Opportunities in India for Investors following Recent Market Outperformance

India recently posted GDP growth of 7.8% YoY as of the end of June 2023, at a time when most of the world’s major economies were grappling with avoiding recession and controlling inflation. Our house view remains that India is at the cusp of an economic boom with strong macro tailwinds for years or even decades to come.

While India resembles China from 30 years ago in having a large working-age population, low but growing GDP per capita and an infrastructure and manufacturing boom, there are also some striking differences. India’s democratic form of government as opposed to China’s one-party communist regime, India’s “soft power diplomacy” vs. China’s growing territorial disputes and India’s relatively free market approach in contrast to China’s state control are a few examples. We expect these factors to help India sustain growth and continue to attract outside investments.

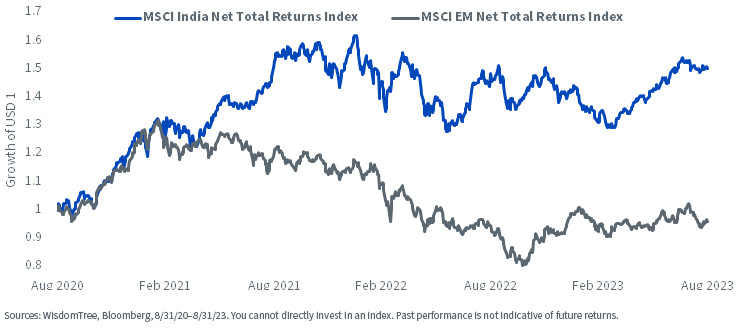

The Indian stock market reflects this sentiment. Over the past three years, India (proxied by the MSCI India Index) has outperformed the broader EM market (proxied by the MSCI EM Index) by a massive 54.37%, with an annualized performance of 14.54% in USD as of August 31, 2023.

One knock on India is that prices reflect this enthusiasm, and it carries one of the highest valuation multiples within the emerging markets universe. This is where WisdomTree’s valuation-sensitive rebalancing discipline can help access India at more reasonable valuations.

WisdomTree India Earnings Index Rebalance

The WisdomTree India Earnings Index (WTIND) targets exposure to profitable companies in the fast-growing Indian equity market.

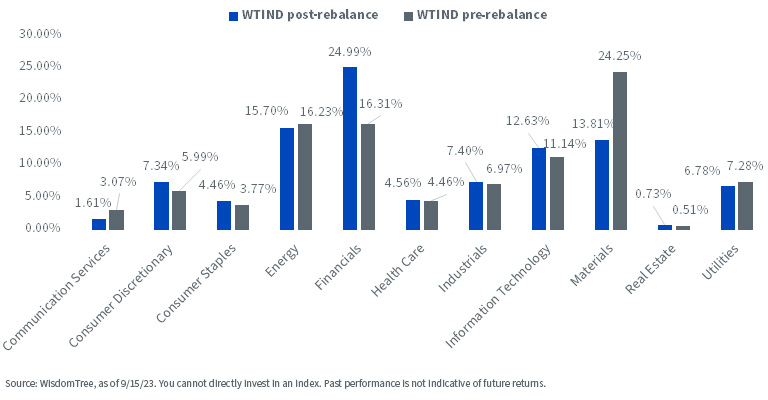

During its most recent annual rebalance, to be implemented after the market close on September 15, the Index added an 8.5% weight allocation to Financials and reduced exposure to the Materials sector by more than 10%. The lower weight of Materials is due to the lower realized earnings in the sector, which could be attributed to the drop in commodity prices over the previous year when commodity prices were extraordinarily high due to the Russia-Ukraine war.

Sector Allocation

Note that HDFC Bank, one of India’s largest private sector banks, was the biggest addition, with a 7% weight allocation and a change in eligibility due to more capacity for foreign investors to buy the stock.

Digging further into the Materials sector, Tata Steel Ltd., WTIND’s largest current holding, saw its weight cut by nearly 80% in line with the decrease in its earnings.

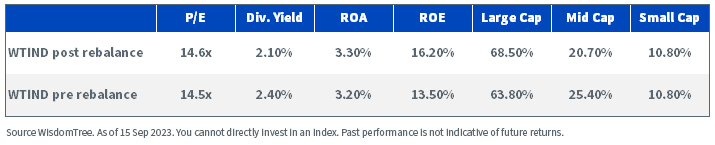

From a fundamental perspective, quality metrics improved, with ROA increasing from 3.22% to 3.32% and ROE from 13.49% to 16.21%. The rebalancing also led to a slight increase in the percentage of large cap stocks while maintaining the Index’s broad-based exposure.

Indian equities are often deemed expensive. However, by weighting by earnings instead of market capitalization, the WisdomTree India Earnings Index achieves valuations that are consistently cheaper than the MSCI India Index on both price-to-book and price-to-earnings metrics.

Price-to-Book Ratio

Price-to-Earnings Ratio

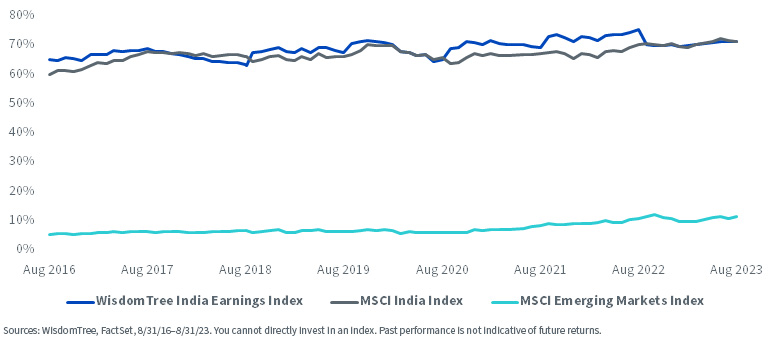

Notably, the revenue exposure of the MSCI Emerging Markets Index to India has doubled over the last seven years as of August 2023, from 6% to 12%, establishing the significance of Indian markets in the broader emerging markets. The WisdomTree India Earnings Index has maintained slightly higher exposure to the growing domestic market versus the MSCI India Index. Post rebalance, the revenue exposure will equal 72.25%, slightly edging the MSCI India Index’s exposure of 71.6% to the domestic market as of August 31, 2023.

Revenue Exposure to Indian Domestic Market

Conclusion

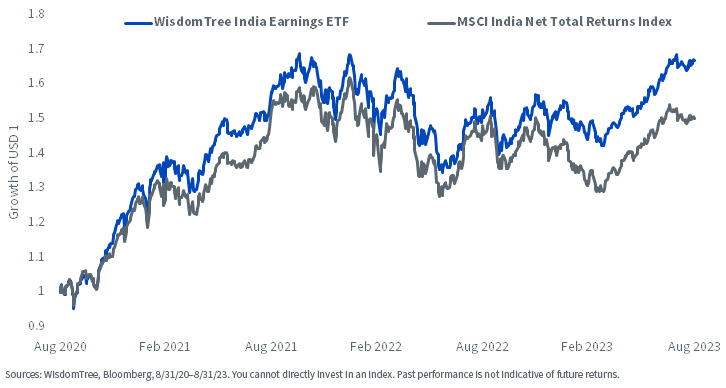

Given the expensive nature of Indian equities over their EM counterparts, the WisdomTree India Earnings Index targets higher profitability at a discount by weighting constituents using earnings and, at the same time, avoiding value traps by filtering out securities with price-to-earnings ratios of less than 2x. This approach has translated well into performance, with the WisdomTree India Earnings Fund gaining 67% while delivering an annualized outperformance of 4.08% over the MSCI India Net Total Returns Index in the last three years ending August 2023.

The performance data quoted represents past performance and is no guarantee of future results. Investment

return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be

worth more or less than their original cost. Current performance may be lower or higher than the performance

data quoted. For the most recent month-end and standardized performance click here.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Ayush is a Global Associate Director in WisdomTree's research and index teams, where he focuses on developing innovative quantitative strategies across asset classes and supporting WisdomTree's diverse range of products. He specialises in factor exploration, portfolio construction and optimisation, and risk management.

Ayush has over 7 years of experience in the financial services industry. Prior to joining WisdomTree, Ayush worked in investment research teams at J.P. Morgan and Franklin Templeton where he was responsible for developing and managing equity/fixed income smart beta products, as well as cross-asset risk premia products for global institutional and retail clients. His experience spans across a range of asset classes and investment styles.

Ayush holds a Bachelor's and a Master's degree in Engineering Physics from the Indian Institute of Technology, Bombay.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.