Leaning into Emerging Market Value

Emerging market (EM) economies have shifted their composition in the past decade, becoming less dependent on exporters and commodity-driven companies. But recent performance has shown how some of these economies can thrive in a commodity boom such as the one we’ve seen over the past few years.

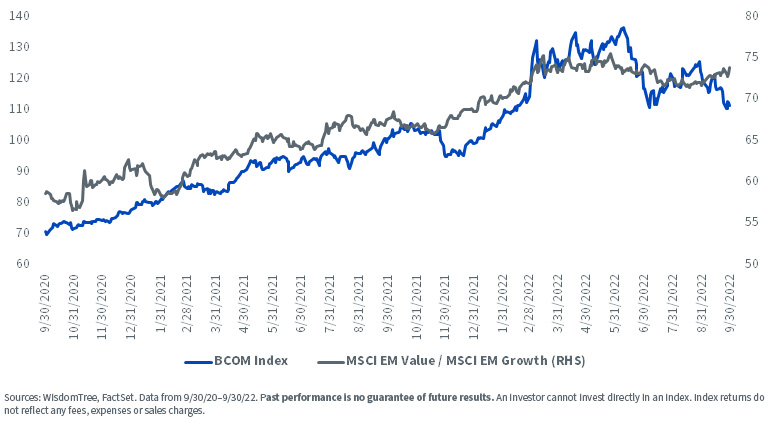

In the chart below, we can see how the MSCI EM Value Index has outperformed its growth counterpart over the last 24 months, at the same time the BCOM Index has trended higher.

'

'

WisdomTree Indexes with a Value Tilt in EM

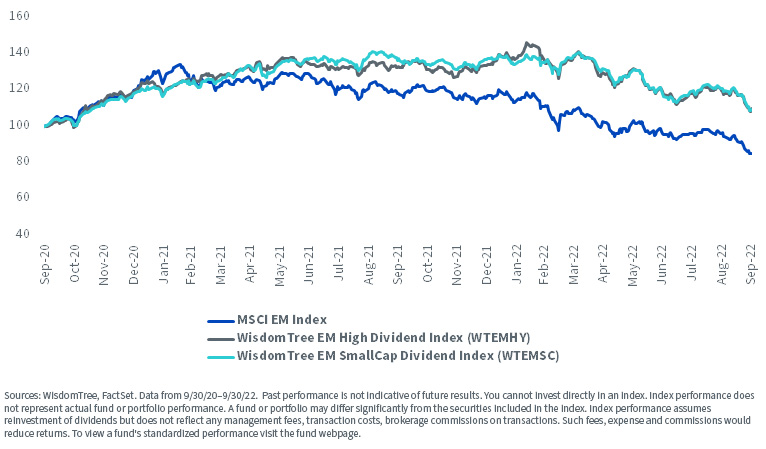

At the same time, the WisdomTree Emerging Markets High Dividend Index (WTEMHY) and WisdomTree Emerging Markets SmallCap Dividend Index (WTEMSC) have continued to outperform the MSCI EM Index with lower volatility, thanks to their value exposures and resulting sector and country exposures.

Growth of $100

These Indexes, which are tracked by the WisdomTree Emerging Markets High Dividend Fund (DEM) and WisdomTree Emerging Markets SmallCap Dividend Fund (DGS), are reconstituted annually, and their new weights become effective after the close on October 20. In both cases, we can see how these portfolios maintain exposure to commodity sectors and economies and are positioned to take advantage of this market environment.

WisdomTree’s Emerging Markets High Dividend Index (WTEMHY)

WTEMHY holds the highest (top 30%) dividend-yielding companies in EM and screens out those with the highest risk according to our composite risk screen measure.

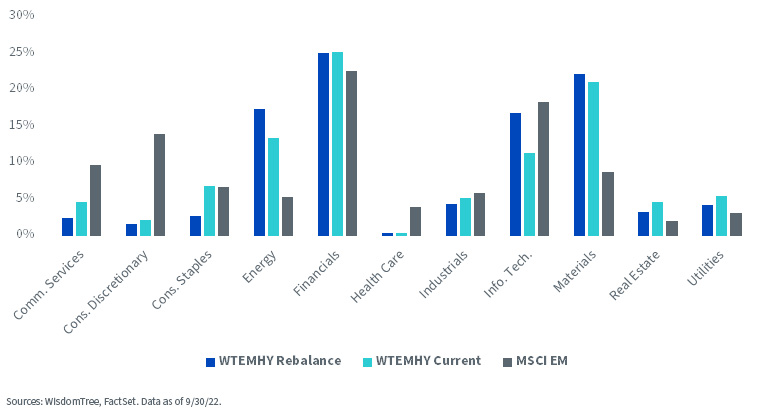

Selected companies are weighted by the dividends they’ve paid out over the past 12 months. In its most recent reconstitution, WTEMHY added weight to the Information Technology, Energy and Materials sectors, as these have grown dividends proportionally faster in the last year and have shown strong fundamentals. The Index continues to show a significant tilt to value sectors versus the broad MSCI EM Index.

EM High Yield Universe

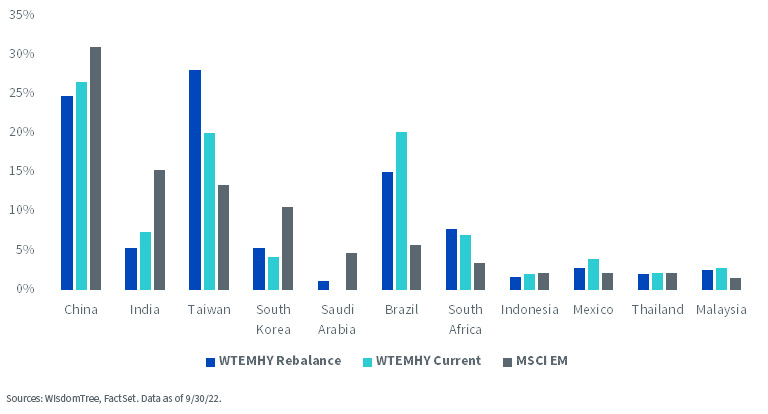

In terms of country exposures, the rebalanced portfolio saw an increased exposure to Taiwan as a result of Information Technology and Materials companies increasing their distributions on the back of strong earnings growth. It is worth highlighting that Saudi Arabia was added to WisdomTree’s list of eligible EM securities and has a modest weight after rebalancing. The exposure to Brazil is being reset, as it has had a significant run-up since we last rebalanced the Index in October 2021. WTEMHY continues to be over-weight in commodity-driven and “value” economies in China and South Korea, which tend to be technology- and financial-heavy.

EM High Yield Universe

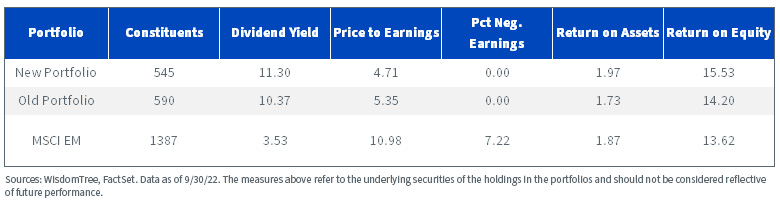

Looking at the portfolio’s fundamentals below, we can see how WTEMHY improved its dividend yield by 93 basis points (bps), reduced its valuation (P/E ratio) by 0.64x to 4.71x and improved its profitability during its rebalance. Compared to MSCI EM, WTEMHY has an excess yield north of 7.5%, is trading at more than a 50% discount and has higher profitability measures.

High Yield Emerging Markets Rebalance

WisdomTree Emerging Markets SmallCap Dividend Index (WTEMSC)

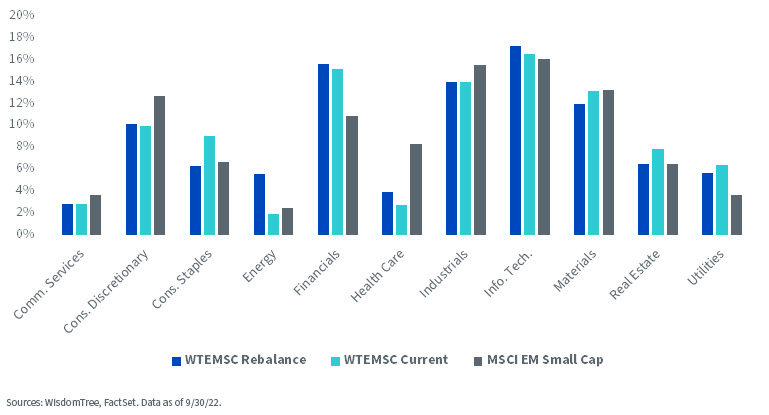

Sector changes to WTEMSC during its reconstitution were small, with the largest shift coming from Energy into Consumer Staples. Overall, the Index remains strongly exposed to the traditional value sectors in emerging markets.

EM SmallCap Universe

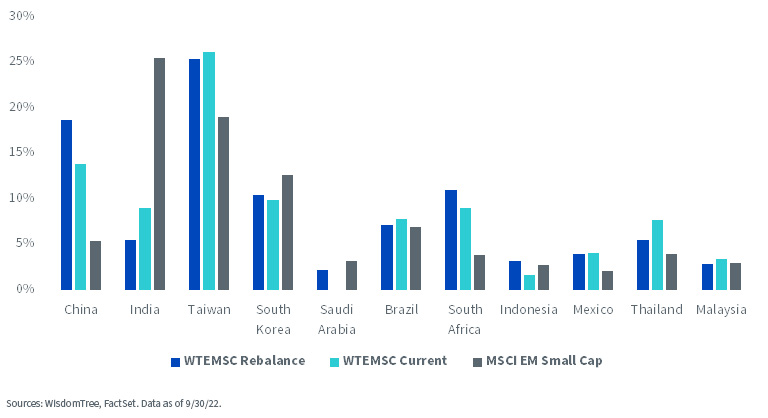

Like WTEMHY, WTEMSC continues to be over-weight in commodity-driven economies. Something to highlight is the increased exposure to China caused by companies falling into the bottom 10% of total market capitalization in the WisdomTree Emerging Markets Index, which is the starting universe for WTEMSC, as Chinese markets continue to trend downward.

EM SmallCap Universe

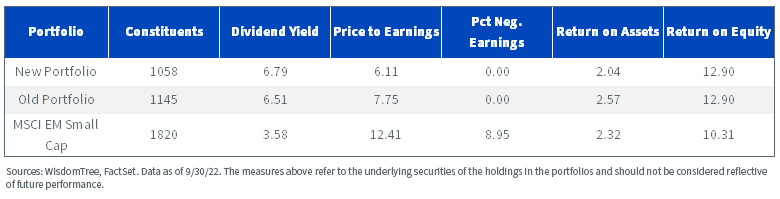

WTEMSC’s aggregate fundamentals show rebalance-related improvement across the different metrics, taking its dividend yield up almost 30 bps and cutting its valuation by 1.6x. It is very interesting to see how this basket of small-cap EM companies can have profitability metrics that are comparable to broad market benchmarks like the MSCI EM and MSCI EAFE Indexes.

Small-Cap Emerging Markets Rebalance

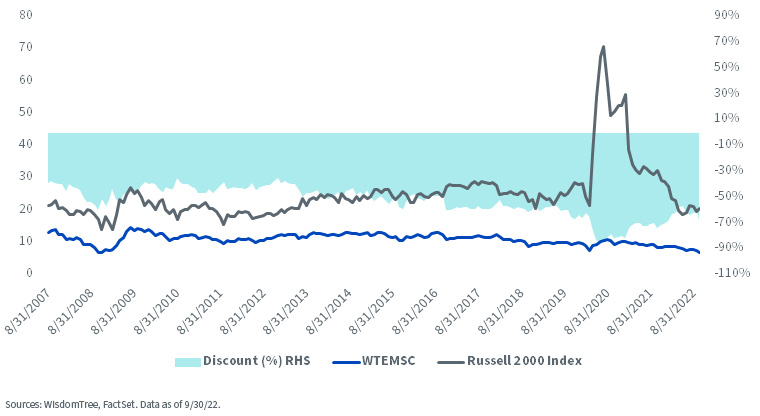

The valuation of this emerging market small-cap basket at six times earnings is very low compared to global benchmarks, particularly U.S. large caps and U.S. small caps. While our team has been writing that small caps in the U.S. are attractive, given wide discounts relative to large caps, the discounts with WisdomTree’s EM small-cap dividend approach are also some of widest in 15 years.

Fwd. Price-to-Earnings Ratio

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as the risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Funds’ prospectuses for specific details regarding the Funds’ risk profiles.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.