Equities for Income

Barron’s recently published a cover story titled “Yes, You Can Retire on Dividends. 10 Stocks to Build an Income Stream for the Long Haul.”

We know the theory of living off dividends in retirement makes some total-return-focused investors uneasy. But as we wrote in a recent post, and as can be inferred from this Barron’s cover story, it is impossible to deny that dividends—and dividend growth—matter to a large and growing group of retired investors.

Building a Diversified Portfolio

What may be most surprising to investors less familiar with dividend-focused portfolios is that you can achieve good sector diversification—particularly in large caps—when targeting cash dividends.

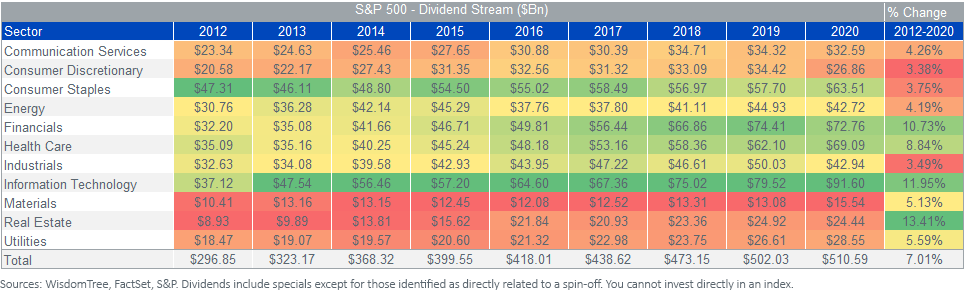

In the below table, we can see that the Dividend Stream® of the S&P 500 over the past nine years has been relatively stable from a sector distribution perspective.

A few notable trends:

- Consumer Staples dropped from the top dividend sector to only the fourth largest

- Financials improved from the fifth to the second largest

- Information Technology emerged as the largest dividend sector

Two of the high-yield sectors that are often considered “bond proxies”—Real Estate and Utilities—are only the tenth and eighth largest.

While there is greater risk assumed from a company’s dividend compared to interest income, 2020 offered a remarkable example of the resilience of cash dividends from large-cap U.S. companies.

For all the economic uncertainty, S&P 500 dividends still grew by just under 2%. Over the eight years between 2012 and 2020, S&P 500 dividends grew a healthy 7% annualized.

Sector Dividend Stream

Growing Income Stream

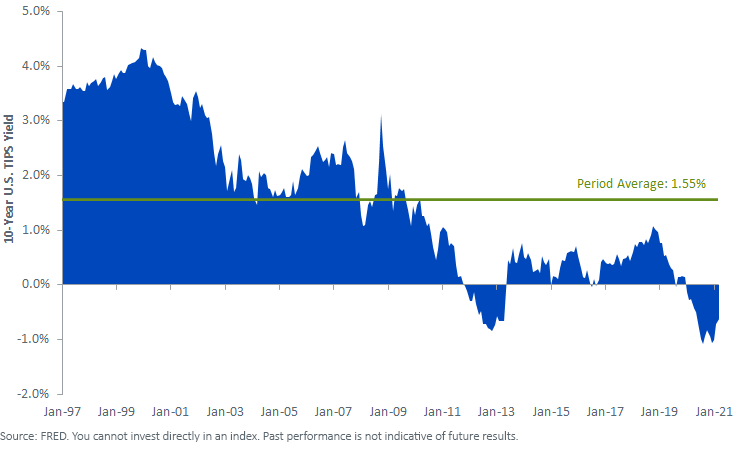

Inflation uncertainty has been lurking for several months. The economy is reopening at the same time as stimulus checks have been sent out, plus talk of trillions in infrastructure spending. All these factors point toward an economy heating up.

While the Federal Reserve is portraying calm on inflation concerns, investors seem to be a bit more skittish.

As a hedge against inflation, investors have been piling into negative-yielding inflation-protected Treasuries.

10-Year U.S. TIPS Yields (1/31/1997–3/31/2021)

But for investors with a greater risk tolerance and/or longer time horizons, equity income may be a more attractive inflation hedge.

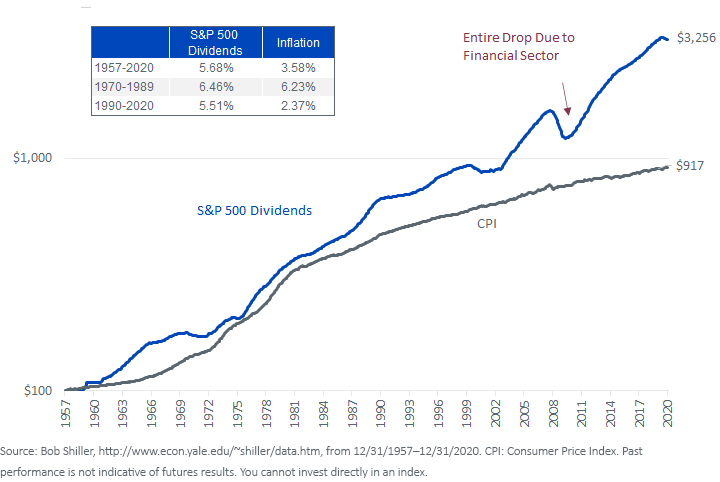

Since 1957, dividends have grown by an average of 5.7% per year—more than 2% above the rate of inflation. This was true during high-inflation periods (the ’70s and ’80s), when inflation averaged more than 6%. It’s also been true during low-inflation periods, such as the last three decades.

Inflation and Dividends

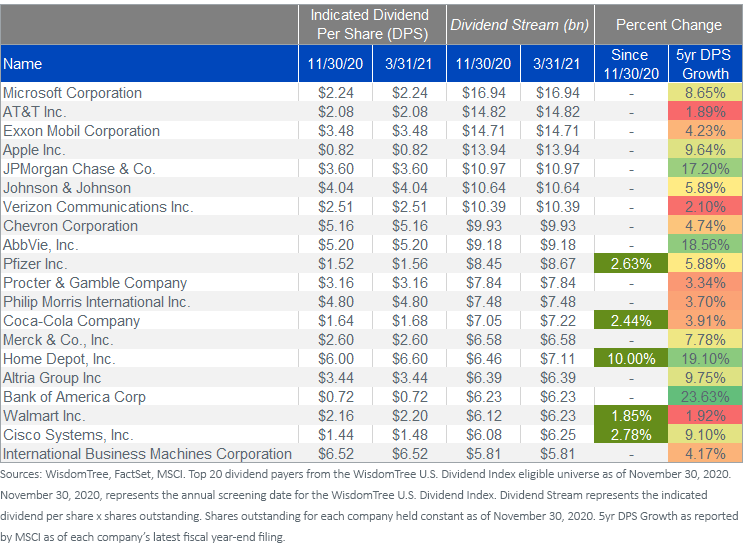

At an individual company level, the below table shows the dividend per share of the 20 largest U.S. dividend payers. Seventeen out of 20 of these companies have had annualized dividend growth greater than 3% over the past five years, well ahead of the Fed’s 2% average inflation target. Several have even grown greater than 10% annualized.

Top 20 U.S. Dividend Payers

WisdomTree Dividend Solutions

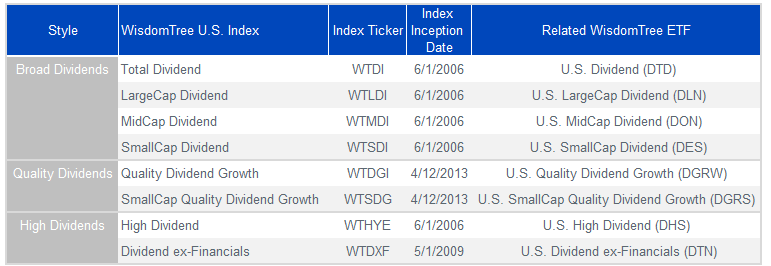

WisdomTree has eight domestic dividend Indexes representing different market caps (total market, large cap, mid-cap, small cap) and styles (quality or high dividends).

WisdomTree U.S. Dividend Indexes

For definitions of Indexes in the table, please visit our glossary.

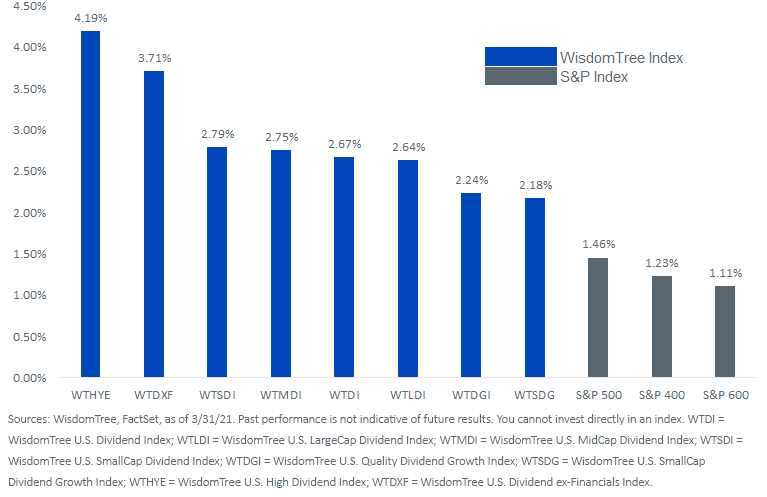

For investors seeking alternative sources of income to fixed income, consider the equity income potential from broadly diversified baskets of U.S. dividend payers.

While the market cap-weighted S&P 500 is now yielding just under 1.5%, WisdomTree’s total market dividend Index—the WisdomTree U.S. Dividend Index (WTDI)—yields 2.7%. For investors with higher income needs, the WisdomTree U.S. High Dividend Index (WTHYE) yields greater than 4%.

Indicated Dividend Yield

For more timely information on U.S. dividends, check out our regularly updated dividend monitor on our website.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.