How Will You Use AI: Cloud Software

Artificial intelligence has taken up a large share of the world’s consciousness in 2023. Prior to ChatGPT, there were many AI applications that were “pretty good,” but very few things that were strong enough to fully capture the world’s attention. After ChatGPT, CEOs of public tech companies raced to make AI announcements on earnings calls.

What Does AI Look Like?

There is a big difference between “mentioning” and “implementing” AI initiatives, but let’s look at what AI means across paradigms:

1. AI is integrated into existing software. Virtual meeting tools like Microsoft Teams and Zoom improved transcription, summaries and even action points of meetings. Cybersecurity is another important area, with more and different types of attacks and not enough employees to fill necessary cybersecurity positions.

2. New AI modules are options users can pay for. Microsoft allowed users of Office 365 to pay more and access a version of Copilot directly on its platform. Google Workspace is also vying for users in these productivity enhancers.

3. New tools: ChatGPT was a “new tool,” spawning a lot of additional applications that can take a prompt and create text to “fulfill” said prompt. The same principle was applied to create videos and pictures. Maybe it will become normal for future slide presentations to be given fully by AI—meaning systems create the slides, and the system is also able to narrate the text to draw out the stories. We are transitioning from feeling like “This is cool” to “Can this tech really add value?” As investors, we have to look at increasing revenues, and then cash flows and, ultimately, earnings.

Cloud Software Companies Have Not Participated in 2023’s AI Rally

So far, 2023 has been defined by such stocks as the “Magnificent 7” and Nvidia.

Many of these AI applications require cloud-based computing platforms and services. However, emerging cloud software companies have not participated like the Magnificent 7 in the AI boom of 2023.

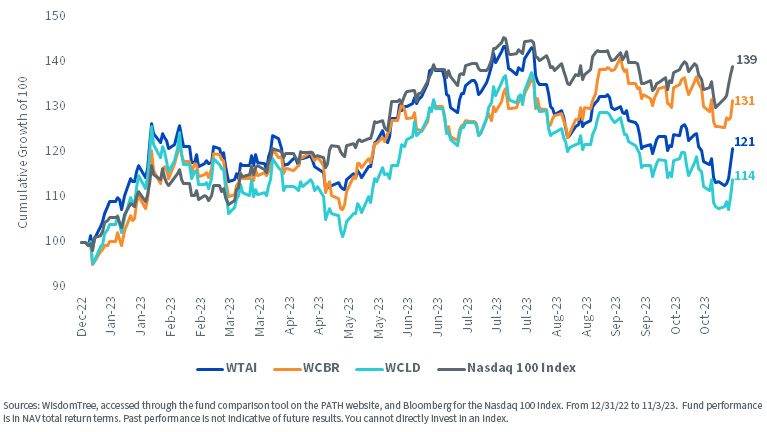

• The Nasdaq 100 Index, with its massive weight in the Magnificent 7, has defined 2023 as strongly delivering equity market returns, but there are a number of ways to invest in the growing tech space.

• WisdomTree has the WisdomTree Cybersecurity Fund (WCBR), the WisdomTree Cloud Computing Fund (WCLD) and the WisdomTree Artificial Intelligence and Innovation Fund (WTAI). WCBR and WCLD are largely software-focused, whereas WTAI represents a mix.

• WCBR has rallied of late. Whenever there is a new technology—this year, generative AI—we believe it is important to also think about how to secure it.

• WCLD has been the relative laggard. Many asked if they “missed” 2023’s AI rally. If our thesis is correct—that many users of AI will use it through cloud software—maybe this portends a reaction in WCLD's returns as we look forward.

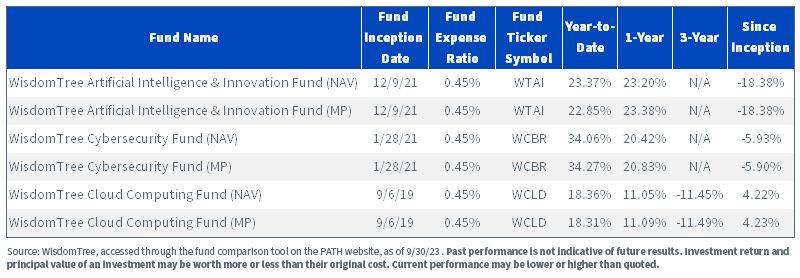

Figure 1a: Standardized Performance

For current holdings, 30-day SEC yield, SEC standardized return and most recent month-end performance, click the respective ticker: WTAI, WCBR, WCLD.

Figure 1b: Emerging Cloud Companies Largely Lagged in 2023

For 30-day SEC yield, SEC standardized return and most recent month-end performance, click the respective ticker: WTAI, WCBR, WCLD.

WCLD Dropped below the Russell 1000 Growth Index on a Valuation Basis

Most investors who speak to us never forget about the fundamentals—and WisdomTree’s foundation was built on looking at such fundamentals as dividends and earnings.

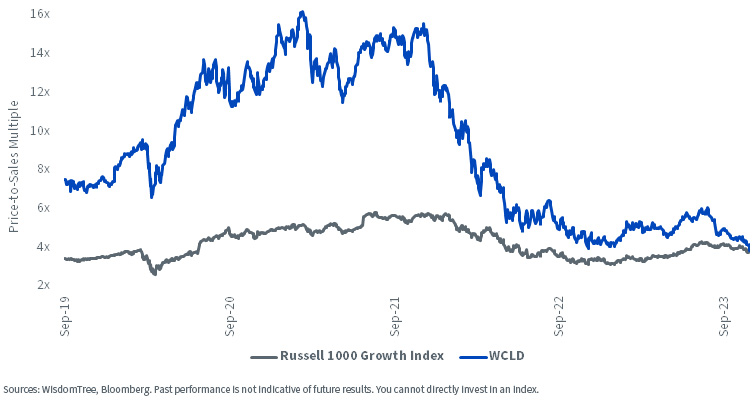

However, when we shift the focus to WCLD and the underlying companies defined by the BVP Nasdaq Emerging Cloud Index, it’s clear that those waiting for an “inexpensive valuation” might be sitting on the sidelines for quite a long time. It’s possible that “emerging cloud software” companies never look inexpensive by traditional measures, given their above-average growth rates over the coming years.

At least based on what we have seen since 2021, emerging cloud software stocks like those in WCLD have been very interest rate sensitive. When we see the U.S. 10-Year Treasury note interest rate going up, we tend to see valuations dropping…and performance doing the same. Similarly, when rates fall, performance picks up.

In figure 2a, maybe due to the recent rise in the U.S. 10-Year Treasury note interest rate, we see something new over the live history of WCLD since its inception.

• Usually, the emerging companies within WCLD are defined by their “potential,” and at times, that potential doesn’t yet have positive earnings behind it. When companies are defined by potential, it tends to push up valuations.

• But rising rates have pushed down the multiples.

• WCLD's price-to-sales multiple actually dropped below that of the Russell 1000 Growth Index for the first time.

Figure 2a: Valuation Opportunity?

Remember the Seesaw: Valuation AND Growth, Not Just Valuation

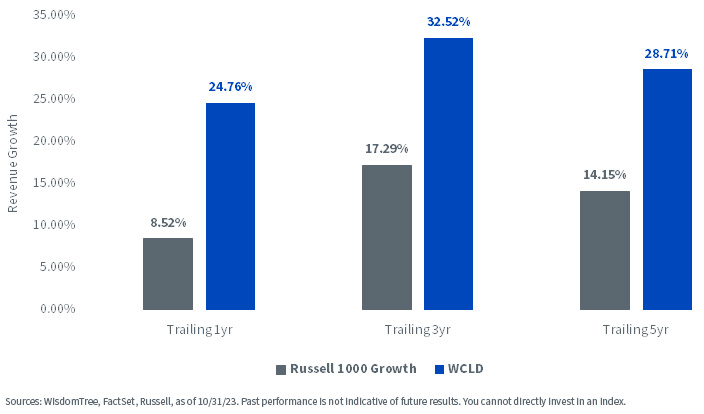

In our view the true question is actually not whether the companies represented within WCLD are expensive or inexpensive but rather whether those companies are exhibiting strong enough growth to justify their valuations. When we see the higher valuations in figure 2a, investors were pushing those prices up because the demand for software during the height of the pandemic was extremely high.

In figure 2b, we show the historical revenue growth as well as the future revenue growth expectations. As with any estimates or expectations, there are never any guarantees, but one thing we are excited about is that the companies within WCLD are continuing to exhibit faster growth than that of the Russell 1000 Growth Index.

Another big picture point to have in mind—the majority of the companies in WCLD are Software-as-a-Service (SaaS) companies, and the customer is choosing to, after due diligence, subscribe to the software to solve a particular business need. In today’s world, these software packages tend to be more associated with efficiency gains than spending more overall. While nothing is “recession-proof,” you might, therefore, say that these subscriptions would rarely be the first things cut in a period of stress.

Figure 2b: The Revenue Growth Side of the Ledger

Conclusion: Did Cloud Computing Companies Become More Interesting in 2023?

While we can never know future performance with certainty, we do know two things about the stocks represented within WCLD as a result of 2023’s experience.

1. Valuations have come down further over the course of the year, even amidst some volatility.

2. AI represents a possible catalyst to get more users in that if the cloud computing software companies can offer AI solutions, it might increase the overall adoption and get companies spending more because they believe there are possibly greater benefits to be had.

We’d also note—most companies will probably never buy an Nvidia H100 (or similar) AI-accelerating chip, but they are likely to select and subscribe to software. We believe Cloud computing represents a very favorable model of software delivery, where companies can pay almost feature by feature and operation by operation in certain cases. AI might lead to more subscriptions over time.

Important Risks Related to this Article

For current Fund holdings, please click the respective ticker: WTAI, WCBR, WCLD. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal.

WTAI: The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee, and the Index may not perform as intended.

WCBR: The Fund invests in cybersecurity companies, which generate a meaningful part of their revenue from security protocols that prevent intrusion and attacks to systems, networks, applications, computers and mobile devices. Cybersecurity companies are particularly vulnerable to rapid changes in technology, rapid obsolescence of products and services, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally. Cybersecurity company stocks, especially those which are internet related, have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. These companies may also be smaller and less experienced companies, with limited product or service lines, markets or financial resources and fewer experienced management or marketing personnel. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended.

WCLD: There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the internet and utilizing a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended.

All funds are managed differently and do not react the same to economic or market events. The investment objectives, strategies, policies or restrictions of other funds may differ and more information can be found in their respective prospectuses. Therefore, we generally do not believe it is possible to make direct fund to fund comparisons in an effort to highlight the benefits of a fund versus another similarly managed fund. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.