What Is a Value Stock?

The first half of 2022 was characterized by the “value rotation.”

It’s noticeable because after the global financial crisis of 2008–2009, growth stocks—helped by accommodative central bank policy—went on an 11–12-year run. Value investors were tested to just stick with their strategies after dramatic, sustained underperformance.

But that’s changed this year.

Value Is in the Eye of the Fundamental Metric

So, what is a “value” stock?

If you think of all the different index providers, each has its own definition of the fundamentals that it believes denote “value.” Some focus on a smaller subset of fundamentals; others look at a more diverse array. Like many things across the investment landscape, it’s difficult to note if there is a “correct” approach. Each method tends to tilt toward or away from companies with certain attributes.

The FTSE Russell Value & Growth Index Reconstitution

At the close of June 24, 2022, FTSE Russell undertook its Value & Growth Index reconstitution.1

- FTSE Russell Value Indexes use the book-to-price ratio to denote value.2

- FTSE Russell Growth Indexes use 1) I/B/E/S Forecast Medium-Term Growth, with a two-year horizon, and 2) sales per share historical growth over the past five years.3

Probably more important than fundamentals is this critical fact: stocks can have their weight allocated to BOTH growth and value indexes at the same time. This means the same company can have part of its market cap allocated to the Russell 3000 Value and Russell 3000 Growth Indexes. Many people might assume the two categories are mutually exclusive, but they are not.

The Lines Between Value and Growth Can Blur

If stocks can experience severe reductions in their price-to-book value ratios (another way of saying an increase in book-to-price ratios), per the FTSE Russell methodology, they can become allocated more and more toward value.

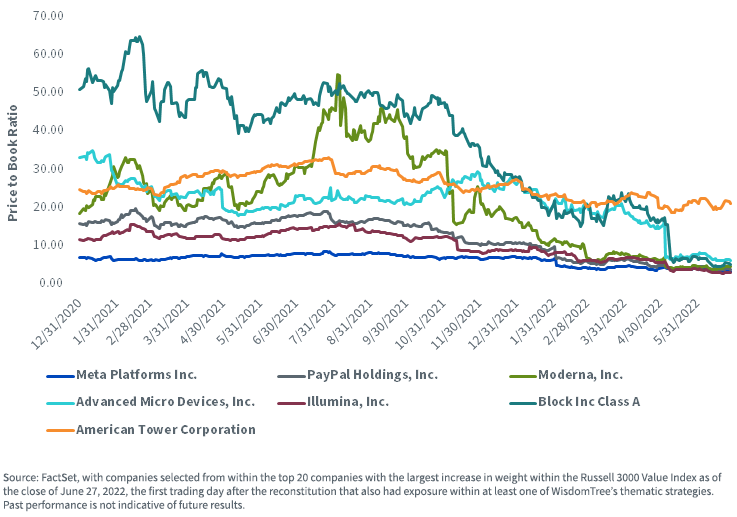

In figure 1, we can see:4

- If one stock is making headlines for moving from “mostly growth” to “mostly value,” it is Meta Platforms, formerly known as Facebook. Its price-to-book value ratio dropped roughly 60% from June 28, 2021 to June 28, 2022. We are certainly not the first to write about this particular shift.

- Block (formerly known as Square) is a formidable player in fintech with its payments software and Cash App, not to mention its recent acquisition of Afterpay. Yet, possibly due to CEO Jack Dorsey’s association with bitcoin, even if the company itself is making small investments, the price-to-book ratio has dropped nearly 90% from June 28, 2021 to June 28, 2022. PayPal, maybe a more longstanding payments company in the cloud, has done better—but its price-to-book ratio dropped nearly 80% over this same period.

- Moderna is a firm many associate with the life-saving innovations of the mRNA vaccines during the pandemic. Its price-to-book dropped nearly 84% over this same period.

- Many investors have heard about the “chip shortage,” which is still an issue. It’s hard to imagine the demand for semiconductors being higher at any point in history, yet Advanced Micro Devices (AMD) has seen its price-to-book ratio drop more than 70% over this period.

- Illumina is at the forefront of merging advances in data analysis with advances in genetic capabilities. Over the past year, its price-to-book ratio has dropped nearly 80%.

- American Tower Corporation is a market leader when it comes to owning cell phone tower assets, and if we’re looking for something that only seems to increase, it is our demand for cell phone data. Yet, the price-to-book ratio still dropped during this period by about a factor of one-third—which looks oddly stable against some of these others.

The severity of these moves leads us to think about how these names, which many would have thought were emblematic of the “growth” style, make us think they might be ripe for at least some of their market caps being shifted into the value side of the FTSE Russell Indexes.

Figure 1: The Growth to Value Metamorphosis Begins (December 31, 2020 to June 28, 2022)

Russell 3000 Value Index Rebalance Results

And now, the drumroll—what happened?

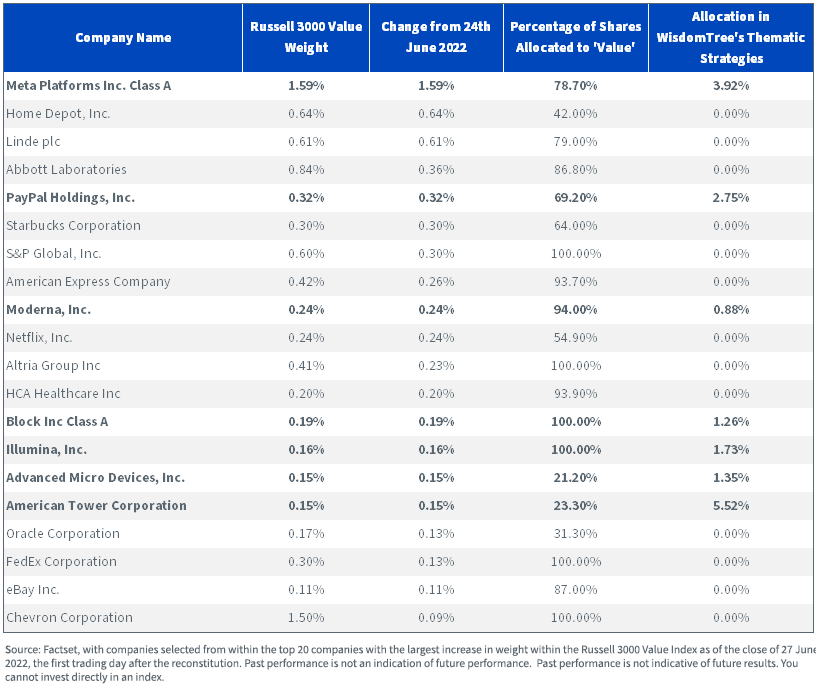

Figure 2, a table, contains a lot of valuable information.5

- The “Russell 3000 Value Weight” represents the company’s weight as of June 27, 2022. If viewed in isolation, the fact that this Index has so many constituents makes distinct takeaways tricky. Meta Platforms was the biggest story by far, yet it had only a weight of 1.59%, not a big number.

- The “Change from June 24th, 2022” is not much different. Companies where the “Change from June 24th, 2022” matches the “Russell 3000 Value Weight” exactly tell us which companies had 0% starting weight and would have been added to the Russell 3000 Index.

- The “Percentage of Shares Allocated to Value” to us is one of the most notable columns. This gets at the fact that many companies are not 100% in either growth or value within FTSE Russell Indexes. Meta Platforms is having almost 80% of its weight allocated to value. It’s interesting that Block and Illumina see 100% of their shares allocated to value, meaning they wouldn’t be in the Russell 3000 Growth Index at all.

- The “Allocation in WisdomTree’s Thematic Strategies” relates to the companies that would be represented in at least one WisdomTree thematic strategy. The reason we mention this—thematic strategies are most typically classified as “growth.” If stocks represented in thematic strategies—like cloud computing or artificial intelligence—are starting to show up in value strategies, it speaks to the magnitude of the current correction we have seen.

Figure 2: The Top 20 Gainers in Weight in the Russell 3000 Value Index (as of June 27, 2022)

Conclusion – What Is Value?

What’s clear is that the companies that comprise the “value” style are not constant.

Some very well-known growth names are seeing at least some of the weight getting allocated to value, at least within the FTSE Russell universe.

We may be far from saying “thematic strategies are in the value style fully,” but it is a notable way to quantify the incredible nature of the correction we’ve seen in 2022 so far.

1 Source: https://content.ftserussell.com/sites/default/files/2022.02.03_russell_recon_schedule.pdf

2 Source: Russell U.S. Equity Indexes, version 5.5, Construction and Methodology Document, June 2022.

3 Source: Russell U.S. Equity Indexes, June 2022.

4 Source: FactSet, with data up 6/28/22.

5 Sources: FTSE Russell, FactSet, with data as of closing price, 6/27/22.

Important Risks Related to this Article

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.