Can India Continue Its Strong 2023 Performance?

India faced global headwinds in 2023 of high global inflation, rising interest rates and unstable geopolitics and shined as one of the best-performing markets globally. The Sensex and Nifty, two widely followed benchmarks for the Indian markets, grew 19.57% and 21.11%, respectively, in USD terms.

India’s economy displayed strong local retail demand, moderate inflation, stable interest rates and healthy foreign exchange reserves. India also enjoyed relatively healthy relations with most major economies of the world and cautiously navigated the geopolitical conflicts.

As we look ahead in 2024, we remain confident in our outlook for India as a long-term story, one that could last for years if not decades to come. National elections are due to be held around May 2024. Current prime minister Narendra Modi is seeking a historic third term, and we see it as highly likely the ruling party, BJP, will win with a full majority like the previous two times.

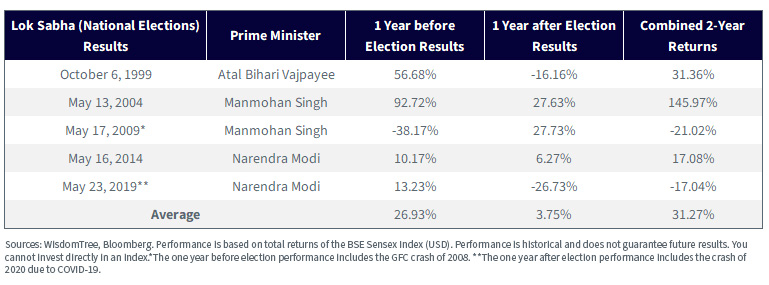

India has benefited from Modi’s pro-business and pro-growth policies, and a stable political environment further boosts prospects to realize rapid growth. We analyzed the performance of BSE Sensex, one of the widely followed benchmarks of the Indian stock market, pre and post elections.

On an average, the Indian markets displayed positive performance delivering over 31% returns over the year leading up to, combined with the year after election results. This is despite the global financial crisis of 2008, and the COVID-19 drawdown negatively impacting the performance leading to 2009 elections, and after the 2019 elections respectively. We expect this trend to continue with the likely return of the incumbent government.

Of course, should Modi surprisingly lose, some of the recent gains might reverse. That seems highly unlikely, given the state of opposition, as multiple political parties, including some with completely unaligned agendas, have joined hands to prevent a third Modi term. This was evident over the five recent elections in which the BJP won by a huge majority in three of the largest states with the highest proportion of Lok Sabha (national election) constituencies.

Other important factors that investors might want to keep an eye out for during the year:

1. Rate cuts: The Fed’s pace and timing on rate cuts will impact global markets, and India is no exception. The quicker and higher the cuts, the more capital expected to be diverted toward equities, and with a strong momentum from the previous year, India might be one of the top picks in the emerging markets.

2. Crude oil prices: The Indian economy heavily depends on the import of crude oil. The higher the crude oil prices, the more stress on India’s foreign current accounts. Drops in crude oil could help India’s economy grow faster and allow more room for spending on growth and infrastructure. India is also simultaneously working to reduce dependency on crude oil by diversifying into ethanol. Over the last few years, ethanol production has increased manifold, and there is a growing push to increase the usage of ethanol-blended fuel to power vehicles. This could potentially save the country much-needed cash and help direct it to fuel economic growth and reduce fiscal deficits.

3. China decoupling: India has emerged as one of the most credible contenders to help diversify manufacturing out of China. Some examples: Apple established a considerable footprint and plans to scale up operations multi-fold, significant investments and subsidies were introduced to attract semiconductor companies from Taiwan, and there are also suggestions Tesla is looking to enter India with a US$2 billion investment in a manufacturing facility based in the state of Gujrat.

One of the most iconic policies of the current government over the last decade has been “Make in India.” The government will be pushing hard to attract more companies to set up manufacturing plants in India and leverage the success of “Make in India” among voters

4. Geopolitical instability: India has been relatively less impacted by geopolitical conflicts around the globe. India maintained its neutral stance and successfully managed to stand firm despite pressure from the West by importing discounted oil from Russia to ensure its energy security while at the same time pitching itself as a closer ally to the U.S. to counter the growing China threat.

5. Retail flows: In recent years, India witnessed increasing participation of retail investors in the stock market. There are 80 million unique investors in the Indian stock markets that invest through the NSE. Moreover, the size of mutual fund AUM is currently around 24% compared to 11% a decade ago. The strong retail presence helps add stability to the Indian markets in the event of global instability and foreign institutional investor (FII) outflows.

Conclusion

As we have highlighted time and again, we believe that India is a multi-decade story, and we are in the very early stages of it. This is not to say that investors should expect a smooth ride. As with all major equity markets, the ride might be bumpy but could come with significant upside potential for investors over the long term.

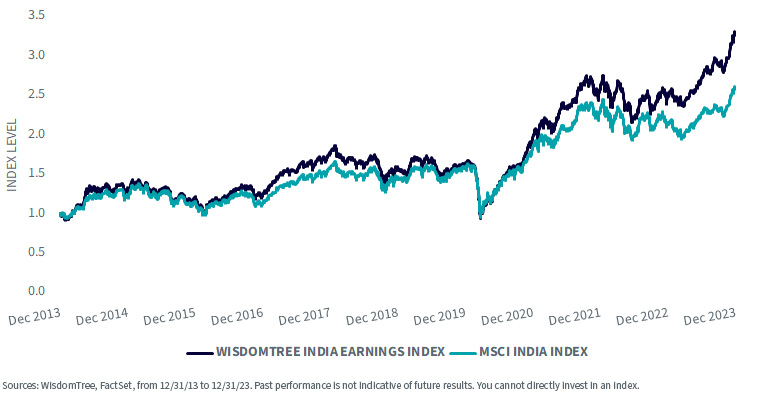

MSCI India outperformed MSCI EM and MSCI China by significant margins over the last 10 years, and we expect the trend to continue. The question then arises, if India could be accessed in a better way, could that help avoid valuation traps and deliver better performance than the market cap-weighted index? We believe that the WisdomTree India Earnings Fund (EPI), with its broad market and earnings weighting approach, does just that and has a proven track record as one of the earliest India funds (read more here).

MSCI India vs. MSCI China & MSCI EM

WisdomTree India Earnings Index vs. MSCI India Index

For the WisdomTree India Earnings Fund’s most recent month-end and standardized performance, click here.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Ayush is a Global Associate Director in WisdomTree's research and index teams, where he focuses on developing innovative quantitative strategies across asset classes and supporting WisdomTree's diverse range of products. He specialises in factor exploration, portfolio construction and optimisation, and risk management.

Ayush has over 7 years of experience in the financial services industry. Prior to joining WisdomTree, Ayush worked in investment research teams at J.P. Morgan and Franklin Templeton where he was responsible for developing and managing equity/fixed income smart beta products, as well as cross-asset risk premia products for global institutional and retail clients. His experience spans across a range of asset classes and investment styles.

Ayush holds a Bachelor's and a Master's degree in Engineering Physics from the Indian Institute of Technology, Bombay.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.