The WisdomTree Portfolio Review, Part Two: Outcome-Focused Models

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

We began this “mini-series” of blog posts with a review of our strategic models. Now let’s turn our attention to our “outcome-focused” models.

Our outcome-focused models can and are used as stand-alone models by some of our clients. But most advisors view them as complementary “sleeves” to an already existing portfolio in order to achieve specific investment mandates.

Let’s review them in the order they appear on our Model Adoption Center.

Global Dividend

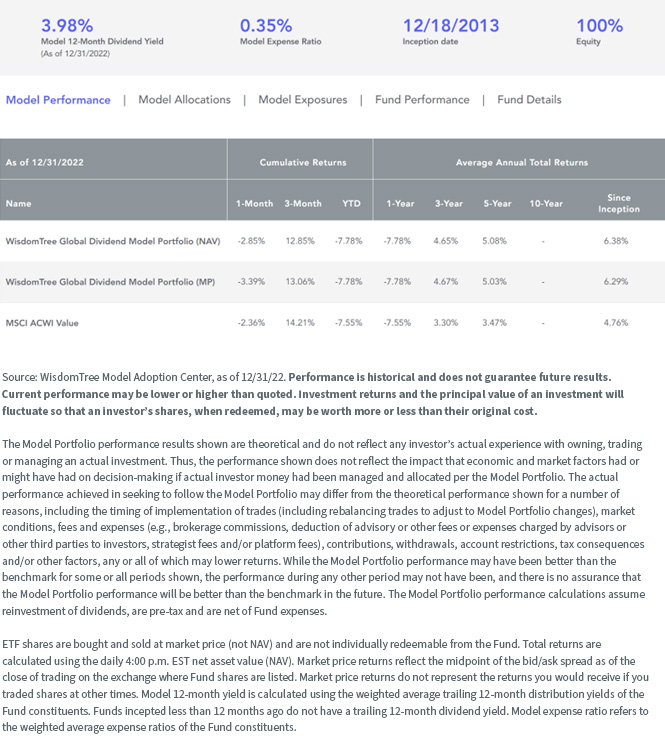

Exactly as it sounds, this is a global all-equity portfolio that focuses on generating the optimal level of dividends for those investors seeking to “goose” the yield of their overall portfolio. Most of the WisdomTree products in this portfolio also have a quality screen. What this means is not just chasing the highest dividend payers but focusing on those companies we believe have the most sustainable dividends (or dividend growth), regardless of market regime.

In 2022, this portfolio essentially tracked (though slightly lagged) the MSCI ACWI Value Index. Value was on such a tear in 2022 that our quality screens took some of the performance away versus that benchmark. But we will never apologize for tilting toward quality within our portfolios—it is one of our anchoring philosophies.

As of December 31, 2022, the yield on the benchmark MSCI ACWI Value Index was 3.60%. The model met its mandate—delivering comparable or better total returns with an enhanced dividend yield relative to its underlying benchmark.

WisdomTree Global Dividend Model Portfolio

For underlying Fund performance, including standardized performance and 30-day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs.

Global Multi-Asset Income

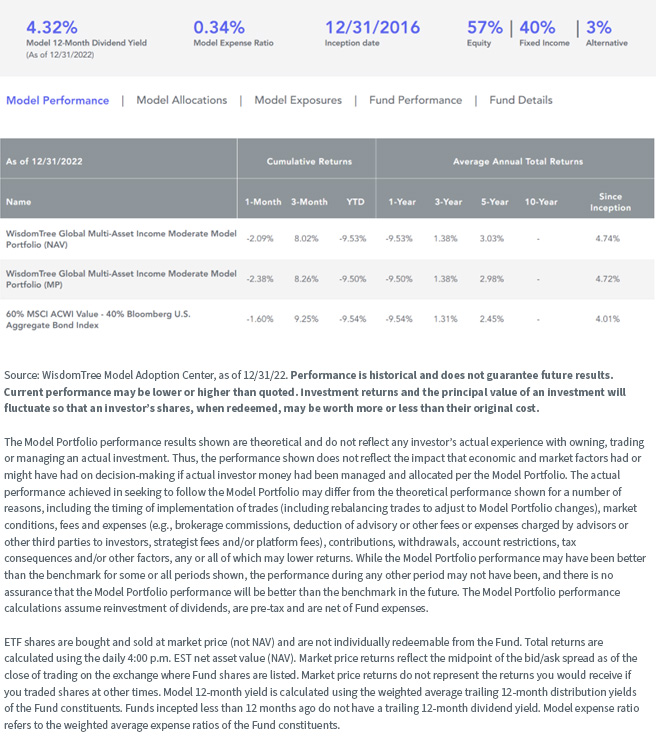

Similar to the global dividend model, this model seeks to optimize quality income but invests across multiple asset classes to do so. In addition to dividend-oriented stocks and fixed income, this portfolio allocates to MLPs, a traditionally high-yielding asset.

MLPs absolutely ripped in 2022—the Alerian MLP Index was up more than 20% for the year. So the inclusion of an MLP strategy (though at a small allocation level—3%) certainly helped the total return of the overall portfolio, but it also helped to enhance the overall income profile.

If we use our “moderate risk” version of this portfolio as an example (which tracks most closely to a traditional 60/40 stock/bond portfolio), as of December 31, 2022, our total return performance tracked almost exactly to the underlying Index (60% MSCI ACWI Value + 40% Bloomberg Aggregate). Once again, this portfolio met its mandate—tracking or beating the total return performance of the benchmark while delivering an attractive yield.

WisdomTree Global Multi-Asset Income Moderate Model Portfolio

For underlying Fund performance, including standardized performance and 30-day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs.

Multifactor

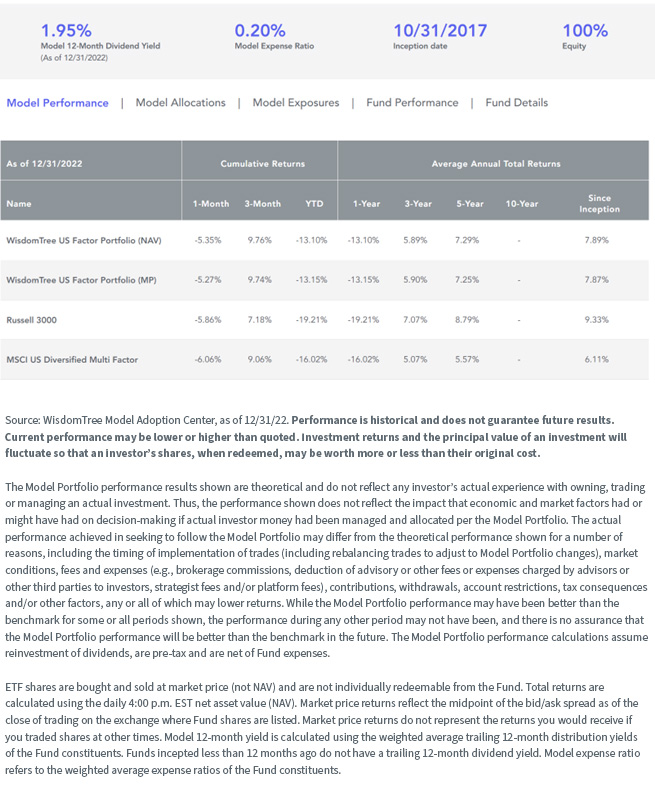

The multifactor model is a different animal than the global dividend or global multi-asset income models. This portfolio is designed to improve the risk factor diversification of an overall portfolio while still attempting to deliver a superior total return.

We offer a U.S., developed international and emerging markets version of the multifactor model. Since it is the most widely used, we will focus on the U.S. version.

The underlying allocations within this portfolio all have various factor tilts, focusing primarily on value, quality, earnings and size. In a year in which value and size outperformed broad cap-weighted benchmarks, you might imagine that this portfolio performed quite well on a relative basis—and you would be correct.

This portfolio outperformed its primary benchmark, the Russell 3000 Index (a broad market U.S. Index incorporating large-, mid- and small-cap stocks) by more than 600 basis points (6%) while also beating its secondary benchmark, the MSCI US Multi-Factor Index, by almost 300 basis points (3%).

We saw similar, though more subdued, outperformance by the developed international and emerging markets multifactor models relative to their primary broad market indexes.

WisdomTree U.S. Factor Portfolio

For underlying Fund performance, including standardized performance and 30-day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs.

Volatility Management

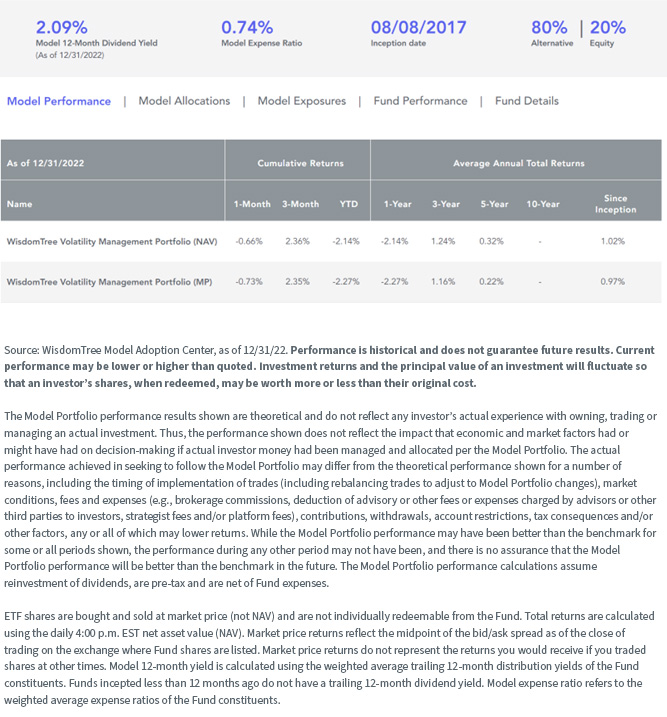

Last but by no means least, we come to our volatility management portfolio. This portfolio consists of several non-traditional or alternative strategies, including diversified arbitrage, hedged equity, short bias, managed futures and equity long/short. The portfolio was constructed to have lower correlations to both stocks and bonds and also to be diversified between the strategies themselves.

The mandate is to deliver a diversifying “sleeve” within an overall portfolio in an attempt to lower portfolio volatility and improve performance consistency regardless of market regime, but especially in down markets. (Remember the power of compounding—if you don’t lose as much in down markets, you don’t have to make as much in up markets to still come out ahead.)

In part one of this series, we reviewed our endowment model, which includes both real assets and alternatives. In essence, the volatility management model is designed as a complement to a more traditional stock/bond portfolio to allow advisors to deliver a more “endowment-like” experience.

We use the 3-Month Treasury bill as a proxy benchmark for this portfolio, under an assumption that advisors could simply move to cash if they are looking to “de-risk” the portfolio. The difference is that the volatility management model gives the advisor some potential for upside versus simply moving to cash.

In a year in which the Fed raised rates aggressively, 3-Month Treasuries were up 1.50% in 2022. So, in one sense, we underperformed. But in comparison to the dramatic market declines, the addition of this model to a broader model would have served its purpose—dampen volatility and “smooth out” an otherwise very bumpy ride.

WisdomTree Volatility Management Portfolio

For underlying Fund performance, including standardized performance and 30-day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs.

Conclusion

We built our outcome-focused models to serve specific purposes for advisors seeking specific investment outcomes. On a relative basis, 2022 was a good year for these models—they did their jobs in an awful market environment. We believe we have good foundations to build on as we move through 2023.

In part three, the final of this series, we will examine the performances of our collaboration models.

Financial advisors can learn more about these models, and how to successfully position them with end clients, at our Model Adoption Center.

Important Risks Related to this Article

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.