A Deeper Look at Our International Dividend Index Rebalance

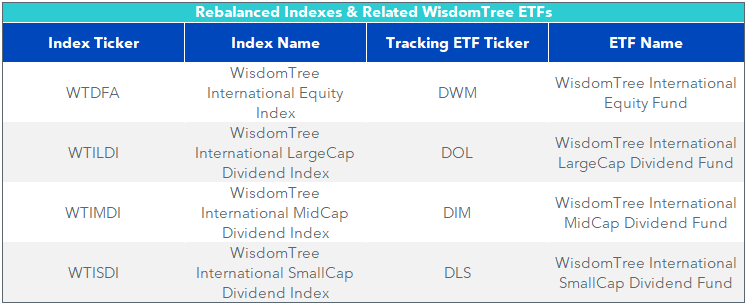

We recently rebalanced many of our WisdomTree international equity Indexes as part of their annual reconstitution process, with the new constituents and weights taking effect after the markets close on November 4.

Below you’ll find a summary of the changes to the following international equity Indexes, covering the market cap spectrum, with a focus on fundamentals, sector positioning and country exposures resulting from their rules-based, dividend-weighted methodologies.

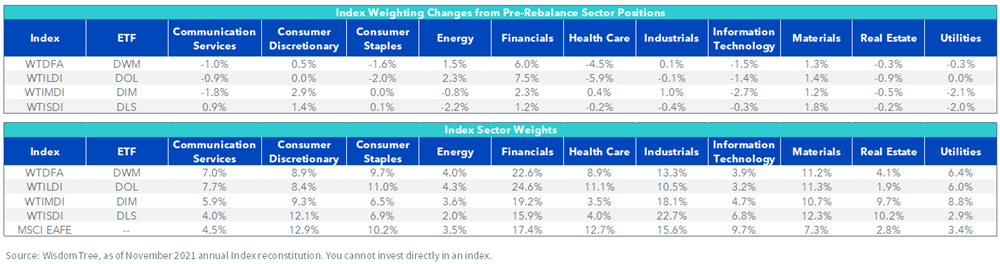

Changes to Sector Weights

As a result of the 2021 rebalance, the broad market and large-cap Indexes exhibited modest changes of 2% or less across all sectors compared to their pre-rebalance positions, except for Financials and Health Care. Within the broad market Index, Financials picked up nearly 6% in weight, while Health Care lost about 4.5%. In the large-cap Index, those changes were a bit more pronounced—Financials gained about 7.5% in weight, while Health Care lost nearly 6%.

These changes were expected given last year’s moratorium on dividend payments in the developed world and generally reflect the changing composition of the developed equity market Dividend Stream™.

Many financial companies, and Europe’s largest banks in particular, suspended dividend payments to preserve cash during the onset of the COVID-19 pandemic. This guidance was explicitly recommended by the European Central Bank late last year to combat liquidity fears during the sudden downturn.

However, as the recovery materialized and economic outlook improved, many of these companies reintroduced their regular dividend payments, which restored their contribution to the Dividend Stream™. As a result, they were awarded more weight than they received during last year’s rebalance.

The Indexes’ underweight allocations to Health Care involves a bit more nuance, however. Recall that last year WisdomTree introduced a Composite Risk Screening mechanism to many of our Indexes to help combat value traps and to exclude the riskiest companies that still managed to pass our dividend screens.

One key element of the Composite Risk Score is an assessment of quality and momentum trends, which helps adjust the final dividend weights that make up these Indexes.

Health Care was a severe laggard over the past year. Based on these quality and momentum metrics, its allocation is not being overweighted this year as it was during 2020’s rebalance, hence the dividend underweight of about 4.5%–6% in the broad market and large-cap Indexes.

Moving down the market-cap spectrum, the most pronounced changes in the mid-cap Index affected the Information Technology and Consumer Discretionary sectors. The former lost about 3% in weight, while the latter added roughly the same amount. Like the impact to Financials in the broad market and large-cap Indexes, this is likely due to the fact that smaller Consumer Discretionary companies may have finally regained solid financial footing amid the economic recovery and are comfortable using excess profits for dividend payments once again.

Sector weights in the small-cap Index were modestly impacted, with only Energy showing a change greater than 2% in absolute value.

Again, these changes represent a return to a normalized developed equity market Dividend Stream™ now that the economic outlook has improved across sectors from the throes of the COVID-19 pandemic. Below you’ll find the sector weights for each Index along with those for the MSCI EAFE Index (MXEA), illustrating how the dividend-weighted methodologies result in our Indexes being overweight or underweight in certain sectors compared to a traditional market cap-weighted approach.

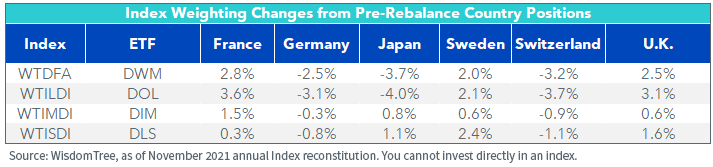

Changes to Country Exposures

The most significant changes to country exposures within the broad market and large-cap Indexes centered on some of Europe’s largest economies. Within both, France picked up roughly 3%–3.5% more weight while the U.K. added another 2.5%–3% as well. This mostly came at the expense of Germany and Switzerland, which both lost anywhere from 2.5%–3.7% apiece in both Indexes. Japan also lost about 4% of its exposure during this rebalance.

These changes are consistent with the sector changes we outlined previously, where returning dividend-payers made a notable impact to the overall Dividend Stream™ as dividend policies continued to normalize.

Country impacts within our mid-cap Index were modest, with Australia making the biggest impact due to a 2% increase in weight. Elsewhere, changes were relatively consistent with changes to the Dividend Stream™ composition in Europe.

The same can be said for country exposures within our small-cap Index. Sweden had the greatest impact, increasing its weight by about 2.4% while all other position changes were negligible.

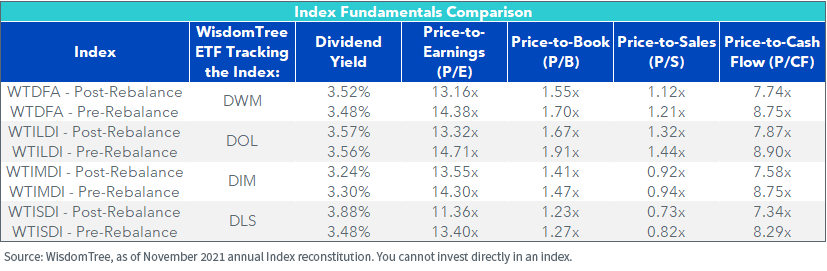

Fundamentals Comparison

The 2021 rebalance also reflects the benefits of a rule-based, dividend-weighted methodology in developed equity markets. Because of the emphasis on dividends, these Indexes tend to follow a traditional value investing framework, and the portfolios’ fundamentals illustrate that.

In most cases, the dividend yield increased in the Indexes after the rebalance, which is especially advantageous for investors in a market environment characterized by historically low interest rates and tight credit spreads.

More important, however, is the valuation profile of each Index after the rebalance. In each of the four, valuations were reduced considerably across key ratios, such as price-to-earnings, price-to-book, price-to-sales and price-to-cash flow, all while generally maintaining their pre-rebalance dividend yields.

This signals to us that the reduced valuations do not indicate a particular risk to company dividends, which is the ethos of their methodologies. Likewise, they indicate that there are still compelling opportunities in developed equity markets despite their gains over the last 12 months.

Summary

Overall, the 2021 rebalance for our developed market dividend Indexes represents the current state of the international dividend environment. While much has changed since the onset of the COVID-19 pandemic early in 2020, this year’s reconstitution represents another step toward a true “return to normal” in international equity markets. We believe the Index methodologies once again give credence to the benefits of a rules-based, dividend-focused approach to international investing, and prove that there have been compelling fundamental, sector and country opportunities when utilizing this approach in a portfolio. For investors interested in this methodology, we encourage you to consider the following WisdomTree Funds:

- WisdomTree International Equity Fund (DWM)

- WisdomTree International LargeCap Dividend Fund (DOL)

- WisdomTree International MidCap Dividend Fund (DIM)

- WisdomTree International SmallCap Dividend Fund (DLS)

Each of the WisdomTree Funds shown seeks to track the price and yield performance, before fees and expenses, of its respective WisdomTree international Index.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.