaning that large caps may not show the same leadership, it could benefit to have exposure to more mid-caps or small caps.

- If investors have a thesis that the U.S. Federal Reserve could be more likely to cut interest rates, that might benefit small-cap or mid-cap growth companies, if history is any guide. Specifically, when the U.S. Federal Reserve has lowered its policy rate in the past, mid-cap and small-cap growth companies have performed well.4

- WCBR had less exposure to large caps and more exposure to mid-caps than HACK and CIBR. None of the three Funds had significant small-cap exposure, so the differentiation, at least by market cap, would come in the mid-cap size segment, at least with respect to the December 31, 2023 data.

Figure 2: Exposure to Companies outside of Large Caps

Figure 3:

- The primary reason to even consider thematic equities over a broad market portfolio is that one believes the growth of the specific thematic equities should be faster than that of the broad market.

- Cybersecurity risks are omnipresent, and few believe this trend reverses. We have certain geopolitical risks, be it with respect to Russia/Ukraine, the Middle East or places in Asia, whether related to North Korea or Taiwan. We also have criminal actors taking in new generative AI tools and considering how to deploy them for nefarious purposes. So, everyone needs cybersecurity tools. But is there revenue growth in the actual companies that different funds define as focused on cybersecurity?

- If we look at the current companies in WCBR, HACK and CIBR and note both the median and weighted average sales growth figures, we see that WCBR stands out. The WisdomTree Team8 Cybersecurity Index, which WCBR is tracking after fees and expenses, does have a revenue growth metric included within its selection and weighting methodology. Specifically, companies that have been able to indicate two- to three-year revenue growth rates above 20% on an annualized basis tend to see higher weight than those companies that have not been able to generate such growth.

Figure 3: Five-Year Sales Growth as of December 31, 2023

Conclusion: Can the Demand for Cybersecurity Solutions Go Down?

At the 2024 Davos conference, artificial intelligence was a central topic, but we certainly caught the reference from JP Morgan about the amount of money it spends on cyber defense. The bank spends $15 billion on technology every year and employs 62,000 technologists, with many of them focused directly on cybersecurity.5

As I put my hands on the keys to write this blog post, I saw a different headline: “Microsoft Reports Hack by Nation-State Actor.”6

We see the demand for cybersecurity tools increasing. Every firm requires it. Newer companies that focus on many different types of cybersecurity defense could be the most interesting, but we think it’s important that people realize the word “cybersecurity” in a fund’s name does not tell you much in terms of how that fund is focused on the topic.

Figure 4: Further Information Supporting the Comparison of Different Funds

If you are interested in diving more into the comparison of these Funds, please check out our Fund Comparison Tool.

1 Source: WisdomTree December 2023 Performance Report

2 In this context, “the market” refers to the global equity portfolio weighted by market capitalization, which could look like a strategy built to track the returns of the MSCI ACWI IMI Index.

3 Source: WisdomTree U.S. Thematic Update

4 Will Daniel, “The Wall Street bull who called this year’s stock market rally says small-cap stocks could surge 50% over the next year,” Fortune, 12/15/23.

5 Source: Owen Walker, “JPMorgan suffers wave of cyber attacks as fraudsters get ‘more devious,’” Financial Times, 1/17/24.

6 Source: Dean Seal, “Microsoft Reports Hack by Nation-State Actor,” Wall Street Journal, 1/19/24.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund invests in cybersecurity companies, which generate a meaningful part of their revenue from security protocols that prevent intrusion and attacks to systems, networks, applications, computers and mobile devices. Cybersecurity companies are particularly vulnerable to rapid changes in technology, rapid obsolescence of products and services, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally. Cybersecurity company stocks, especially those that are internet-related, have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. These companies may also be smaller and less experienced, with limited product or service lines, markets or financial resources and fewer experienced management or marketing personnel. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.