Can a Weaker Dollar Be an Antidote for EM?

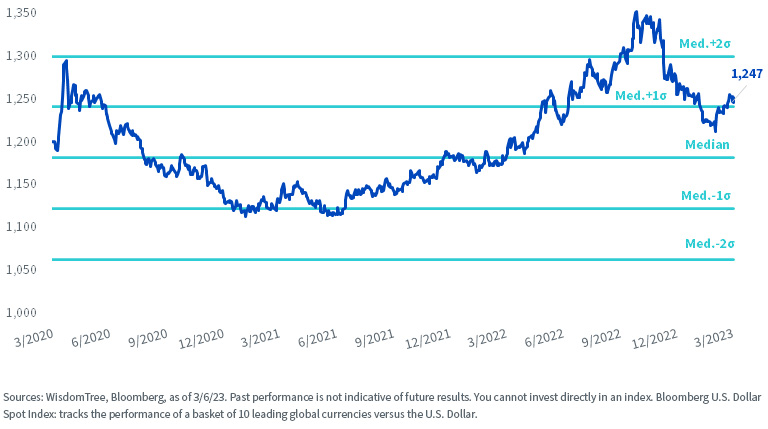

For most of the last two years, the dollar steadily strengthened against most major currencies with little interruption. Record inflation in the U.S. prompted the Federal Reserve to embark on its most rapid pace of interest rate hikes that many in our industry have ever seen, and the dollar followed suit. It peaked in late 2022, more than two standard deviations above its median price over the past three years.

Bloomberg U.S. Dollar Spot Index

While higher rates extinguished risk appetite for investors and sent the dollar soaring, emerging market (EM) equities continued their downtrend. Although the region caught a brief reprieve when China announced the end of its “Zero Covid” policy last fall, providing renewed optimism for the region’s largest growth engine, EM remains hamstrung by the U.S. economic and policy landscape and their attendant effects on the dollar.

Recently, the dollar has slipped from last year’s highs but remains elevated compared to recent history, as U.S. economic data continues to surprise to the upside, complicating the future path of monetary policy for the Fed.

To be clear, however, we’re not dollar bearish. The early 2023 economic data and commentary from Fed officials imply that more rate hikes are virtually certain over the near term to temper the stubbornly resilient U.S. economy.

Our view is that the dollar may eventually fall closer to a more reasonable level, off last year’s highs, as the path of U.S. interest rates becomes clearer. That forces us to consider what assets may benefit most. In this scenario, we think EM may receive a modest tailwind, potentially benefiting from supportive relationship dynamics with the USD.

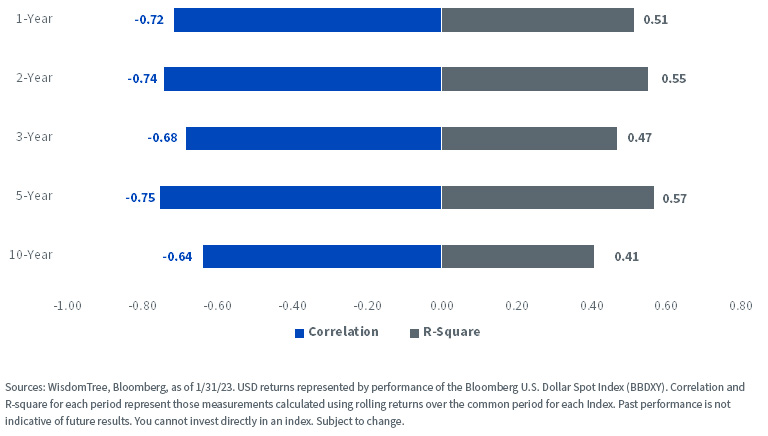

Correlations Point to EM Upside in a Weak Dollar Environment

EM equities and the dollar have long displayed an inverse relationship. There are myriad reasons for this, both technical and sentiment-driven.

At a business level, EM companies often borrow in dollars, which creates difficulty in servicing that debt during periods when the U.S. dollar is strong and local currencies are weak, challenging the prospects of businesses themselves.

EM equities are also an explicit barometer of investor risk appetite across global markets. The dollar often tends to rally as a safe haven during risk-off periods when investors sell EM assets to reduce risk exposure.

The magnitude of the inverse correlation suggests that even a slight decline in the dollar can improve EM returns, especially over the short and medium terms.

Rolling Return Relationships - MSCI EM vs. USD

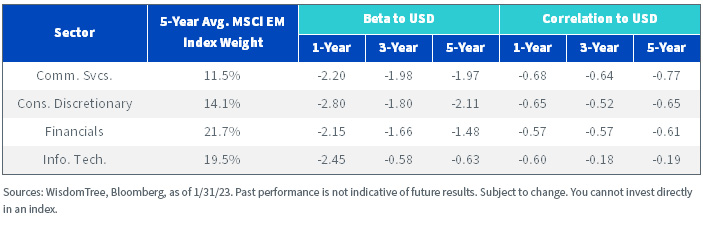

Sector Composition May Compound These Effects

Emerging markets resemble a partial hybrid of both the U.S. and developed markets. Sizable footprints in “growthy,” consumer-focused areas such as Technology, Communication Services and Consumer Discretionary are reminiscent of the U.S. equity market, while an even larger allocation to Financials resembles a heavyweight from the developed market universe. These four sector concentrations comprised exactly two-thirds of the MSCI Emerging Markets Index over the past five years, on average.

Most notable, however, are their respective relationships to the trajectory of the dollar. Beta and correlation measures over the last several years indicate that each sector tends to move emphatically in the opposite direction of the greenback.1

This could also benefit the EM region if we see reduced volatility in the dollar.

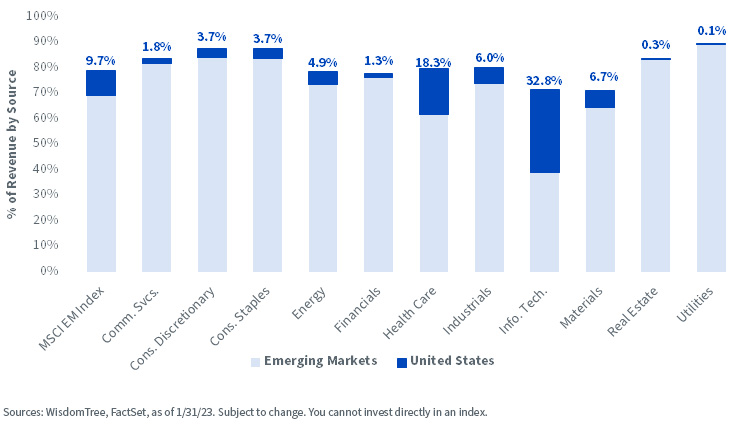

Weak USD Poses Little Threat to Revenue

Currency fluctuations impact trade competitiveness and relationships, and emerging markets exports are no exception. However, geographic revenue data suggests that although the broader region is globally interconnected, its relationship with the U.S., and therefore the dollar, is less significant.

Geographic Revenue Exposure

The headline EM Index only generates about 10% of total revenue from the U.S. market. Excluding Information Technology once again, where the U.S. is a significant consumer, every other sector generates a majority of revenue from within the greater EM region.

This introduces more favorable currency dynamics into the viability of EM as a whole since the region is not beholden to U.S. economic growth or the path of U.S. monetary policy from a revenue standpoint. Instead, regional economic interrelationships and local currency fluctuations may be more deterministic, especially in anticipation of U.S. economic weakness.

EM Assets Would Welcome a Dollar Downtrend

While the surge higher in the dollar last year was at times both a symptom and a cause of investors’ agony, the dynamic of its relationship with emerging market equities suggests that even a slight weakening would offer a reprieve. A softening may provide a much-needed tailwind to EM equities without threatening revenue prospects for the region as well since the U.S. is only a modest consumer of EM goods.

As we look further into this year or next year, rate cuts that would reduce the U.S. policy gap with the rest of the world and moderate the dollar could create renewed risk appetite for EM equities.

1 Information Technology had the least negative beta and correlation of the four sectors mentioned over the 3- and 5-year periods.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.