WisdomTree Has Built a Long Track Record Delivering the Value Style

WisdomTree launched its first strategies within the exchange-traded fund (ETF) wrapper on June 16, 2006. At the time, it was one of the only options for investors looking for something not tracking market capitalization-weighted benchmarks. In 2022, we might be spoiled for choice in terms of the menu of indexes weighted by all sorts of different metrics, but in 2006, the main choices were:

- Equal-weight: The S&P 500 Equal-Weight was the best-known.1

- Multiple fundamental factors: The FTSE-RAFI strategies were the best-known, with the concept being to take multiple different financial metrics and build a weighting scheme based on that mixture.2

- Dividend-weight: This was WisdomTree’s innovation, the concept being to weight constituents based on the cash dividends that each company distributes.3

Little did WisdomTree know, however, that—after one of the most severe financial crises experienced in global markets in 2008–09—we would then experience one of the greatest equity bull markets led by the ‘growth’ style that we had ever seen.

The later stages of this growth bull market were even characterized by new acronyms. One of the most popular was FANG, for Facebook, Amazon, Netflix and Google. While there are certainly variants, with some incorporating Apple, it’s worth nothing that Facebook, Amazon, Netflix and Google do not, as yet, pay dividends. This is emblematic of how dividend-focused strategies were running into the wind, given that some of the market’s performance leaders were not paying dividends at all.

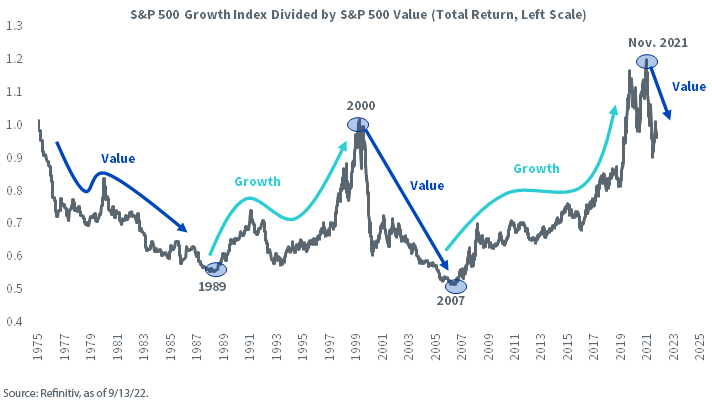

Figure 1 allows us to visualize the path of history. We can take the value and growth variants of the S&P 500 Index and do a calculation such that a downward slope means value is outperforming, while an upward slope indicates growth is outperforming.

While there are never any guarantees, and past behavior does not tell us the future with certainty, we can see that the broader trends have tended to take place over at least a span of years.

Figure 1: The Value & Growth Styles Have Tended to Trade Market Leadership over Time

2022—An Historic Year for Market Participants

There is little question that many, many textbooks will be written about the COVID-19 pandemic, the fiscal and monetary response to it and then what we are experiencing in 2022—the attempt to ‘return to normal’ after some of the most stimulative economic policies ever seen. Think about how:

- We have seen MULTIPLE, CONSECUTIVE meetings of the U.S. Federal Reserve leading to the Federal Funds Rate being raised by 75 basis points (bps). One has to go back to the times of Federal Reserve Chairman Paul Volcker to see anything similar.

- We have a generation of people who thought of inflation only as a theory, and it is now a central household concern globally.

- We have a generation of people who say their high-risk investments tend to trend basically in one direction, as the cost of capital was basically zero or if not zero, then insignificant, from roughly 2009 to 2021.

All these changes have occurred in 2022, and these are really the ingredients that catalyzed the shift in equity market performance away from the growth style (what was generating the stronger performance for years) to the value style (what has been generating the stronger performance in 2022).

WisdomTree Has a Longstanding Value Business

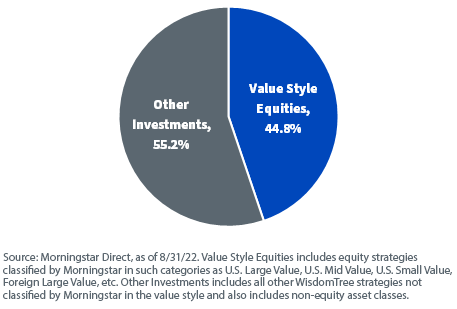

As of August 31, 2022, WisdomTree was entrusted with roughly $50 billion of assets from investors across the United States. We see in Figure 2:

- 44.8% of these assets under management (AUM) are in equity strategies classified by Morningstar as being of the value style. This includes both U.S. value and foreign value, across the market capitalization spectrum.

- The other 55.2% includes the AUM that WisdomTree manages in other equity styles, as well as other non-equity asset classes.

Figure 2: Roughly 45% of WisdomTree’s U.S. AUM Is in the Value Style

This 44.8% equates to about $22.3 billion in actual dollars entrusted to value strategies. A logical next question is—how are these strategies doing?

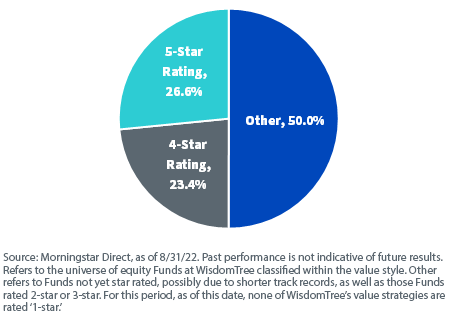

While libraries of white papers are written aimed at answering the question of performance evaluation, there are some simple tools one can use to at least start down the track. One of them is Morningstar’s star rating system. While we recognize the star system is far from perfect, in figure 3, we see:

- Of the $22.3 billion in AUM, 26.6% is in Funds that Morningstar has rated as ‘5-Star,’ their highest rating.

- 23.4% of that AUM is in Funds Morningstar has rated as ‘4-Star.’ This means that half of WisdomTree’s AUM in the value style is rated either 4-Star or 5-Star by Morningstar.

- The category of ‘other’ refers to AUM rated in the 3-Star or 2-Star levels, as well as those Funds that may not yet be rated, most likely due to short performance histories. At this time, none of WisdomTree’s value strategies classified by Morningstar are rated as ‘1-Star.’

We are excited by these results, but we’d also remind people that these ratings are based on the past. Ratings can and do change, and for any period of 10 years, it’s possible that a single investment vehicle will experience an array of ratings.

Figure 3: How Are WisdomTree’s Value Strategies Doing?

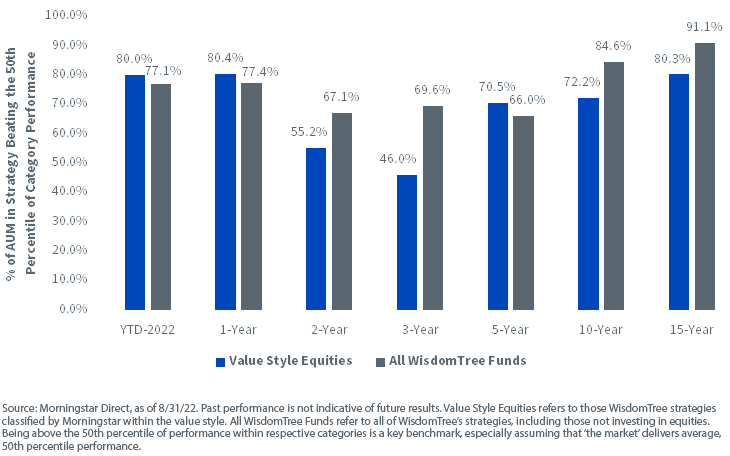

Then, there is the concept of ‘beating benchmarks.’ One way to think about this is to take each respective category, e.g., U.S. Large Value, and to indicate the 50th performance percentile within that category. Figure 3 shows the percentage of WisdomTree AUM that is above the 50th percentile in its respective Morningstar peer group.

- We note that there has been a shift in the 2022 year-to-date period, which is through August 31, 2022, and the 1-year period, where the value style equities take the lead over all WisdomTree Funds. Technically, this means that more of the value AUM was above the 50% percentile relative to WisdomTree’s total AUM.

- We also note that, for the 15-year period, more than 80% of WisdomTree’s value AUM was above the 50th performance percentile. This period includes the global financial crisis of 2008–09, as well as the big bull run that we saw in growth equities that led to such terms as ‘FANG’ being thrown around. It was a tough period for value, and yet the surviving strategies hung in there.

Figure 4: How Are WisdomTree’s Strategies Doing within their Peer Groups? The 50th Percentile Test

Conclusion: The Value Rotation of 2022 Has Brought Attention Back to the Value Style

WisdomTree’s track record in managing assets back to 2006 has led to seeing many different types of market environments. The meaning of monetary policy itself and what it entails, for example, has completely changed over this period. WisdomTree Funds categorized by Morningstar within the value style have been resilient during the tougher periods, when growth has been in favor, and we have seen a real acceleration in their performance during the current value rotation in 2022. Investors seeking the value style can find a plethora of strategies at WisdomTree covering nearly any global equity exposure.

Those investors seeking to do further research on value strategies in the current environment may consider WisdomTree’s suite of ‘high dividend’ approaches. In these kinds of environments, a strong earnings yield over inflation-adjusted bond yields may be an important metric to watch, and these strategies are designed to tilt exposure in this type of direction. While WisdomTree has a large array of value-strategies, we note that these are among the most strongly value-oriented.4

- WisdomTree U.S. High Dividend Fund (DHS): earnings yield of 9.00%

- WisdomTree Emerging Markets High Dividend Fund (DEM): earnings yield of 16.69%

- WisdomTree International High Dividend Fund (DTH): earnings yield of 10.92%

- WisdomTree Global High Dividend Fund (DEW): earnings yield of 9.32%

For a prospectus click here.

For those interested in hearing more about the WisdomTree value story, please listen to the podcast below featuring a conversation with our Jarrett Lilien, our COO & President, around the drivers behind market growth.

1 The S&P 500 Equal-Weight Index began live calculation on 1/8/03.

2 The FTSE-RAFI US 1000 Index began live calculation on 11/28/05.

3 WisdomTree’s first U.S. Dividend-Weighted Indexes began live calculation on 6/1/06.

4 Source Factset data, as of 9/13/22. The earnings per share for the most recent 12-month period divided by the current market price per share. The earnings yield (which is the inverse of the P/E ratio) shows the percentage of each dollar invested in the stock that was earned by the company.

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management, Inc.’s parent company, WisdomTree Investments, Inc.

Important Risks Related to this Article

For standardized performance and current 30-Day SEC yield click on the respective fund ticker within the article.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at wisdomtree.com.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of these Funds it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5%receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period has the greatest impact because it is included in all three rating periods.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.