Getting Exposure to Quality Companies in Developed Markets?

The quality factor has outperformed the broad market this year across the globe, and we expect that to continue through the expansion phase of the economic cycle.

The WisdomTree International Quality Dividend Growth Index (WTIDG) selects companies with strong measures of profitability and earnings growth prospects in the developed markets. The thesis is that these companies will be able to grow their dividends at a faster and more stable pace, translating into strategic outperformance.

Having exposure to these companies when COVID-19 hit was important. WTIDG’s median annual dividend growth over the last three years has been 10.5% compared to 2.8% by the MSCI EAFE Index. During this same period, WTIDG has outperformed MSCI EAFE by more than 400 basis points (bps) while its hedged version, the WisdomTree International Hedged Quality Dividend Growth Index (WTIDGH), has outperformed by a wider 600 bps1.

WTIDG and WTIDGH share a common equity basket and are tracked by the WisdomTree International Quality Dividend Growth Fund (IQDG) and the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), respectively. This equity basket underwent its annual reconstitution at the beginning of November.

Rebalance Summary

Fundamentals

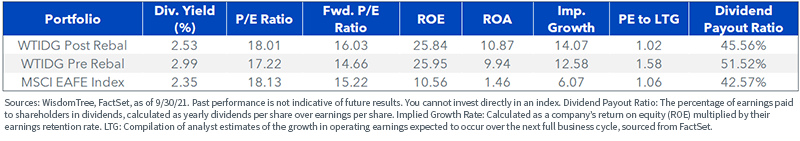

Fundamentals after our rebalance show an increase in quality metrics, as well as higher implied growth as measured by the earnings retention times the return on equity (ROE). Return on assets (ROA) improves from 9.94% to 10.87% and implied growth rate from 12.58% to 14.07%.

Within its objectives, WTIDG’s fundamentals show a portfolio with more attractive quality and growth metrics than the MSCI EAFE Index, along with a lower growth-adjusted valuation.

Country and Sector Changes

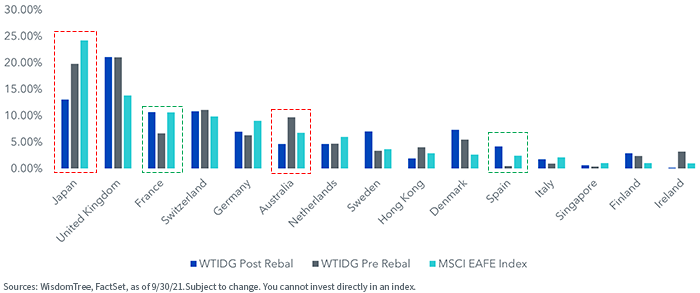

During this latest reconstitution, Japan and Australia saw notable reductions in weights relative to the MSCI EAFE Index. Exposures to France, Sweden and Spain were significantly increased.

The largest change from a country perspective was France, whose weight increased 4.04%. This increase was driven by the addition of Consumer Discretionary conglomerates Kering SA and Michelin. Both companies showed a solid rebound in earnings and dividend growth post COVID-19 slowdown. Increases for Sweden and Spain can be largely attributed to the addition of companies in the Industrials and Consumer Discretionary sectors, respectively.

Country Exposures

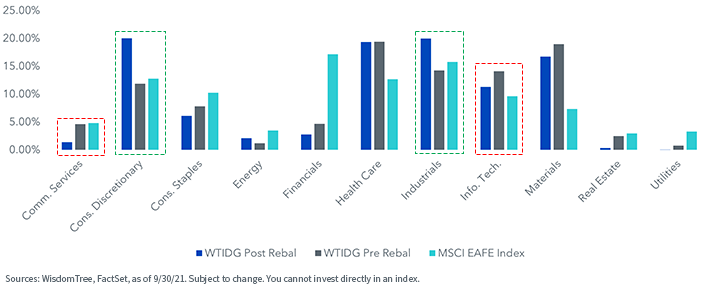

When looking at sector changes, Consumer Discretionary had the biggest percentage weight increase, driven by the previously mentioned French companies along with Spanish Industria de Diseno Textil, S.A. The Industrials sector also saw a significant weight increase driven by Deutsche Post AG, Hapag-Lloyd AS and Sandvik AB.

Noteworthy weight reductions came from the Communication and Information Technology sectors. Companies with large weight reductions were SoftBank Corp. and SAP SE.

Sector Exposures

Possibility of Implementing Currency View

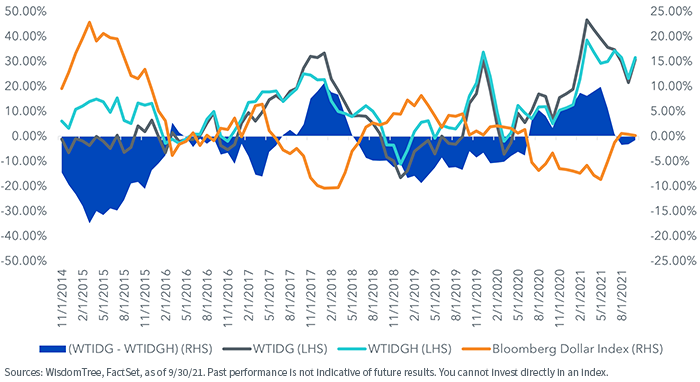

Going back to their common inception in November 2013, we can see how the excess in the rolling 12-month performance between WTIDG and WTIDGH is highly correlated to the performance of the Bloomberg Dollar Spot Index. In periods of U.S. dollar (USD) strength, WTIDGH will seeks to outperform WTIDG, with the opposite happening in periods of USD weakness. The idea behind IQDG and IHDG sharing a stock basket is to allow investors to implement their views on the USD on top of a portfolio of companies with strong profitability and growth outlook metrics.

Trailing 12-Month Return

1 Sources: WisdomTree, FactSet. Data from 9/30/18–9/30/21. Past performance is not indicative of future results. You cannot invest directly in an index.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal.

IHDG: Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs.

IQDG: Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Heightened sector exposure increases the Fund’s vulnerability to any single economic, regulatory or other development impacting that sector. This may result in greater share price volatility. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs.

Please read each Fund’s prospectus for specific details regarding the Fund’s risk profiles.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.