Your Move Jay Powell

One of the key pillars for the Fed to begin a more active exit strategy was “substantial progress” in the labor market. With the July jobs report, it looks like the Fed will need to make some decisions, perhaps sooner rather than later. Here’s a look at the latest numbers:

- Total nonfarm payrolls rose by 943,000, beating the consensus estimate of 870,000 handily. In addition, the prior two months’ tallies were revised upward in a noticeable fashion. Thus, the U.S. jobs market has now produced back-to-back gains in excess of 900,000.

- The breadth of job gains was rather wide as well. The usual suspects (leisure & hospitality) continued their comeback from pandemic lows, but both private service-providing and government payrolls (local government) contributed to the better-than-expected performance in July.

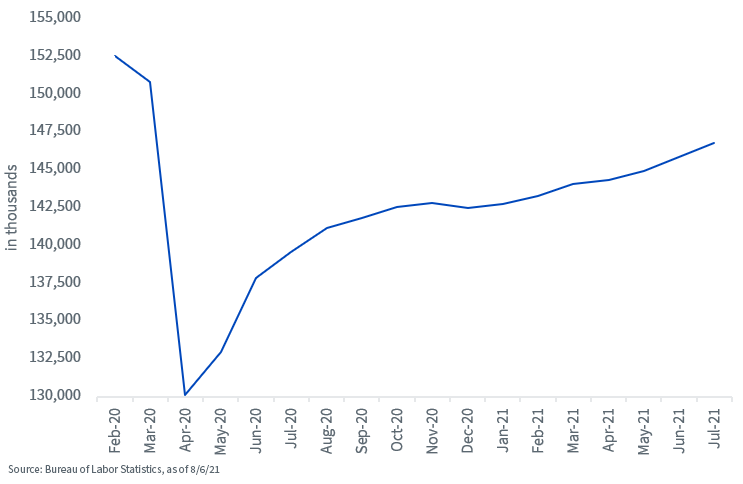

- Overall payrolls are still not back to their pre-pandemic levels, but they have now re-couped 75% of the March/April 2020 plunge.

Total Nonfarm Payrolls

- The unemployment rate dropped 0.5 percentage points to 5.4%, once again beating expectations (5.7%) in a noticeable fashion. In fact, within the household survey of the jobs report, civilian employment topped the million mark at 1,043,000.

- Another key development was the solid gain in average hourly earnings, with the year-over-year increase placed at 4.0%. It definitely appears as if the demand for labor coming from the pandemic recovery is putting upward pressure on wages, a development the BLS also noted in the report.

- Chairman Powell’s “inflation is transitory” argument will fall apart if wages join the party.

- There is no Fed meeting until September 22, but it appears as if some FOMC members are getting a little restless. We still have one more jobs report to go before then, but the July jobs report plays into the narrative that the Fed will make a taper announcement at this meeting, with Powell’s expected Jackson Hole appearance later this month potentially being used as a ‘signal’ to the markets as to what’s coming.

Conclusion