Risk Screens Pay Off during Bumpy July

For most of 2021, quantitative measures that screen for risk have been counterproductive as we’ve been experiencing a “junk rally”.

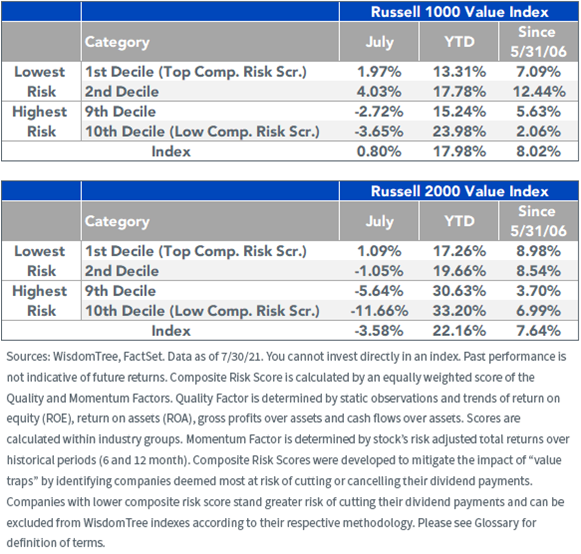

WisdomTree developed a composite risk screen (CRS) comprising multiple measures of profitability/quality combined with risk-adjusted momentum.

In the large-cap value category (the Russell 1000 Value Index), the riskiest decile outperformed the least risky decile by over 1,000 basis points (bps) year-to-date through July.

In small caps the difference has been even larger at almost 1,600 bps of outperformance for the riskiest stocks.

But July saw a very different dynamic play out with more volatile markets.

While the Russell 1000 Value eked out a small gain of 0.8% in July, the two riskiest deciles experienced declines ranging from 2.7% to 3.7%.

In small caps (the Russell 2000 Value Index), the riskiest companies underperformed by more extreme amounts in July: the riskiest decile lost 11.7% and the least risky decile actually gained 1.1%.

Composite Risk Score Decile Returns

While one month does not guarantee a changing trend, it is our belief that over the long run, the risk screens we’ve applied to our dividend-weighted Indexes and corresponding ETFs could result in a smoother ride for the portfolios. It is good to see that play out during a more difficult month for the markets.

The longer-run returns since the inception of WisdomTree’s Indexes about 15 years ago (5/31/06) showcase the outperformance of the top two deciles on these risk measures and underperformance for the bottom two deciles of risk.

We do not expect the high beta rally of the first six months of 2021 to continue indefinitely. With fears of the delta variant starting to pop up, and where we are broadly in elevated market multiples after such large gains, now looks like a good time to embrace valuation-sensitive Indexes that also control for measures of risk. To see this type of attribution interactively, we encourage you to use our Index attribution tool.

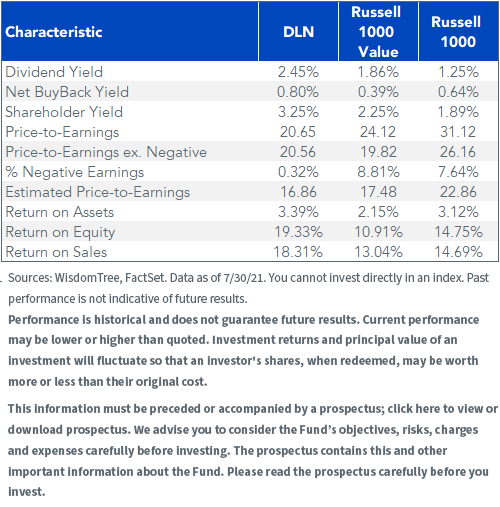

The WisdomTree U.S. LargeCap Dividend Fund (DLN), which seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. LargeCap Dividend Index, is one of our 5-star rated Funds (by Morningstar rating as of July 30, 2021)1 due to both its strong long-term returns, but importantly also lower risk than traditional value benchmarks.

The valuation metrics we see in DLN are as “value-like” as the Russell 1000 Value index, but with profitability metrics that rival and even exceed the traditional core index benchmarks. This is a great combination in our view for the large-cap space.

Performance data for the most recent month-end and standardized performance click here.

For definitions of terms in the table, please visit the glossary.

1Overall Morningstar Rating based on risk-adjusted returns that combines three-, five-, and 10-year ratings. As of July 30, 2021, there were 1,136, 1,007, and 739 funds in the Large Value category for the respective three-, five-, and 10-year periods.

Important Risks Related to this Article

Past performance is not indicative of future results.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

There are risks of investing in value stocks such as the potential that a particular stock may not rise to its anticipated intrinsic value and could decline further in value.

The Morningstar Rating™ for funds, or “star rating,” is calculated for managed products with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars, and the bottom 10% receive one star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three- and five-year Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.