Who Wins If Toyota’s Bet on Solid-State Batteries Pays Off?

In 2023, we wrote a lot about artificial intelligence—possibly the “theme of the year.” On the other side of the ledger, we have been writing a lot about a possible resurgence in the performance of biotechnology stocks in 2024. However, we’d note that biotechnology is not our sole contrarian idea among our worst performers of 2023—there is also the battery value chain.

The WisdomTree Battery Value Chain & Innovation Fund (WBAT) was the third-worst-performing ETF out of all of WisdomTree’s U.S.-listed Funds during the 2023 year—measured at net asset value and total return terms. Many might not be surprised that as investors were getting more and more excited about AI, they seemed to be getting less and less excited about electric vehicle adoption in the U.S. We’d note that similar to biotechnology, there are lots of advances that are very close to fruition and could be game-changers in the coming years for those with the appropriate time horizon. Here, we write about solid-state batteries.

Toyota has recently made headlines with its claims of being on the cusp of manufacturing solid-state batteries at scale—a technology that could prove to be a game-changer for electric vehicles (EVs). If successful, Toyota’s solid-state batteries could give electric vehicles a range of 1,200 kilometers—more than twice the range of most battery-powered vehicles—and a charging time of 10 minutes or less.

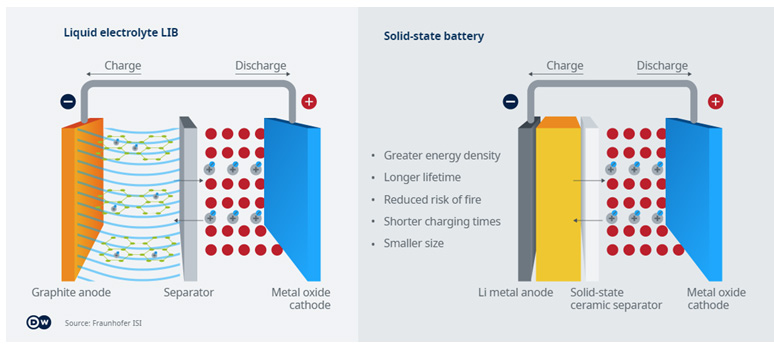

A solid-state battery replaces the liquid electrolyte in a lithium-ion battery with a solid electrolyte. The resulting battery can achieve much greater energy density. The battery is also known to improve safety by reducing the risk of explosion or fire. And, due to its higher energy density and less need for safety components, the battery can be made much smaller in size, thereby rendering it ideal for road transportation.

So, if solid-state-powered cars hit the market as soon as 2027 or 2028, as claimed by Toyota, and the technology is as groundbreaking as it promises to be, who might be the winners from all of this?

Consumers

Range anxiety is still one of the main hurdles for EV adoption. A recent survey conducted by Recurrent revealed that 76% of prospective EV owners worry about range, although this drops to around 59% for current owners.1 Improved range and reduced charging time will certainly help alleviate concerns for many prospective adopters of EVs.

Raw Materials

There is an overlap between the materials used in solid-state batteries and those used in lithium-ion batteries. Producers of key raw materials like lithium and manganese, among others, will benefit from the wider adoption of the technology.

Automakers

At the start of last year, we joined the chorus of voices criticizing Toyota for its lack of strategy on electric vehicles. Worldwide sales of plug-in EVs hit 1.3 million in October 2023, with Chinese automakers dominating the top 20 most-sold models.2 Toyota, one of the largest automakers in the world, is nowhere to be seen on such lists despite it being one of the first to enter the space for self-charging hybrid cars.

But a change in leadership over the course of the year probably catalyzed a renewed push toward doing something special to redeem its reputation as a leading automaker. And although some of it may be attributable to a more favorable macro backdrop (yen depreciation) for Japanese exporters, Toyota’s share price trajectory in 2023, particularly in the second half of the year, suggests markets started seeing the company more favorably following its solid-state headlines.

However, the benefits of the technology will accrue to any automaker that makes its own breakthrough with the technology. In October of last year, Chinese automaker Nio made a filing with the Chinese government to add solid-state batteries to 11 more of its models after previously filing to include them in three. Clearly, other automakers are taking note of the technology and are keen to participate.

Emerging Technologies

The innovation could propel other technologies as well. One obvious example is battery swapping. If you ask an operator of electric buses why battery swapping is not used widely to reduce the time it takes to get a bus back on the road once its charge is depleted, they will cite how impractical it is to do so, given the size of the battery. A smaller battery, potentially with a modular structure, could facilitate battery swapping—something that could be especially beneficial for use in commercial vehicles.

Battery swapping can also reduce the upfront cost of purchasing electric vehicles, be they passenger cars or larger commercial vehicles. If buyers own the vehicle except the battery and subscribe to a battery service, not only will the ownership costs come down, but so will the concerns around the life of the battery.

Investors

The beauty of thematic investing is that by casting the net wide across a sea of possibilities, investors give themselves the chance of making a big catch. Such is the nature of investing in things that can change the world. Some ideas work, others don’t. But the hope is that the ones that do are enough to make the endeavor worthwhile.

“Solid-state” is recognized as one of the 37 subsectors within the WisdomTree Battery Value Chain and Innovation Fund (WBAT). Our partnership with Wood Mackenzie enables us to reevaluate the attractiveness of any given battery technology on an ongoing basis. At each six-month rebalance, all subsectors receive updates to their intensity scores, a measure of the importance of a subsector to the battery theme. By extension, all companies within the battery value chain receive updates to their intensity ratings, a measure of how much revenue the company generates from the given subsector. This approach not only allows investors to capture a wide array of innovations, any of which could become the next big thing, but it also ensures that the strategy keeps one eye on the industry as it stands today and another on its future.

1 Reported by CBT News, November 2023.

2 Inside EVs, December 2023.

Important Risks Related to this Article

For current Fund holdings, please click here. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. The Fund invests in equity securities of exchange-listed companies globally involved in the investment themes of battery and energy storage solutions (“BESS”) and innovation. The value chain of BESS companies is divided into four categories: raw materials, manufacturing, enablers and emerging technologies. Innovation companies are those that introduce a new, creative or different technologically enabled product or service in seeking to potentially change an industry landscape, as well as companies that service those innovative technologies. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit. The Fund does not attempt to outperform its Index or take defensive positions in declining markets, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.