Trying to Reason with Hurricane Season

And now I must confess

I could use some rest

I can’t run at this pace very long

Yes, it’s quite insane

Think I hurt my brain

But it cleans me out, then I can go on…

(From “Trying to Reason with Hurricane Season” by Jimmy Buffett, 1974)

I certainly will miss Jimmy Buffett and his live summer concerts (“Parrot Heads” Forever!). It does seem fitting that if he had to pass away, it would be at the end of summer.

But Labor Day has now passed here in the U.S., and that historically has meant “hurricane season” weather-wise in the southeast U.S., as well as the proverbial “hurricane season” with respect to market volatility.

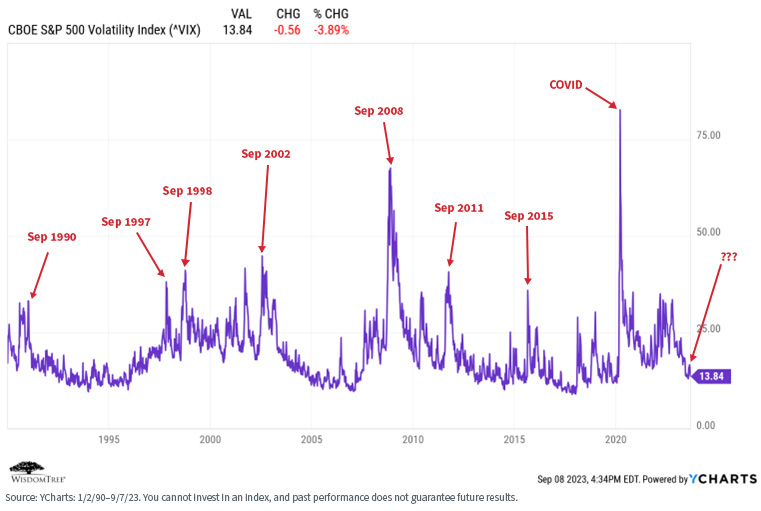

Let’s take a look. By historical standards, the market seems frighteningly complacent…

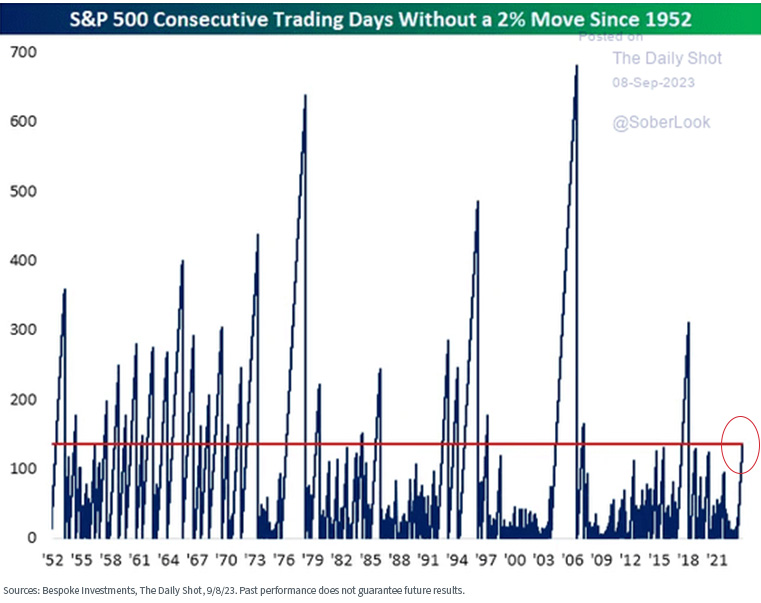

Another way to illustrate this is to measure how many consecutive trading days there have been without a 2% daily market move. The current market is as “quiescent” as it has been since before COVID-19 hit.

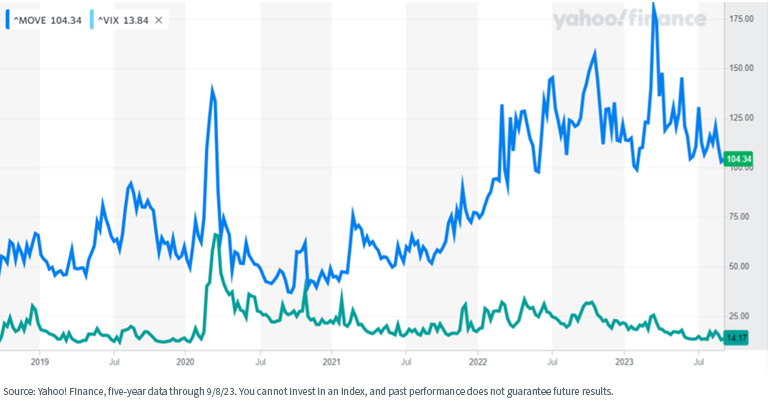

At the same time, bond market volatility (as measured by the ICE BofAML MOVE Index) has moved steadily higher since early 2021 because of uncertainty over economic growth, inflation and Fed policy.

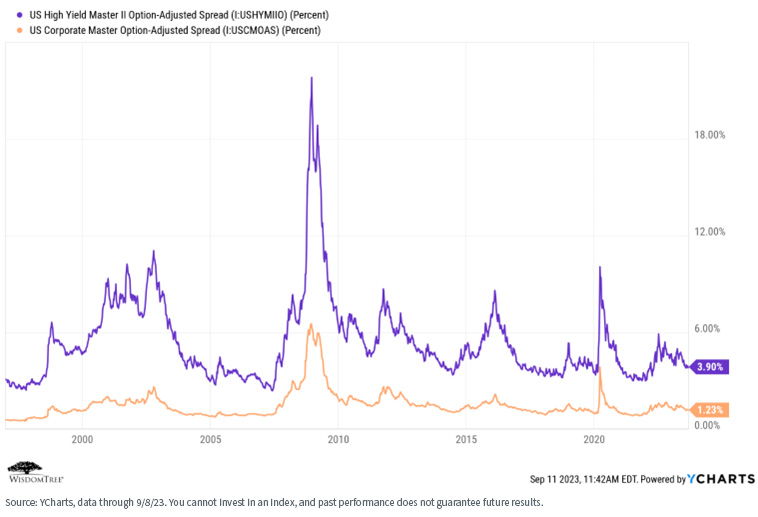

Finally, while we’ve seen volatility in the underlying rate market, credit spreads continue to trade well within their historical levels as bond investors, despite rising default rates and a steady flow of new issuance, seem to be comfortable with the overall strength of corporate balance sheets.

So, What Should Advisors and Investors Be Thinking About?

While not every fall season (i.e., September through November) is marked by increased volatility, it happens frequently enough to be mindful of it. People are back at work and paying attention, and the markets are trading at higher volumes.

We believe this fall will be no different. The markets strike us as very complacent in the face of uncertain economic conditions, rising rates, still-uncertain Fed policy and simmering geopolitical tensions.

In addition, as noted in my last blog post (“Sing Me a Song of Valuation”), U.S. equity market performance this year has been dominated by a small handful of high-flying mega-cap tech stocks, fueled by current investor fascination with artificial intelligence (“AI”).

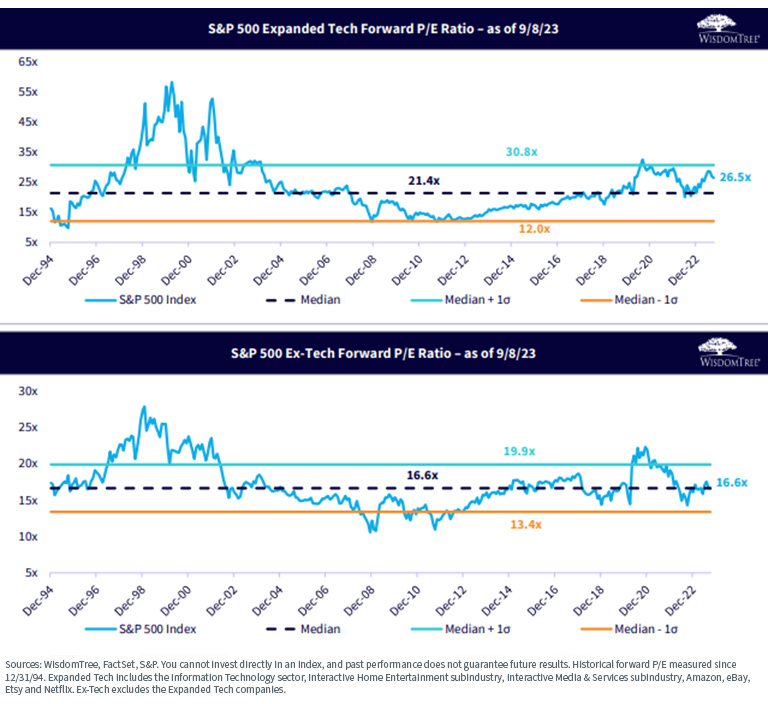

These handful of stocks constitute roughly 25% of the entire S&P 500 market capitalization and have driven an overwhelming percentage of market performance. Consequently, they are trading at frothy valuations far higher than the rest of the market.

Unfortunately, many of these high-priced stocks are the ones most at risk with rising interest rates and rising market volatility. If the market finds itself in another fall “hurricane season,” we may witness precipitous declines in some of these names, and because of their heavy market caps, any declines will reverberate across the entire Index performance, potentially dragging down more reasonably priced stocks as investor sentiment “rolls over” from “greed” to “fear.”

We are not offering this scenario as a “pound the table” conviction—economic growth may continue to rise, earnings may support higher market valuations, inflation and Fed policy may become more transparent, and momentum and investor sentiment can keep market rallies alive well past any contrary signals from underlying fundamentals.

But if advisors and investors want to potentially reallocate or at least develop contingency plans, here are some ideas.

1. Remember that “Quality Is Job One”. Our research suggests that quality is the most consistently performing risk factor (in comparison to growth, value, size, momentum, dividends, etc.)—it is rarely the best- or worst-performing factor over reasonable periods (e.g., a rolling 10-year horizon).

Quality can be defined in many ways, but we prefer to use as our starting point the “DuPont Analysis”, which defines quality companies as those with superior profitability (and therefore dividend sustainability), balance sheets, cash flow and operational efficiency compared to their industry peers. It makes sense intuitively that companies with these characteristics should be able to better withstand changing economic and market regimes, especially if sentiment turns negative.

Many of our products and most of our Model Portfolios use quality as the anchor risk factor and then we diversify across the others, depending on the product or model mandate.

2. Diversify. This seems to be an obvious comment, but as we’ve seen this year, sometimes investors can “fall in love” with certain stocks or markets and then “extrapolate now into forever,” assuming market conditions won’t or can’t change quickly, and they can just continue to ride their current winners. History has proven time and again this can be a very costly mistake, and this is why we diversify our Model Portfolios at both the asset class and risk factor levels.

We believe this gives the best potential to deliver consistent performance regardless of underlying market conditions or economic regimes. Remember the power of compounding—if you don’t lose as much in down markets, you don’t have to gain as much in up markets to still come out ahead. It can also reduce investor anxiety and, therefore, make it easier to stick to the long-term investment plan.

3. Consider allocating to less-traditional strategies or asset classes. Within certain of our models, we allocate to strategies like floating rate Treasuries, managed futures, option-based strategies and global commodities. In addition to other characteristics like income generation or duration control, what these strategies have in common is their lower-correlation profiles in comparison to long stocks and bonds. In times of rising volatility, they can be effective diversifiers within an overall portfolio.

Conclusions

The time to plan for a hurricane is before it hits—once it does, it typically is very difficult to “reason” with. Jimmy Buffett may have been writing and singing about the weather in South Florida when he wrote “Trying to Reason with Hurricane Season,” but advisors and investors can benefit by applying some of the same lessons to their portfolios:

Well, the wind is blowin’ harder now

Fifty knots or there abouts

There’s white caps on the ocean

And I’m watchin’ for water spouts

It’s time to close the shutters

It's time to go inside

[RIP and Godspeed, Jimmy…you brought smiles to millions of faces for more than 50 years, and somewhere out there in paradise, there are a cheeseburger and a margarita waiting for you.]

Contact Us