Commodities: An Immaculate Asset for An Immaculate Disinflation?

Commodities are a strong strategic asset that offers great diversification benefits, inflation hedging and a long-term risk premium. However, we acknowledge that many people only see commodities as a short-term tactical instrument. Looking down the barrel of a global economy that is likely to continue to decelerate in 2024, combined with that perception of commodities as a tactical asset, it is unsurprising that many investors have shied away. However, evidence points to real commodity prices generally rising in soft landings. Many investors could be missing an opportunity by sitting on the sidelines.

What Is a Soft Landing?

Market consensus seems to be coalescing around a soft economic landing or an immaculate disinflation in 2024.

However, there is no official definition of either term. The National Bureau of Economic Research (NBER), which dates recessions, doesn’t have a definition for a soft landing. Many economists consider a recession with a small increase in unemployment as soft. The immaculate disinflation concept is similar in that inflation is quelled by an economic deceleration without a spike in unemployment. Such soft landings or immaculate disinflations are ideal from the perspective of central bankers, as they are associated with enough economic cooling to dampen price pressures but not so much harshness that they inflict widespread economic pain.

Alan Greenspan, the Federal Reserve (Fed) chairman between 1987 and 2005, is often accredited with creating the quintessential soft landing in the mid-1990s. In early 1994, the U.S. economy was in its third year of recovery following the 1990–91 recession. By February 1994, the unemployment rate was falling rapidly, down from 7.8% to 6.6%. CPI inflation was 2.8%, and the Federal Funds Rate was around 3%. With the economy growing and unemployment shrinking rapidly, the Fed was concerned about a potential pick-up of inflation and decided to raise rates pre-emptively. In 1994, the Fed raised rates seven times, doubling the Federal Funds Rate from 3% to 6%. It then cut interest rates three times in 1995 when it saw the economy softening more than required to keep inflation from rising.

Commodities in a Soft Landing

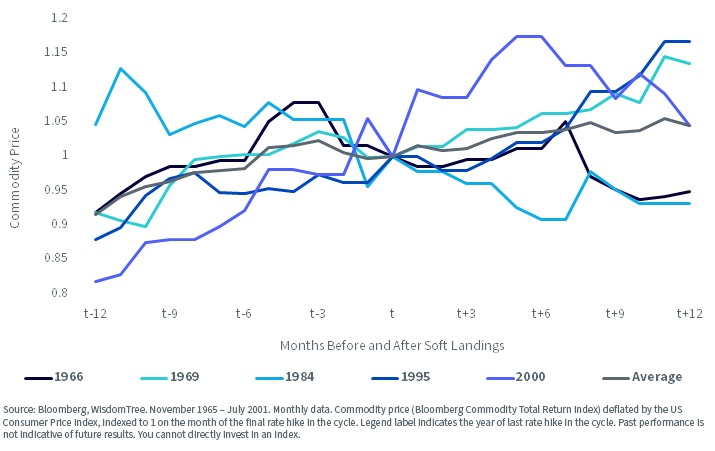

To analyze soft landings, we use the work of Princeton economist Alan Blinder,1 a former Fed vice chair. He considers soft landings as periods when GDP declines by less than 1% and the NBER doesn’t declare a recession within one year of a Fed hiking cycle. We analyze the performance of commodity prices one year before and after the final Federal Funds Rate hike in each of these episodes.

In the chart below, we show real commodity prices (deflated by the U.S. Consumer Price Index), indexed to 1 at the final rate hike in the soft landing period. What is clear is that not every soft landing is the same, but on average, commodity prices are soft for the five months prior to the last rate hike and then rise thereafter.

In 2000 and 1995, commodity prices rose before and after the last rate hike. And in 1984, commodity prices fell before and after the last rate hike. The two examples from the 1960s—1966 and 1969—fit the average profile of softening a few months before the last rate hike and rising after it.

The main takeaway is that in four out of the five soft landings, commodity prices were up five months after the last rate hike.

Real Commodities Prices Around Soft Landings

Are We in a Soft Landing Now?

As we argue in What Will “Higher for Longer” Actually Mean?, major central banks around the world are getting ready for the next stage of monetary policy. The Fed, which is arguably the leader of the pack, has left rates unchanged since August 2023. U.S. inflation pressures appear to be declining in a meaningful way, while U.S. unemployment is very low at 3.7% in November 2023. In fact, while unemployment had been on a slow rising trend from 3.4% in January 2023 to 3.9% in October 2023, it surprisingly dipped in November. While the dip may be accounted for by idiosyncratic factors such as the resolution of strikes and extra hiring by government and healthcare, the University of Michigan survey of consumers also climbed to a four-month high, pointing to positive sentiment that is inconsistent with the beginning of a hard landing. Moreover the survey showed inflation expectations cooling despite underlying strength in the labor market. While soft landings are difficult to achieve, current conditions appear supportive of one.

Investing in Broad Commodity Strategies

The WisdomTree Enhanced Commodity Strategy Fund (GCC) is an actively managed exchange-traded Fund designed to provide broad-based exposure to the following four commodity sectors: Energy, Agriculture, Industrial Metals and Precious Metals, primarily through investments in futures contracts. The strategy seeks to systematically enhance the risk return profile by using the shape of individual commodity futures curves to choose the contract exposure. As we enter a soft landing, many commodity futures may revert to a state of contango (an upward sloping futures curve) away from backwardation (a downward sloping futures curve). Contango presents a drag on returns, but the enhancement process will minimize this drag, allowing the strategy to mitigate the roll drag risks seen in front-month (non-enhanced) strategies like the S&P GSCI or Bloomberg Commodity index.

1 Alan S. Binder, “Landings, Soft and Hard: The Federal Reserve, 1965–2022,” Journal of Economic Perspectives, Winter 2023.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance. These factors include use of commodity futures contracts. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. In addition, derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Because of the frequency with which the Fund expects to roll futures contracts, the price of futures contracts further from expiration may be higher (a condition known as “contango”) or lower (a condition known as “backwardation”) and the impact of such contango or backwardation may be greater than the impact would be if the Fund experienced less portfolio turnover. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.