Why EM Small Caps Now: Diversifying China Tech

China’s large-cap technology stocks have come under immense pressure in the last three months—from actions taken against Ant Financial to delay its initial public offering to the latest regulatory actions against the education companies that crippled their ability to earn a profit.

Thus, we believe it may be a good time to review why emerging market small-cap stocks can help diversify some of the risks in the region, as it may seem counterintuitive that small caps can be less risky than large caps.

DGS Has Less China Weight

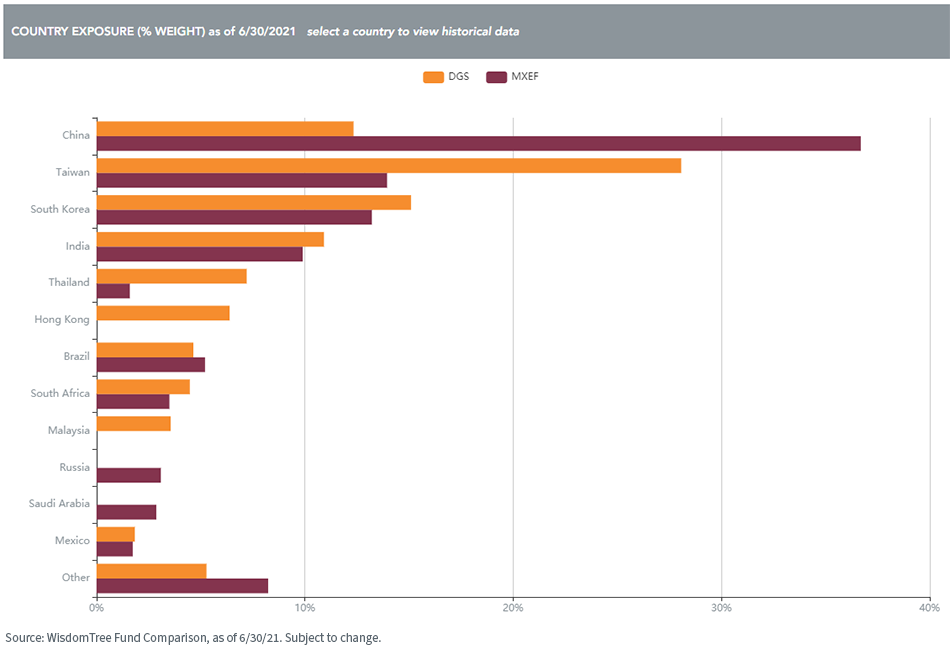

First, let’s take a look at country exposures in the WisdomTree Emerging Markets SmallCap Dividend Fund (DGS) and the broad MSCI Emerging Markets Index (MSCI EM).

China’s weight in the MSCI EM Index has grown to more than one-third with the long-term gains in those large tech giants. DGS, by contrast, had less than a 20% exposure in China and Hong Kong stocks.

For definitions of terms in the table, please visit the glossary.

More Cyclical Reopening Stocks

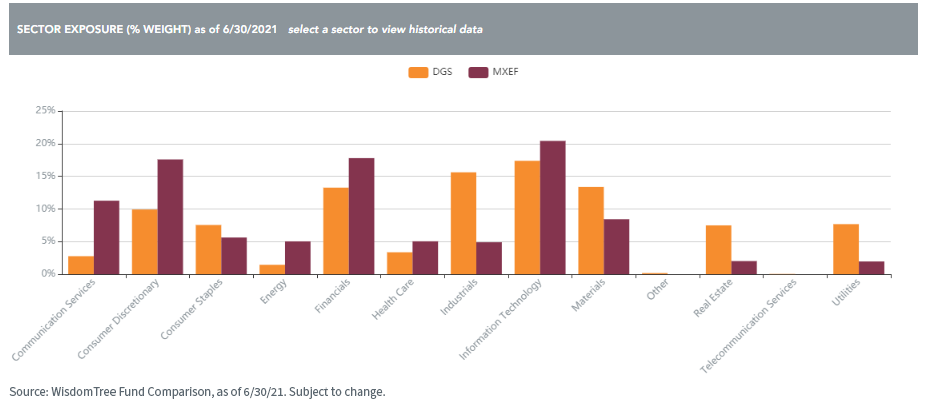

The sector exposures one gets in DGS are also more tilted to cyclical sectors like Industrials and Materials and away from technology and communication services—further helping diversify portfolios in EM.

China Tech Still the Big Winner Over Five Years

Despite recent regulation in the Chinese technology sector, China technology stocks still remain top performers over the last five years. In fact, our WisdomTree China ex-State-Owned Enterprises Index has still outperformed the S&P 500 over the last five years, even with the latest fall from grace.

DGS focuses on dividend-paying stocks—with a rigorous, valuation-based rebalance discipline. When we look at price-to-earnings ratios on estimated forward-looking earnings, we see P/E ratios in single digits at only 9.1x—whereas the broad MSCI EM Index is at 14.5x.

It is rare to find any market segment with this low of a market multiple—and this is not some narrow basket, as DGS has more than 750 constituents in its portfolio.

Why Dividend Payers in EM Small Cap

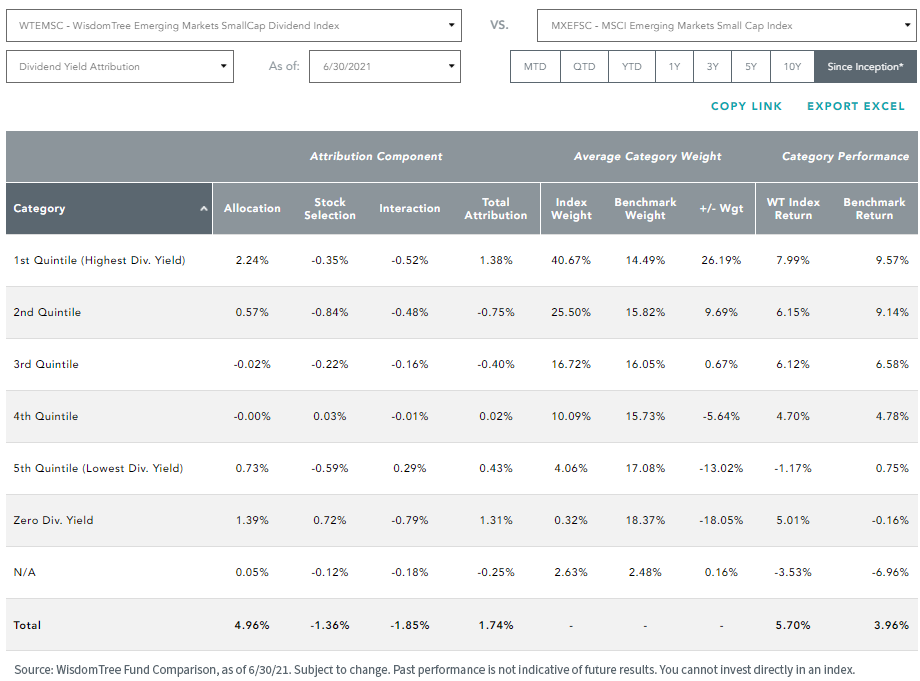

We often describe dividends as a level of corporate governance in emerging markets because companies must have cash to pay dividends, and you can only “fake” a dividend for so long. Dividends have thus served as a measure of quality for these companies, and the data shows this was critical.

Whereas the cap-weighted MSCI Emerging Markets Small Cap Index had less than 30% of its weight allocated to those top two quintiles, the WisdomTree Emerging Market SmallCap Dividend Index had almost two-thirds of its weight allocated to those top dividend quintiles.

This attribution analysis shows the long-term outperformance of the WisdomTree Index was driven both by the over-weights to the highest dividend bucket and the under-weights to the zero and lowest-yield segments.

Cyclical Rotation

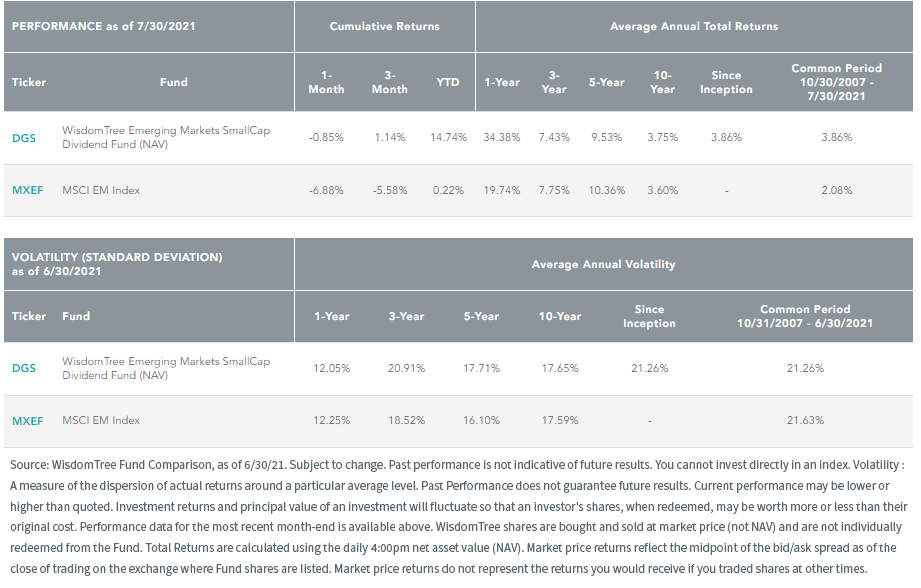

During this rotation away from growth, we have seen small caps with a value tilt perform particularly well in 2021 through July with outperformance by significant margins.

But equally interesting is that small caps have similar volatility as their large-cap brethren. We often think of the Russell 2000 as having significantly more volatility than the S&P 500—partly because there are so many more unprofitable companies in U.S. small caps.

But over the life of DGS, it has displayed volatility levels on par with the broader MSCI EM Index.

For standardized performance of DGS, please click here.

Factor Diversification

Almost all of WisdomTree’s own Model Portfolios have paired DGS with our Emerging Markets ex-State-Owned Enterprises Fund (XSOE) for some time to achieve factor diversification—pairing the growth-tilted core XSOE with small-cap value stocks in DGS. That pairing worked particularly well in 2021—and the current uncertainty surrounding China technology stocks suggests DGS and small caps could play an ever-larger role in diversifying portfolios from the latest risks to emerging markets.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits), even if notified of the possibility of such.

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.