Yield? I Do Not Think It Means What You Think It Means

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Vizzini: Incontheivable!

Inigo Montoya: You keep using that word. I do not think it means what you think it means.

(From the movie, “The Princess Bride,” 1987. Vizzini is played by Wallace Shawn, and Inigo Montoya by Mandy Patinkin.)

It is once again time to revisit the topic of generating risk-controlled yield in today’s rate and credit environment—we last visited it in early August. Like “The Princess Bride,” however, the story never gets old and is always open to new interpretations. We’ve seen some significant movement in interest rates (if not credit spreads) over the past few weeks, so let’s see where we stand.

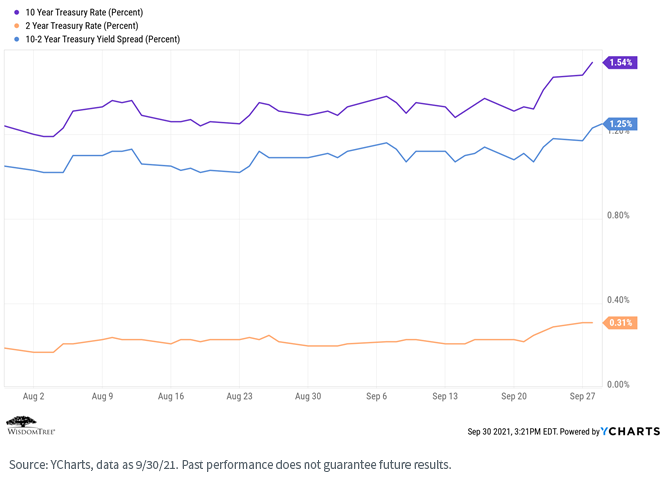

First, let’s look at rates. As inflation rears its ugly head, the Federal Reserve (“Fed”) considers the formal onset of asset reduction (“tapering”), and the Fed’s “dot plot” suggests a slightly more hawkish sentiment within the FOMC. Rates have responded accordingly. Here is the yield curve movement since early August:

The 10-Year rate moved from 1.24% in early August to 1.54% in late September. Thirty basis points may not sound like much on an absolute basis, but it represents an almost 25% increase in rates in just two months. Notice as well that the short end of the curve, as measured by the 2-Year Treasury rate, has jumped roughly 40% just in the past few weeks, due to the Fed officials now being evenly divided between a 2022 and 2023 ‘lift-off’ date. This is in stark contrast to earlier in the year when no rate hikes were on the policy makers’ time horizon until at least 2024.

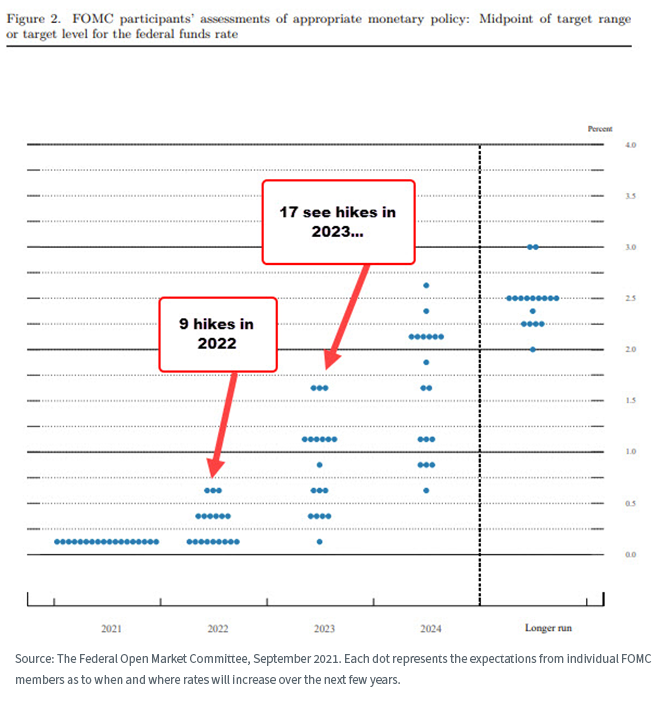

Here is the most recent Fed dot plot following the September FOMC meeting—note that nine Fed officials now see a rate hike coming in 2022, up from seven in the June meeting, and 17 anticipate rate hikes in 2023, up from 13 in June. Clearly the Fed is at least considering the idea that current inflationary trends may not be “transitory.”

For definitions of terms in the chart, please visit the glossary.

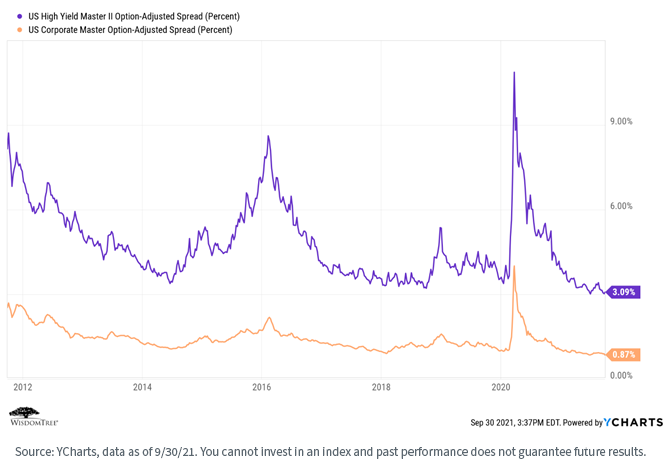

Interestingly, the credit markets largely have yawned through all this recent uncertainty and remain at the narrower end of their “non-crisis” trading ranges—they have in fact tightened since we last visited them in August:

For definitions of terms in the chart, please visit the glossary.

Finally, Treasury real yields (nominal rates minus the inflation rate) remain negative across the yield curve, though we have seen a modest rebound since August. That is, buying Treasuries continues to guarantee a negative real return over the lifetime of the bond (if held to maturity).

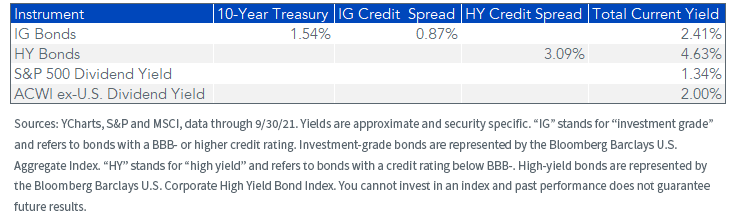

So, how do things look from a yield generation perspective?

Bottom line…we continue to believe that rates most likely will grind higher as the economy recovers and spreads remain historically tight. Corporate balance sheets generally are in good shape, so coupons should be safe, but there is not a lot of optimism about risk-controlled total return potential in the fixed income markets.

Let’s compare current nominal fixed income yields to current equity dividend yields.

For definitions of terms in the table, please visit the glossary.

Our own Model Portfolios remain short duration and overweight credit, with an explicit focus on quality security selection, relative to the Bloomberg Barclays U.S. Aggregate Index (the “Agg”). We definitely are not looking to take excessive risk in our fixed income portfolios in a reach for yield.

But here are some ideas that may be of interest.

Fixed Income Strategy Ideas

Although a challenging landscape does exist for fixed income, there are some ideas investors should consider. In our opinion, the U.S. Treasury 10-Year yield could be poised for a move back up to the 1.75%–2.00% level, last observed in late March of this year. Against this backdrop, we would suggest a rate-hedging vehicle that provides income opportunities as well: the WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD). This Fund offers a core-plus barbell approach that can help mitigate potential rate risk.

Another strategy that focuses on income is the WisdomTree Alternative Income Fund (HYIN). This Fund provides individual investors with access to an asset class that, in the past, was available mainly to institutional portfolios, and can serve as a strategic allocation that traditionally has a low correlation to interest rate movements.

Portfolio Ideas

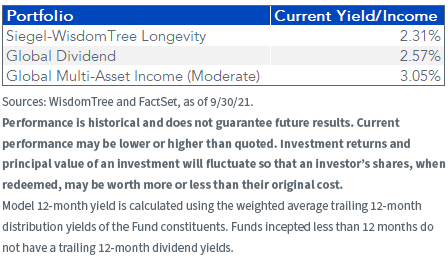

WisdomTree manages three specific Model Portfolios that are yield and income oriented: our Global Dividend, Siegel-WisdomTree Longevity and Global Multi-Asset Income Models.

Let’s look at the current yield of these portfolios (as of September 30, 2021). “Current Yield/Income” refers to the most recently posted 12-month dividend yield, as indicated here.

For Fund performance please click the respective Siegel-WisdomTree Longevity, Global Dividend and Global Multi-Asset Income (Moderate) Model Portfolios in our Model Adoption Center for individual Fund standardized performance, and see the Fund Details tab for Fund-specific links for yield, most recent month-end performance and a prospectus.

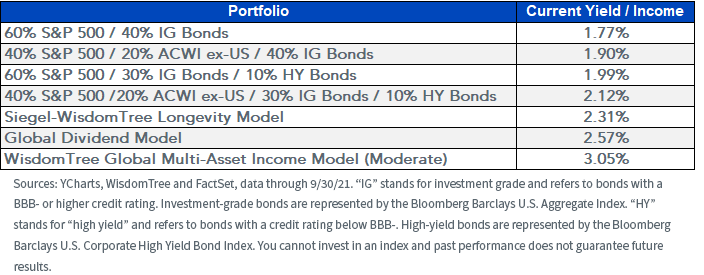

Now let’s combine all of this into hypothetical “typical” client portfolios.

Conclusions

Today’s market environment is fraught with risks for fixed income investors. We continue to believe that taking excessive risk in the fixed income market is the wrong way to look for yield . We believe you can get where you want to go more safely by focusing on the global equity markets to generate yield, while still maintaining an appropriate fixed income allocation, both for income generation and as a hedge to your equity beta risk.

Today’s yield environment may “not mean what you think it means.” But you can still find environments for generating yield that are relatively safer than simply taking more risk in your bond portfolio.

You can get all the details on our individual strategies and our Model Portfolios on the WisdomTree Model Adoption Center (MAC)

Important Risks Related to this Article

Investors and their advisors should consider the investment objectives, risks, charges and expenses of the funds included in any Model Portfolio carefully before investing. This and other information can be obtained in the Fund’s prospectus by visiting www.wisdomtree.com for WisdomTree Funds. Visit the applicable third-party website for third-party funds. Please read the prospectus carefully before you invest. WisdomTree Asset Management, Inc., does not endorse and is not responsible or liable for any content or other materials made available by other ETF sponsors.

For retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment adviser may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: Your investment adviser, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment adviser and may differ from information provided by your investment adviser. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Jeremy Siegel serves as Senior Investment Strategy Advisor to WisdomTree Investments, Inc., and its subsidiary, WisdomTree Asset Management, Inc. (“WTAM” or “WisdomTree”). He serves on the Model Portfolio Investment Committee for the Siegel-WisdomTree Model Portfolios of WisdomTree, which develops and rebalances WisdomTree’s Model Portfolios. In serving as an advisor to WisdomTree in such roles, Mr. Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.

HYIN: There are risks associated with investing, including the possible loss of principal. The Fund invests in alternative credit sectors through investments in underlying closed-end investment companies (“CEFs”), including those that have elected to be regulated as business development companies (“BDCs”), and real estate investment trusts (“REITs”). The value of a CEF can decrease due to movements in the overall financial markets. BDCs generally invest in less mature private companies, which involve greater risk than well-established, publicly traded companies and are subject to high failure rates among the companies in which they invest. By investing in REITs, the Fund is exposed to the risks of owning real estate, such as decreases in real estate values, overbuilding, increased competition and other risks related to local or general economic conditions. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read HYIN’s prospectus for specific details regarding the Fund’s risk profile.

HYZD: There are risks associated with investing, including the possible loss of principal. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The Fund seeks to mitigate interest rate risk by taking short positions in U.S. Treasuries (or futures providing exposure to U.S. Treasuries), but there is no guarantee this will be achieved. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions.

Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Unlike typical exchange-traded funds, there is no index that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objective will depend on the effectiveness of the portfolio manager. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.