Conversations with a Market Bear

On Behind the Markets, a podcast brought to you by Jeremy Schwartz, WisdomTree’s Global Head of Research, we talk to market strategists, business executives and financial advisors about important trends in the financial markets.

In this episode, Jeremy talks to Milton Berg, CEO and Chief Investment Strategist at MB Advisors.

Listeners will hear about:

Milton’s career has spanned 40 years and he has worked for some of the best hedge fund managers around including Michael Steinhardt, George Soros and Stanley Druckenmiller. We talked about what he learned from each of them including their very different work styles.

Milton started his career as a traditional value stock analyst and devotee of Benjamin Graham. But he started seeing Graham discard his deep valuation metrics over time—and even his disciple, Warren Buffett, started buying better quality businesses that were not cheap by any traditional Graham way of evaluating the market.

Milton became a strong devotee of broad database driven cycle research on the markets to compare recent activity to past behavior. Milton employs this same work for both broad markets and portfolios of individual stocks.

Bearish on the money supply?

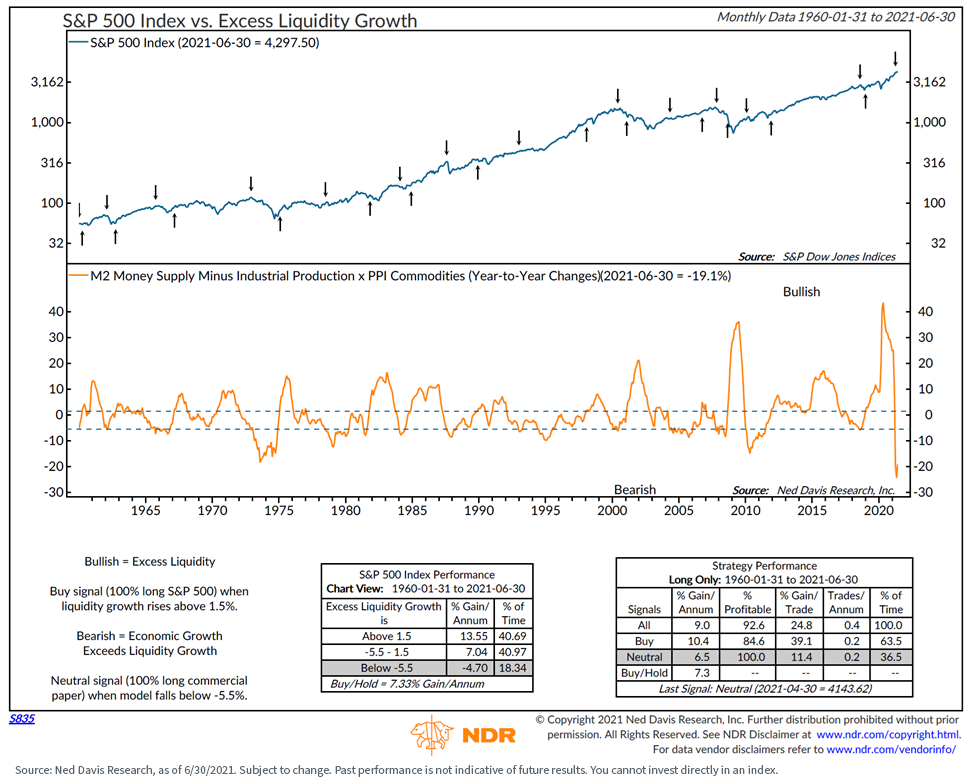

We have been talking about money supply issues with Professor Siegel for some time. Milton also looks at money supply growth, but evaluates it in comparison to both industrial production (a measure of the economy) and commodity prices. When the economy and commodities are growing at greater rates than money supply, Milton interprets this as money being drained from the markets to the real economy and commodities.

- Milton mentioned companies investing for growth versus buying back their own stock as an example.

- This April, money supply growth slowed relative to these indicators, which is one of the indicators that has him becoming more bearish on the markets.

- Going back to 1960, this indicator can be seen before approximately 80% of 10%+ markets drops and some greater bear markets.

- When the pandemic began, there was a surge in the money supply but a contraction in industrial production and commodities, which was very bullish for the markets.

Milton’s bearish tone is not yet making the case the great bull market is over- but rather he is looking for the type of 10% pullback before he would turn more long again. The chart below shows illustrates the relationship between the S&P 500 performance and liquidity growth, courtesy of Ned Davis Research.

Is inflation temporary or permanent?

Milton discussed a number of indicators that suggest inflation has been with us for some time even though the Federal Reserve says we’ve struggled to reach their 2% target over the past few years. The statistics below are for the last 20 years:

- Hospital care: 5.4% per year

- Education, books and supplies: 4.5% per year

- Tuition: 4.2% per year

- Cable and satellite TV: 3.2% per year

- Restaurants: 2.9% per year

- Electrical utilities: 2.6% per year

- CPI: 2.14% per year

Milton wants to know why the Fed is so concerned about not hitting inflation targets. He thinks it is a mistake to consider 2% inflation as a good concept, and prefers stable money and 0% inflation.

Review of 2020 buy signals

While Milton is currently positioned net short the market, he did not want to give the impression he is a perma-bear. He reviewed all his strong buy signal work from last September, October and November, which had optimistic outlooks for the market and proved quite accurate.

Milton has a very interesting approach to the markets, and this conversation is worth a listen.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.