A Fresh Look: International Dividends Annual Rebalance

When will international equities outperform the U.S.?

This seems to be a constant refrain from investors over the last decade.

Owing to outperformance in the fourth quarter of 2022, the MSCI EAFE has clung onto a trailing 12-month advantage over the S&P 500 of more than 4%.1

Without the tailwind of mega-cap growth stocks in the developed international market, as in the U.S., international equities have lagged this year.

That has meant less multiple expansion, and less expensive multiples, in international equities.

Refreshing Exposures in WisdomTree International Equity ETFs

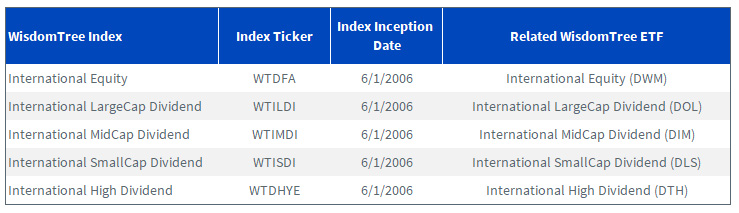

Earlier this month, WisdomTree completed the annual rebalance of its developed international dividend-weighted Indexes.

These Indexes were designed with a focus on being broadly diversified, highly correlated to the representative market cap-weighted indexes and investable.

Each Index is tracked by a related WisdomTree ETF with more than 17 years of live track record.

The screening date for the Indexes was September 29, with implementation of the rebalance at the market close of November 8.

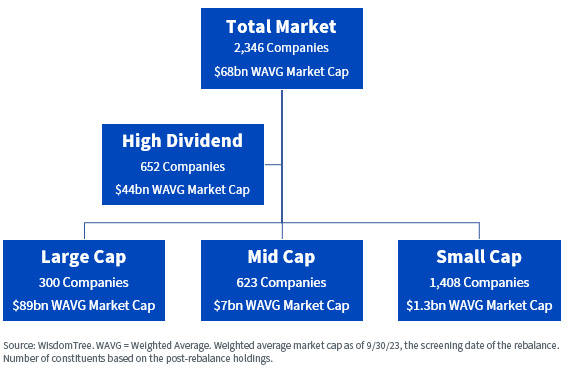

The WisdomTree International Equity Index—a modified dividend-weighted Index tracking the performance of more than 2,000 dividend-paying companies from the developed international universe—is the parent total market index of three market-cap segments of the international equity market as well as a high dividend index.

- WisdomTree International LargeCap Dividend Index – Comprises the 300 largest companies ranked by market capitalization from the WisdomTree International Equity Index.

- WisdomTree International MidCap Dividend Index – Comprises the top 75% of the market capitalization of the WisdomTree International Equity Index after the 300 largest companies have been removed.

- WisdomTree International SmallCap Dividend Index – Comprises the bottom 25% of the market capitalization of the WisdomTree International Equity Index after the 300 largest companies have been removed.

- WisdomTree International High Dividend Index – Comprises the top 30% of companies ranked by dividend yield from the WisdomTree International Equity Index.

WisdomTree International Equity Index Hierarchy

WisdomTree creates its proprietary developed international universe based on the below main criteria:

- Geography: Incorporated/listed in Japan, the 15 European countries (Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland or the United Kingdom), Israel, Australia, Hong Kong or Singapore

- Regular cash dividend payer: Pay at least $5 million in gross cash dividends

- Dividend sustainability: Companies screened out from the Index based on a proprietary composite risk screen of factors, including profitability, momentum and dividend yield

- Volume: Trade at least 250,000 shares per month for each of the six months and have a median daily dollar volume of at least $100,000 for three months

- Minimum market cap: Companies must have a minimum market cap of $100 million

After running the above screens to include eligible international dividend payers in the Index, constituents are then fundamentally weighted based on regular cash dividends paid, adjusted for a propriety composite risk screen of dividend sustainability.

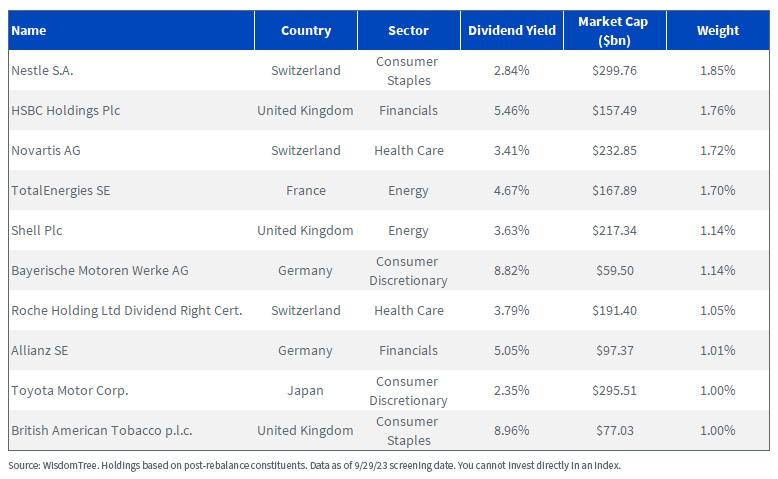

Top 10 WisdomTree International Equity Index Holdings

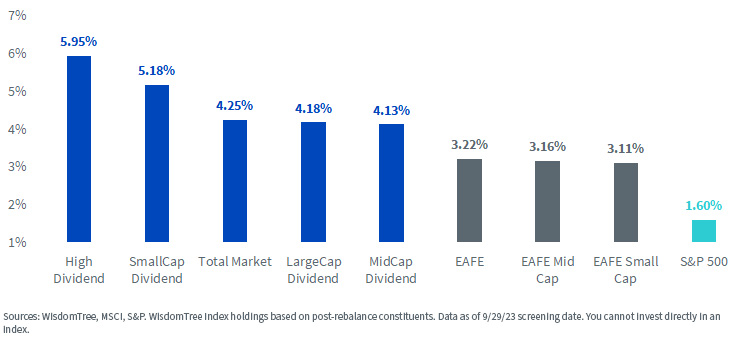

The total market WisdomTree International Equity Index has a trailing 12-month dividend yield of 4.25%, an improvement of about 100 basis points over the MSCI EAFE Index. The 4.25% yield is more than 2.5x greater than the 1.60% yield of the S&P 500.

The WisdomTree International High Dividend Index has a dividend yield of almost 6%.

Index Trailing 12-Month Dividend Yields

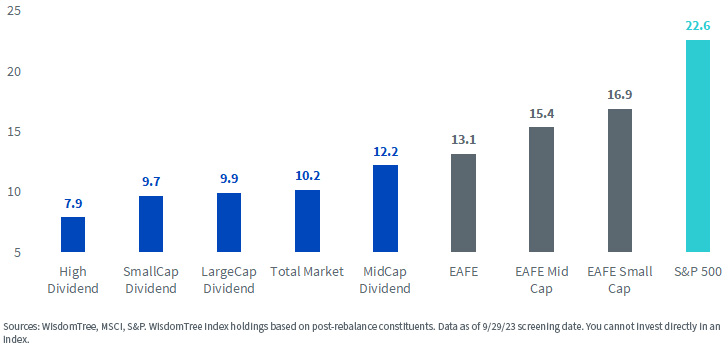

In addition to higher dividend yields, the fundamentally weighted Indexes typically have lower price-to-earnings ratios than the market cap-weighted Indexes.

One of the deepest value cuts of the market globally is the International High Dividend Index, with a price-to-earnings ratio just below 8x.

For context, the S&P 500 P/E ratio is more than 22x.

Index Trailing 12-Month Price-to-Earnings

For additional details on the rebalance of each of the Indexes, please go to their respective Index pages on the WisdomTree website:

- WisdomTree International Equity Index (the WisdomTree International Equity Fund (DWM) seeks to track the price and yield performance, before fees and expenses, of this Index)

- WisdomTree International LargeCap Dividend Index (the WisdomTree International LargeCap Dividend Fund (DOL) seeks to track the price and yield performance, before fees and expenses, of this Index)

- WisdomTree International MidCap Dividend Index (the WisdomTree International MidCap Dividend Fund (DIM)) seeks to track the price and yield performance, before fees and expenses, of this Index)

- WisdomTree International SmallCap Dividend Index (the WisdomTree International SmallCap Dividend Fund (DLS) seeks to track the price and yield performance, before fees and expenses, of this Index)

- WisdomTree International High Dividend Index (the WisdomTree International High Dividend Fund (DTH) seeks to track the price and yield performance, before fees and expenses, of this Index)

1 10/31/22–10/31/23. Returns measured in USD net total returns for the MSCI EAFE and USD gross total returns for the S&P 500.

Important Risks Related to this Article

DWM: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DOL/DIM/DLS/DTH: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.