What’s Hot: Gold Gets a Safe-Haven Bid as Banks Shake Confidence

Investors Turn to Gold amid SVB Collapse and Credit Suisse Takeover by UBS

Financial markets were notably stressed by the news of Silicon Valley Bank (SVB),1 followed by news of the Credit Suisse takeover by UBS. In the U.S., there have been decisive moves by the Federal Deposit Insurance Corporation (FDIC)2 and the Federal Reserve (Fed),3 but market confidence has been shaken, and we have witnessed a flight to safety. In Europe, markets opened on March 20, 2023, to volatility, as investors had to digest various aspects of the UBS takeover of Credit Suisse, spurred on by Swiss regulatory authorities and the Swiss National Bank. Demand for government bonds has risen sharply, driving the yields on 10-Year U.S. Treasuries down around 3.4% on March 20 from levels closer to 4.0% before the SVB issues. In tandem, gold prices have risen notably. The speed of gold’s move indicates that the flight to safety has not been obstructed by any broad-based liquidity issues. Very often, in the initial phases of financial market stress, investors sell gold to raise cash to meet margin calls on futures positions in other assets or for other liquidity needs. The current crisis appears different in that there are no visible signs of panic gold selling, and that could be indicative that the stress in certain parts of the banking sector is idiosyncratic. Nevertheless, investors have been reminded that unexpected events occur with greater frequency than they hoped and have sought to rebuild defensive positions that will help hedge against further turbulence.

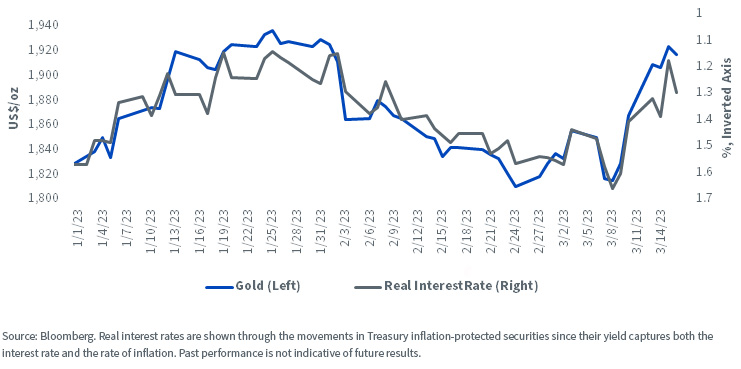

Figure 1: Gold Price Movements vs. Movements in Real Interest Rates

Either Tightening or Loosening Monetary Policy Could Be Interpreted as a Policy Mistake. Gold Is There as a Hedge.

The European Central Bank (ECB) raised interest rates by 50 basis points (bps) on March 16, 2023, marking a bold move given the fragile state of market confidence. However, blended with dovish commentary, markets are expecting fewer rate rises in the future and believe the 50-bp hike was delivered only because the ECB felt like it had pre-committed and any smaller hike would signal conditions are worse than what the market has priced in. The euro appreciated against the dollar, and the dollar basket depreciated, providing further support for gold in dollar terms.

While the jury is out on whether the Federal Reserve will pivot its monetary policy early at the March Federal Open Market Committee meeting, investors are seeking to protect themselves with hard assets. If the Fed doesn’t soften its hawkish stance, it risks transforming a bank liquidity issue into a recession, as risk appetite and confidence have been shaken. If the Fed does act either by terminating quantitative tightening or prematurely ending the hike cycle, the central bank’s monetary largesse will linger for longer. Either way, gold is likely to benefit. Gold tends to do well in recessions and is seen as the antithesis of central bank-created fiat currencies.

Gold Gains Are Well-Supported

We, therefore, expect gold to hold on to recent gains in this time of turbulence. The key short-term risk for gold at this stage is not market confidence recovering quickly but a broader market meltdown that could drive gold selling to raise liquidity for meeting other obligations (such as margin calls). In that scenario, gold is likely to recover in time, as other investors will buy the metal to shore up their defensive hedges.

Different Allocation Options Backed by the Gold Investment Story

Recent events outlined above may cause investors to think more about gold as a possible allocation idea. We would note that other options on the table blend gold and equities in innovative combinations. In the context of a diversified portfolio that is not targeting 100% gold exposure but maintaining different equity positions, there could be interesting attributes:

- The WisdomTree Efficient Gold Plus Equity Strategy Fund (GDE) seeks total return by investing, either directly or through a wholly owned subsidiary, in a portfolio comprised of U.S.-listed gold futures contracts and U.S. large-cap equity securities. For each dollar of exposure, 90% is exposed to large-cap equities, 10% is used as collateral and 90% is exposed to gold futures contracts—leading to each dollar representing $1.80 of notional exposure, a leveraged position. While leverage can create risk, it’s also notable that investors can achieve mixed exposure to gold and equities in a single allocation, possibly allowing them to keep other positions in the portfolio unchanged.

- The WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN) seeks total return by investing in the equities of gold miners and gold futures contracts. For each dollar of exposure, 90% is exposed to gold miners, 10% is used as collateral and 90% is exposure to gold futures contracts—leading to each dollar of exposure representing $1.80 of notional exposure, a leveraged position. Similar to what we said above, the investor thinking about a gold allocation may also be researching a gold mining equity position, and this would be a way to consider combining the two in a single trade—albeit with a different total risk profile than either gold or gold miners alone.

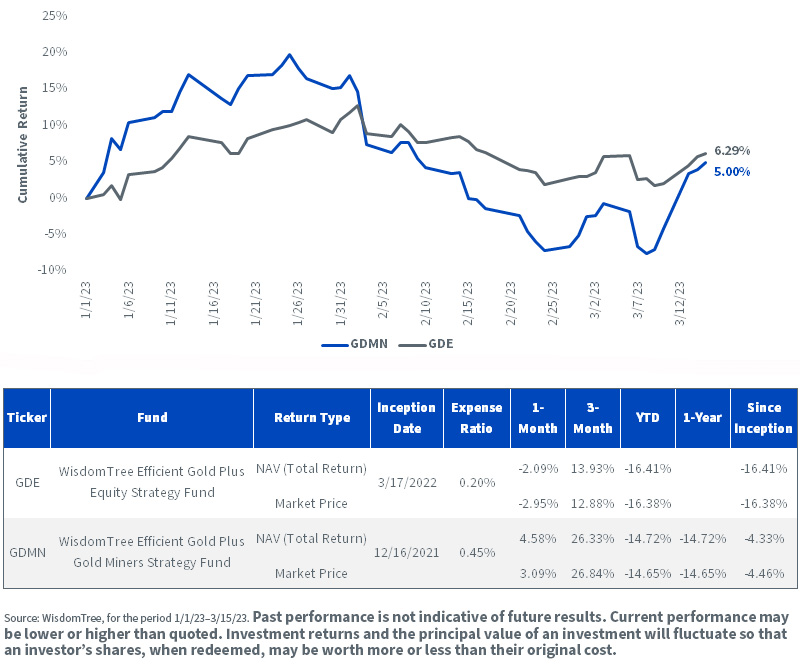

If we look at the trajectory of these strategies, GDE and GDMN, during 2023 so far, we see:

- As expected, GDE, with its large-cap equity exposure, has proved less volatile than GDMN, where the gold mining equities can and do exhibit wider swings in performance.

- GDMN started the year rallying to almost 20% positive returns by January 25, 2023. Then, from that date to February 24, 2023, we saw GDMN return negative 22%. While GDE did not rally as strongly to start the year, you see differentiation in the drawdown—only dropping 7% over this same, tougher period.

- In the recent period of volatility—if we look from March 8, 2023, the near-term low—GDMN has rallied more than 13%, while GDE has rallied almost 3.5%.

Of course, these are short-term periods, and we cannot know exactly how these strategies will respond in all environments going forward. However, during a time when people may be considering gold allocations in the face of banking concerns, it’s important to place these kinds of strategies into the appropriate context. While both strategies employ leverage in their structure, a base exposure to 500 large-cap stocks is quite different from a base exposure to gold mining stocks—and that is quite visible in the results.

Figure 2: GDMN and GDE in 2023

Click the respective ticker for standardized performance and performance data for the most recent month-end: GDE, GDMN.

Conclusion: Investors May Be Considering Gold due to Increased Expectations of Volatility

If investors are looking at recent events and thinking that they need to manage their exposures, gold may come into their consideration, as the metal has a history of holding up in periods of market stress. However, sometimes thinking about gold is simpler than figuring out how to fund a gold allocation from an existing portfolio. WisdomTree’s “efficient” suite of Funds seeks to alleviate this concern by utilizing leverage to employ more than $1.00 of notional exposure for every $1.00 invested—but this, of course, comes with risk. Additionally, some views on gold may support bullishness in gold miners, while other views on gold may have a different focus. In our opinion, these tools represent something not previously available to ETF investors during prior periods of stress when gold may have been attractive.

1 As of 3/16/23, GDE and GDMN did not have exposure to Silicon Valley Bank.

2 The FDIC provided more than its usual $250,000 insurance on deposits.

3 The Fed created a new liquidity tool—Bank Term Funding Program (BTFP)—offering loans of up to one year in length to banks, savings associations, credit unions and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral

Important Risks and Disclaimer Related to this Article

Nitesh Shah is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

GDE: There are risks associated with investing, including the possible loss of principal. The Fund is actively managed and invests in U.S.-listed gold futures and U.S. equity securities. The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. Moreover, the price movements in gold and gold futures contracts may fluctuate quickly and dramatically and have a historically low correlation with the returns of the stock and bond markets. U.S. equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund’s investment strategy will also require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds, which may cause the Fund to recognize capital gains. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

GDMN: There are risks associated with investing, including the possible loss of principal. The Fund is actively managed and invests in U.S.-listed gold futures and global equity securities issued by companies that derive at least 50% of their revenue from the gold mining business (“gold miners”). The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. Moreover, the price movements in gold and gold futures contracts may fluctuate quickly and dramatically and have a historically low correlation with the returns of the stock and bond markets. By investing in the equity securities of gold miners, the Fund may be susceptible to financial, economic, political or market events that impact the gold mining sub-industry, including commodity prices and the success of exploration projects. The Fund may invest a significant portion of its assets in the securities of companies of a single country or region, including emerging markets, and thus, the Fund is more likely to be impacted by events and political, economic, or regulatory conditions affecting that country or region, or emerging markets generally. The Fund’s investment strategy will also require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds, which may cause the Fund to recognize capital gains. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.