The Story Behind Bitcoin Futures in an ETF

Cryptocurrencies have become the focal emerging asset class of the year.

Companies purchasing bitcoin on their balance sheet and large banks offering cryptocurrency exposure to their wealth management clients have shown institutions’ belief that cryptocurrencies can play an important role in investment portfolios.

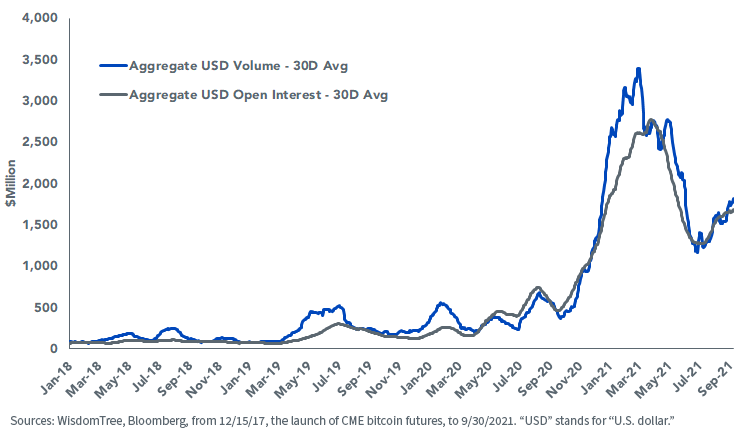

Access to crypto also matured, including exposure to bitcoin through bitcoin futures, as seen through the large increase of their open interest and volume on the Chicago Mercantile Exchange (CME).

WisdomTree believes the bitcoin futures market has developed such that it supports institutions and funds adding exposures to this asset class in a thoughtful and measured manner.

As of October 15, the WisdomTree Enhanced Commodity Strategy Fund (GCC) added an approximate 3% allocation to cash-settled bitcoin futures traded on the CME, making it the first ETF to provide exposure to crypto assets through bitcoin futures.1

Bitcoin as Digital Gold as Expressed Through Bitcoin Futures

1. Economic Underpinning of Scarcity

The 3% allocation to bitcoin futures was made from the Fund’s position in gold, which stands at approximately 9% after the rebalance. This move was motivated by the view that bitcoin is often compared to “digital gold” as a store of value and use case, which is being expressed for GCC via bitcoin futures.2

From the perspective of past performance, it is helpful to compare bitcoin and gold to point to their differences in volatility and risk level. Over the past three years, bitcoin’s annualized volatility is 76.84% while gold’s annualized volatility is 14.80%.3 The highly volatile return indicates that bitcoin’s adoption is still at early stage and its price might be partly driven by speculation. In the short run, investors allocating to bitcoin should have a higher tolerance of risk. However, we believe gold and bitcoin are similar in their underlying economic structure which can present the potential analogy of bitcoin as “digital gold.”

For much of recorded history, gold has been considered a currency, a commodity and an investment. Its durability, exchangeability and scarcity make it an asset with inherent value.

Bitcoin is like gold in many regards. Designed to be a peer-to-peer value transfer agent, bitcoin is exchangeable, and its records are irreversible. Most importantly, it is a scarce and structurally deflationary asset.

Bitcoin’s design is based on two embedded and predetermined economic principles:

- Fixed Total Supply – A fixed total supply to be realized in 2140 with the amount of 21 million bitcoins.

- Reduction of Issuance – A “halving” event that cuts the mining rewards to half every four years. It occurs to reduce supply since mining is the only activity that generates new bitcoins.4

These two economic principles underpin bitcoin’s economy. They limit bitcoin’s supply by setting a cap and implementing a mining activity that controls the speed of its provision. Similarly, gold has a set available stock and can only be produced from mining activity.

Compared to fiat currencies that can be increased by central banks at will, bitcoin and gold’s economics dictate that they cannot be debased or manipulated in the same way that fiat currencies can be, providing them with a foundation to serve as potential store-of-value financial asset.

2. Supply-and-Demand Dynamic

Gold’s price depends on its supply and demand—how much it is mined and consumed. Bitcoin, too, has a supply-and-demand dynamic.

From the supply side, gold’s newly excavated stock accounts for little of its price movement, because the amount is small compared to its total above-ground stock. As bitcoin’s block reward gets cut further, its supply’s dominance would also be dimmed as fewer coins are generated. A large portion of bitcoin (approximately 18.8 million out of 21 million) has already been mined.

Going forward, bitcoin’s pricing could gradually shift toward the demand side, similar to gold’s, which depends on how much the system is used and how successful it is in evolving into a store-of-value vehicle. However, investors who believe in such, must have an appetite for short term volatility and risk. The risks such as regulatory uncertainties, price speculations, and technological development difficulties must be kept in mind of.

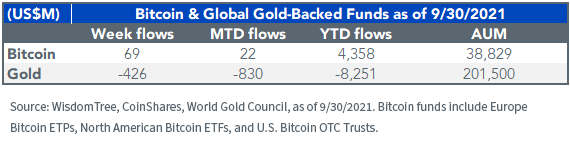

The current inflationary environment so far aids its store-of-value narrative, as fiat money and bonds become less attractive. Gold, traditionally a good inflation hedge, has been disappointing over the last 12 months, and many attribute bitcoin to taking in some of the demand, as can be seen with our own allocation shift.

Gold funds experienced heavy outflows, while there is a strong inflow to bitcoin funds. Bitcoin’s market capitalization has risen to more than $1 trillion, compared to gold’s $11 trillion.

Global gold-backed funds can be found here.

Bitcoin Futures in Seeking to Enhance Portfolio Diversification

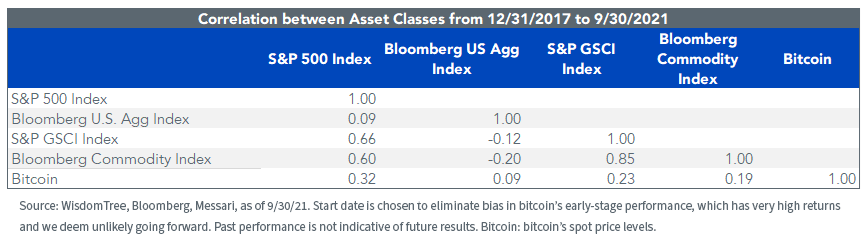

We view bitcoin futures as a potentially compelling asset for addition to a commodity strategy such as GCC that seeks to provide returns uncorrelated with equities and fixed income. Historically, bitcoin has a correlation well below 0.5 against most major asset classes.

For definitions of terms in the chart, please visit the glossary.

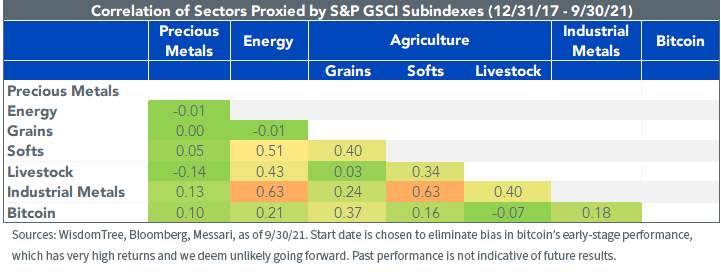

We believe it could also further enhance portfolio diversification among commodity sectors.

Bitcoin Futures Market’s Maturation

Regulated bitcoin futures debuted in December 2017 on the CME. Since then, a lot of new buyers have been entering the market via futures. They include family offices, asset managers and hedge funds.

We have witnessed a pickup in institutional demand, reflected by rises in open interest and trading volume since last November. Despite the shortfall that took place this past March through May, the futures market has recovered steadily in recent months.

The increase in volume and open interest suggests the gradual maturation of the futures market, which provided more liquidity for institutional investors.

Bitcoin Futures Carry

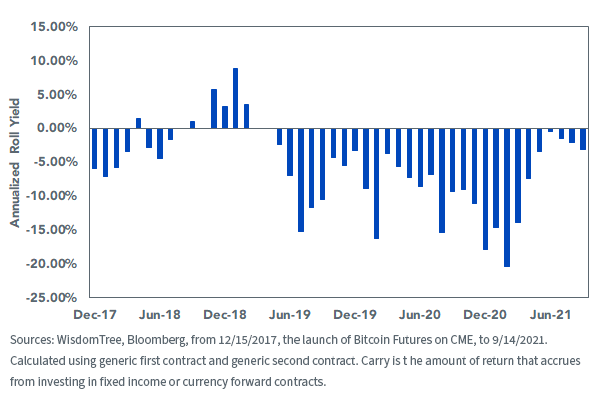

Bitcoin futures curves used to be in heavy contango, and carry cost could be significant. This is due to the high borrow cost, tracking error, and other risks.

For the past five months, carry has generally narrowed to annualized cost within 5%, compared to the historical average of 8.8% for the past two years, although carry has been higher more recently. However, this gradual evolution has presented institutional investors with an opportunity to seek exposure to bitcoin through futures.

For definitions of terms in the chart, please visit the glossary.

Conclusion

While institutional access to bitcoin via other channels is still limited, we are excited that GCC is the first ETF to add bitcoin futures exposure. We believe, in the current inflationary environment, a limited allocation to bitcoin futures can potentially generate excess returns in a risk-controlled approach as well as further diversify the portfolio.

1 GCC will not invest in bitcoin directly. The discussion of bitcoin is for educational purposes only in order to help the reader generally understand bitcoin, which is the reference asset for bitcoin futures. Bitcoin and bitcoin futures have different risk profiles and different characteristics.

2 The price of bitcoin futures and related costs should be expected to differ from the cash price of bitcoin. Consequently, the performance of bitcoin futures should be expected to perform differently from the price of bitcoin, including the correlation of returns to other asset classes. These differences could be significant.

3 Bitcoin’s volatility is calculated with bitcoin price levels from Messari. Gold’s volatility is calculated with gold spot price levels from Bloomberg. From 9/30/2018 to 9/30/2021.

4 The last halving occurred on May 11, 2020, with the current block reward being 6.25 BTC per block.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance. These factors include use of commodity futures contracts. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks and historically have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. In addition, derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund, and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.

The Fund’s investment strategy is subject to risks related to rolling. The price of futures contracts further from expiration may be higher (a condition known as “contango”) or lower (a condition known as “backwardation”), which can impact the Fund’s returns. Because of the frequency with which the Fund expects to roll futures contracts, the impact of such contango or backwardation may be greater than the impact would be if the Fund experienced less portfolio turnover

Prior to December 21, 2020, the ticker symbol GCC was used for an exchange-traded commodity pool trading under a different name and strategy.

Jianing Wu joined WisdomTree as a Research Analyst in October 2018. She is responsible for analyzing market trends and helping support WisdomTree’s research efforts. Previously, Jianing completed internships and projects at Geode Capital, Starwint Capital, and Invesco Great Wall Fund Management with a focus in quantitative research. Jianing received her M.S in Finance from the Massachusetts Institute of Technology. She graduated with honors from Boston College with degrees in Mathematics and Philosophy.