A Sense of Malaise is Setting the Market’s Tone

You can feel it in the air. A feeling of frustration, people spinning their wheels. Some of it is because of rising prices. It is also in the little things, like when you when you need the dishwasher fixed, but it’ll be 10 days before someone can swing by. Then the big one of the last 2 years: COVID, which is only now feeling like it’s fading from our collective consciousness. Now Americans watch as war in Eastern Europe flairs.

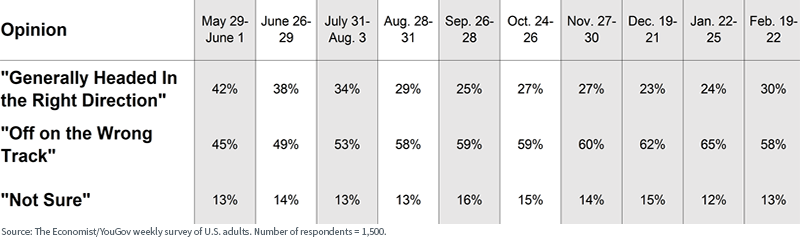

Last spring, only 42% of the public told pollsters from The Economist and YouGov that the country is “generally headed in the right direction.” That was low indeed, especially since many at the time were lining up to get the vaccine, which we were told would get life back to normal.

But COVID kept droning on. Here we are, over a year since the original recipients took the jab in December 2020, still duking it out in what looks like the ninth inning of the COVID culture wars. By late-January, the 42% who said the country was headed in the right direction had slipped to 24%, though it has subsequently risen to 30% in the latest poll, which was taken before Russia invaded Ukraine (figure 1).

Figure 1: The Economist/YouGov Poll: “Would You Say Things in This Country Today Are…”

You know what else isn’t “headed in the right direction?" The NASDAQ.

You could be forgiven for seeing the 7% annualized growth pace in Q4 GDP and concluding it would support the market’s major indexes. But economic growth is being treated as much less important to stocks than the path to be taken by the Federal Reserve, now that we have a sudden war in the central bank’s calculus.

Nevertheless, with the unemployment rate south of 4%, previous prognostications of a deliberate rate hiking tendency by the Fed have morphed to an outlook that witnesses overnight rates rising consistently for the rest of the year and beyond. The consensus anticipates six quarter-point rate hikes in 2022, down from seven increases before Russia went into Ukraine.

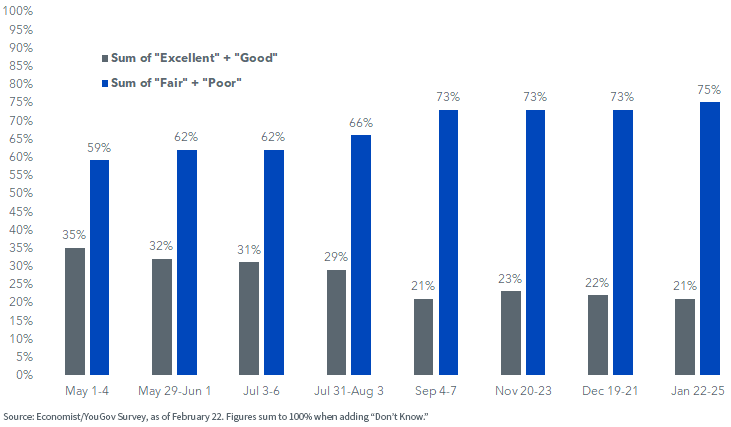

Nevertheless, if GDP growth is so hot and the labor market is so tight, then why do about seven in 10 Americans rate the U.S. economy either “Fair” or “Poor?”

In a word: Inflation.

Figure 2: The Economist/YouGov Poll: “How Would You Describe the Current State of the American Economy?”

Long-duration NASDAQ stocks—those that have distant cash flows and are most sensitive to discount rates—haven’t waited around for the Fed to fight rising prices. From their 52-week highs, 30% of the index’s roughly 3,600 companies have been cut down by more than half.

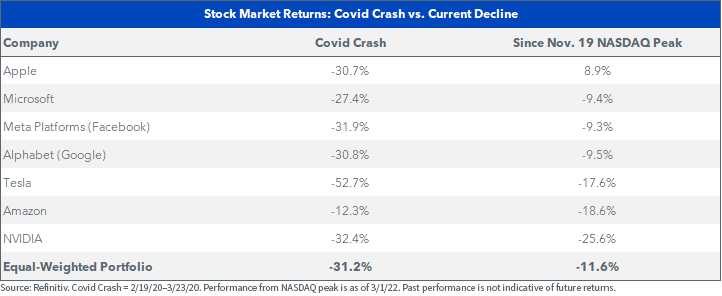

Until recently, the market’s “generals” were holding the fort. For example, while the NASDAQ peaked in mid-November and started tumbling, Meta Platforms, which is Facebook’s new name, chopped sideways…for a while.

Not anymore. The bears eventually came for Meta and for most of the market’s other “big dogs,” save Apple, which has achieved the moral victory of breaking even in recent months.

Figure 3: Comparing the Current Market to Early 2020

In the meantime, our value stuff has managed to hold up, despite the ugly tape. While the NASDAQ 100 went into an official bear market intraday on February 24, about three months after its November 19 peak, the WisdomTree U.S. Value Fund (WTV) is only off 3.5% since then.

As bullish as I am about value vs. growth, I’m a little stunned by how well WTV has held up. If you had told me around Thanksgiving that Tesla, Meta and NVIDIA—among many others—would fall out of bed so rapidly, I would have suspected more pain in other equity groups too, even in Value stocks.

Yet WTV’s partner, the income-oriented WisdomTree Large Cap Dividend Fund (DLN), is only off 0.3% since November 19. This is with the VIX having gone north of 30 in December, January, February and here in March.

Another one is a “yield gooser,” the WisdomTree U.S. High Dividend Fund (DHS), which is up 7.8% since the NASDAQ peak.

The logical takeaway: the market is treating value stocks as a relative haven.

The vibe out there is one of malaise, “sticky” inflation, a stock market that doesn’t want to play nice. Maybe something like a whiff of the 1970s. This is uncharted territory for most players. It makes me think of an old market maxim that says the stock market’s leaders in one cycle are rarely the leaders when another cycle comes along.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For the most recent month-end performance go to wisdomtree.com

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While WTV is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.

Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Investments in value stocks present the risk that a stock may decline in value or never reach the value the adviser believes is its full market value. In addition, the Fund’s value investment style may go out of favor with investors during certain parts of the market cycle, which may negatively affect the Fund’s performance.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.