Three-Quarters of the Way through 2023—Is Artificial Intelligence or Cybersecurity the Strategy with the Performance Lead?

While the “Magnificent 7” and large-cap tech are undoubtedly the main story for U.S. equities in the first three quarters of 2023, excitement around artificial intelligence (AI) has been a critical driver. Nvidia delivered truly historic business results and earnings in 2023,1 and it is perceived to be the key company providing necessary hardware to power the coming AI revolution.

And yet, the WisdomTree Artificial Intelligence and Innovation Fund (WTAI) was not even WisdomTree’s strongest-performing thematic strategy for the first nine months—and a little part of October so far—for 2023.

The top-performer was actually the WisdomTree Cybersecurity Fund (WCBR).

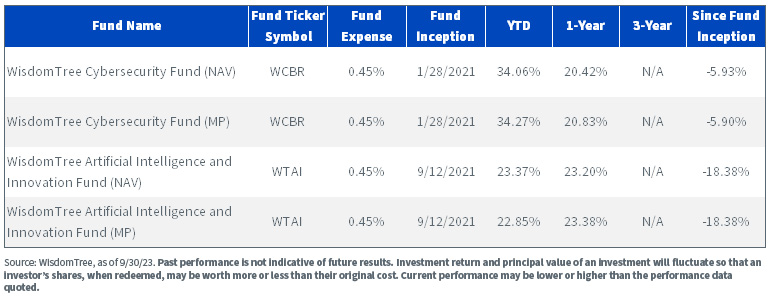

Figure 1a: Standardized Returns

For current holdings, 30-Day SEC Yield, SEC Standardized Return, and the most recent month-end performance click the respective ticker: WCBR, WTAI.

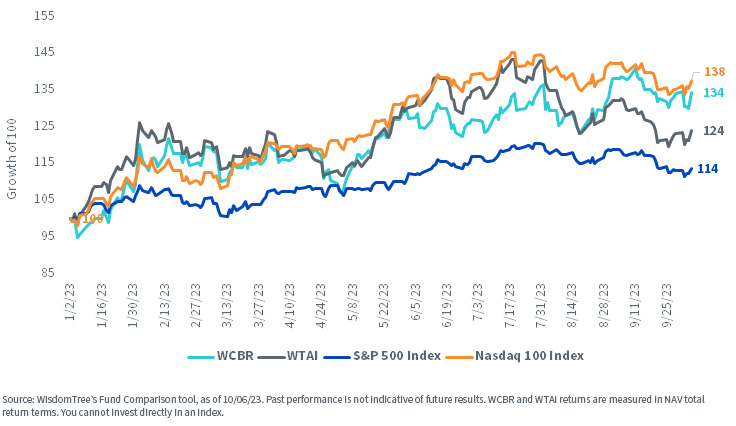

Figure 1b: For the First Three Quarters of 2023 (and a little bit)—WCBR Has Actually BEATEN WTAI on a Total Return Basis

For 30-Day SEC Yield, SEC Standardized Return, and the most recent month-end performance click the respective ticker: WCBR, WTAI.

Pay Attention to Merger & Acquisition Activity

There are a lot more cybersecurity companies than you may realize. This also represents an opportunity for disruption, in that if a company emerges to provide strong enough security solutions across an entire technology stack, many chief information security officers (CISOs) would prefer to work with a smaller array of vendors.

In 2022, we saw a lot of deal activity from more financially oriented players, such as Thoma Bravo and Vista Equity partners. We believe that there could be value in assembling cybersecurity functionality to build multi-purpose platforms that customers can subscribe to.

In late September 2023, we saw the more traditional M&A, and a larger tech company purchased a smaller cybersecurity company to integrate cybersecurity services into its existing offering. A past example of this was Alphabet purchasing Mandiant.2

On September 21, 2023, Cisco announced it was spending $157 per share to acquire Splunk at a 31% premium to the prior close—a total value of $28 billion. The leadership teams of Splunk and Cisco emphasized helping Cisco’s customers better understand their data to provide more services—like those defined by generative AI—to utilize insights from that data.3 Alphabet’s purchase of Mandiant similarly focused on Google Cloud expanding its provided services such that customers could, at least potentially, subscribe to fewer software-as-a-service (SaaS) platforms.

Show Me the Fundamentals!

It is not challenging to convince people of the ever growing need for cybersecurity—investors get it. Every time a new technology in any megatrend area is introduced, it needs to be secured. Hackers are always probing and improving and defenses must do the same. We may not know which cybersecurity providers will become the largest, but we know that individuals and businesses will each need their own strategy for cyber defense.

Many of these companies are newer, recently partaking of the public markets. They have strong sales growth metrics, but they don’t yet have positive earnings and even if they are not as expensive as they were in late 2021…we cannot make the case that they are cheap. It tends to be very difficult to show recently public software companies as cheap.

Sometimes companies can deliver growth commensurate with higher valuations, and it’s also the case that sometimes focusing too much on valuation may lead to investments solely in, for instance, older energy companies and never being exposed to any new software companies. “Always” and “never” are also tricky, because we haven’t yet found any strategy that always leads to higher returns.

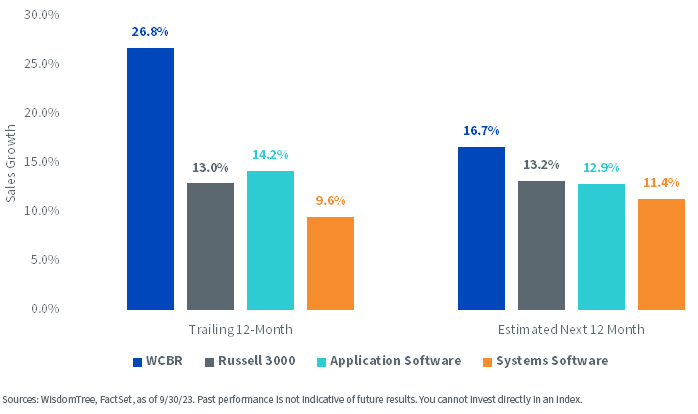

In figure 2, we take a look at both trailing sales growth, which has already happened, and estimated sales growth, for four distinct groups of stocks to be as fair as possible. We also start from a Russell 3000 Index universe to ensure we are not only including large caps or more established, profitable companies.

- The WisdomTree Cybersecurity Fund (WCBR), which tracks the returns of the WisdomTree Team8 Cybersecurity Index and represents an exposure to companies focused on providing cybersecurity solutions.

- The Application Software and Systems Software companies (GICS Sub-Industries) from within the Russell 3000 Index so as to provide a fair comparison to software companies that do tend toward higher revenue growth rates than just general U.S. equities.

- The broader Russell 3000 Index to show the overall baseline so we have a sense of the market’s past sales growth and estimated future sales growth.

Figure 2: Is Sales Growth at Cybersecurity Companies Holding Up Relative to the Market or Other Software Sales Growth?

Even if economic conditions become more challenging, software spending on cybersecurity should hold up even if broader software spending does indeed slow.

- Cybersecurity revenue growth and generative AI revenue growth should be higher relative to general software, but we have to recognize that there are not really pure-play generative AI companies that we can use yet for this analysis.

- The past 12 months have seen faster revenue growth from WCBR relative to broader software or U.S. equities. Forecasted revenue growth for cybersecurity companies is also higher.

Conclusion: What Theme Is More Necessary than Cybersecurity?

Think about that question. If we are thinking about renewable energy companies, space companies, metaverse companies, fintech companies, AI companies…the list goes on. What is a common theme they all need to have a strategy on? The answer: cybersecurity.

Every company, really every person (unless able to get completely off of the grid) needs to have a cybersecurity strategy. It’s hard to think of any other theme for which that is true. We think that the quality pure-play cybersecurity companies have a lot of prospects. If it was last year, we likely would have been mentioning Thoma Bravo buying a series of identity-focused companies. What’s clear is that even in an environment where M&A is not trending straight upward, we’re still seeing actions in cybersecurity.

WCBR is focused on these pure-play, quality cyber firms that have potential as solutions to the cybersecurity questions of tomorrow.

1 Source: https://investor.nvidia.com/news/press-release-details/2023/NVIDIA-Announces-Financial-Results-for-First-Quarter-Fiscal-2024/default.aspx

2 Source: https://www.mandiant.com/company/press-releases/google-acquire-mandiant

3 Source: https://investor.cisco.com/news/news-details/2023/Cisco-to-Acquire-Splunk-to-Help-Make-Organizations-More-Secure-and-Resilient-in-an-AI-Powered-World/default.aspx

Important Risks Related to this Article

For current Fund holdings, please click the respective ticker: WTAI, WCBR. Holdings are subject to risk and change.

WTAI: There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WCBR: There are risks associated with investing, including the possible loss of principal. The Fund invests in cybersecurity companies, which generate a meaningful part of their revenue from security protocols that prevent intrusion and attacks to systems, networks, applications, computers and mobile devices. Cybersecurity companies are particularly vulnerable to rapid changes in technology, rapid obsolescence of products and services, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally. Cybersecurity company stocks, especially those which are internet related, have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. These companies may also be smaller and less experienced companies, with limited product or service lines, markets or financial resources and fewer experienced management or marketing personnel. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.