Wise Words in Warren’s Recent Letter

When I first started doing research for Jeremy Siegel’s book, The Future for Investors, in 2003, the first project the professor suggested was to read everything Warren Buffett had ever written.

Siegel gained fame in 2000 for his stark warnings about the tech bubble, and Buffett was a notable value investor we wanted to study.

The annual Buffett letters are a treasure trove of insights—and I ascribe the success of our largest franchise of equity ETFs, built on a quality dividend approach that has amassed over $10 billion of assets—to principles I learned from reading Buffett’s letters.

Below are some quotes from this year’s letter that stood out to me.

Warren has been investing through Berkshire Hathaway for 58 years, but he ascribes most of his success to remarkably few decisions. He writes:

Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years – and a sometimes-forgotten advantage that favors long-term investors such as Berkshire.

The market’s wild gyrations captivate us. There is more information and analytics that urge us to action. But keeping Buffett’s lesson in mind—you only need one good idea every five years—can make you think about how important each action is.

This rhymes with another famous Buffett quote about minimizing how many good investment ideas you try to implement.

Buffett has a 20-slot ‘punch card’ rule: Imagine we gave you a ticket with only 20 slots in it, so that you had 20 punches—representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did and you’d be forced to load up on what you’d really thought about. So, you’d do so much better.1

Warren’s letter goes into his ‘secret sauce’ and some of the 12 ideas that have worked for him.

Of particular emphasis this year: the compounding of long-term dividend and cash flow growth from his purchases 30 years ago, particularly Coca-Cola and American Express. He writes:

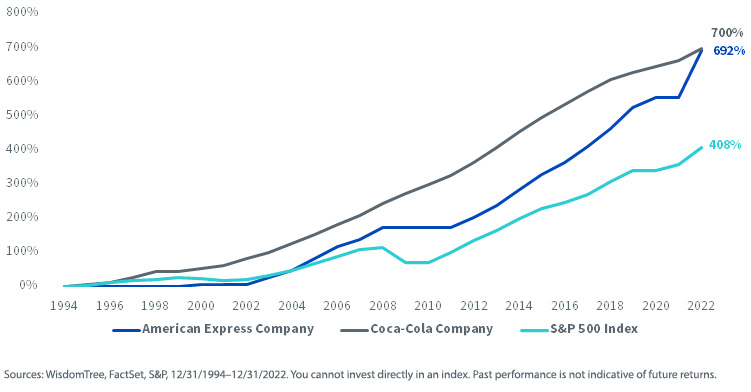

In August 1994 – yes, 1994 – Berkshire completed its seven-year purchase of the 400 million shares of Coca-Cola we now own. The total cost was $1.3 billion – then a very meaningful sum at Berkshire.

The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million. Growth occurred every year, just as certain as birthdays. All Charlie and I were required to do was cash Coke’s quarterly dividend checks. We expect that those checks are highly likely to grow.

American Express is much the same story. Berkshire’s purchases of Amex were essentially completed in 1995 and, coincidentally, also cost $1.3 billion. Annual dividends received from this investment have grown from $41 million to $302 million. Those checks, too, seem highly likely to increase.

These dividend gains, though pleasing, are far from spectacular. But they bring with them important gains in stock prices. At year end, our Coke investment was valued at $25 billion while Amex was recorded at $22 billion. Each holding now accounts for roughly 5% of Berkshire’s net worth, akin to its weighting long ago.

Assume, for a moment, I had made a similarly-sized investment mistake in the 1990s, one that flat-lined and simply retained its $1.3 billion value in 2022. (An example would be a high-grade 30-year bond.) That disappointing investment would now represent an insignificant 0.3% of Berkshire’s net worth and would be delivering to us an unchanged $80 million or so of annual income.

Lessons for today’s investors: Now that there is income back in fixed income and one can earn nearly 5% in short-term Treasuries, some investors have questioned whether equities have tougher competition. Those fixed income returns will struggle to keep up with inflation over time and do not have the long-term compounding of dividend growth like these dividend growers Coca-Cola and American Express.

Dividend Growth since 1994

Buffett Principles without Stock Specific Risk

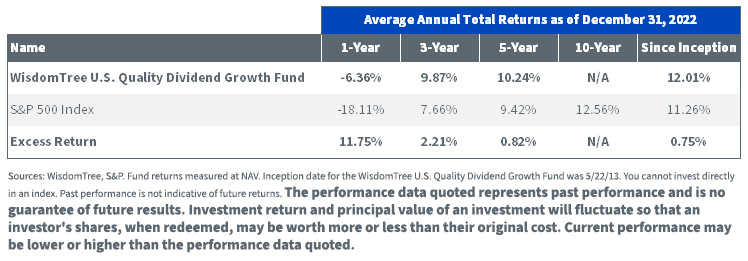

WisdomTree agrees with Buffett on the importance of growing dividends. About 10 years ago, we launched a Quality Dividend Growth Index that included what we refer to as the Buffett factor on quality stock selection.

While Buffett started his career as a Ben Graham’s value disciple, over time he migrated to buying higher-quality businesses like Coca-Cola and American Express.

Buffett’s business partner, Charlie Munger, describes the reason for the shift away from value to quality:

A great business at a fair price is superior to a fair business at a great price.

We’ve really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high quality businesses. And most of the other people who’ve made a lot of money have done so in high quality businesses.

I believe one of your 20-slot punch card ideas should be to invest in these high-quality businesses that grow dividends.

Not everyone can be Warren Buffett and Charlie Munger, dedicating their lives to knowing every detail about individual businesses, with the fortitude to trade big ideas once every five years.

Instead of trying to pick just two or three stocks or even 12 stocks, you can diversify into a broader basket that shares the same principles.

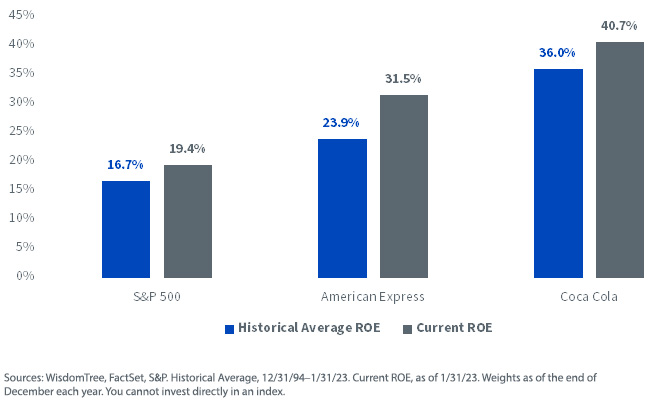

WisdomTree defines high quality as high return on equity (ROE) or high profits (income) over book value (and invested capital) in the business. Buffett also shuns the use of leverage in trying to goose ROE, and so our process also includes high return on assets (ROA) to penalize leverage from driving high ROE in underlying businesses.

To grow dividends, you must grow earnings—so we also look for companies with stronger expected earnings growth—to help us arrive at a forward-looking dividend growth basket. And we manage valuation risk by weighting these indexes and portfolios by the total dividends these companies pay.

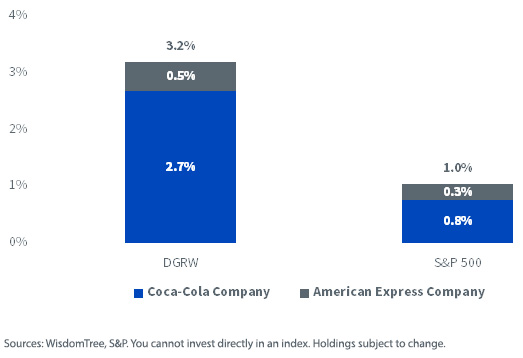

Over the past decade, the WisdomTree U.S. Quality Dividend Growth Index—which is tracked by the WisdomTree U.S. Quality Dividend Growth Fund (DGRW)—has had over-weight allocations in Coca-Cola and American Express, by an average of 0.9% relative to the S&P 500 Index.

Entering 2023, DGRW had over-weight allocations in these two companies, by 2.2%.

12/31/22 Weights

Both companies have premium ROE relative to the S&P 500 and higher historical average ROE going back to 1994, when Buffett completed Berkshire’s share purchases of these companies.

Trailing 12-Month Return on Equity

Another consistent holding in DGRW has been Apple—held every year since the Fund’s launch. Many backwards looking dividend growth ETFs that had screens for 10 years of consecutive growth can only get that 10-year validation this year—10 years after we first included Apple in the portfolio.

Apple has become one of Buffett’s biggest wealth drivers, but DGRW owned it before Buffett (who first purchased Apple in 2016), when it paid its first dividend in 2012 and met our other quality and dividend growth potential screens.

For more information on DGRW, visit the Fund's web page.

For the most recent month-end performance, click here.

1 Source: https://jamesclear.com/buffett-slots

Important Risks and Disclosure Related to this Article

As of March 7, 2023, DGRW held 2.48%, 0.61% and 5.26% in Coca-Cola, American Express and Apple, respectively. Click here for a full list of Fund holdings. Holdings are subject to change.

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.