Bitcoin for Investors in Three Ways

Everyone has a bitcoin take these days.

It’s “going to the moon.”

It’s “digital gold.”

It’s “magic internet money.”

It’s a “fraud.”

A quick Google search will yield a lot of these results—believe us, it is very easy to go down rabbit holes on the topic.

We are not going to take you through the whole debate, but rather lay out a clear and simple framework for how you may want to think about this new asset class.

In summary, we believe bitcoin is an investible asset with a few clear investment theses.

So, what is Bitcoin/bitcoin? Bitcoin (capital B) is a ledger of transactions maintained by a peer-to-peer network. The ledger is governed by a consensus protocol, without the need for any centralized authority. And bitcoin is the currency unit of that network—the asset we’re analyzing here. Without getting too technical, the method of transferring bitcoin from one person to another relies on cryptography—which is where the term “cryptocurrency” (or “crypto”) derives from. However, even the foregoing description provides an unsatisfying answer for investors.

So, what is bitcoin to investors? It is a decentralized, censorship-resistant, scarce and structurally deflationary asset.

Some crypto-friendly pundits will stop there and tell you to move all your money into bitcoin. I think we all know that advice simply doesn’t work for professionals. But there may be sound reasons to add bitcoin to your portfolio.

We see three fundamental investment theses for bitcoin.

1. Scarcity and out of governments’ and central banks’ control

We could call this the “gold” case. Gold has a long and remarkable history as a store of value and hard money currency for human civilizations. We can point to several characteristics for why this is, such as scarcity, decentralization, fungibility and divisibility. Bitcoin shares these traits. There are additional benefits with bitcoin in this category, but also additional risks. These differing risks include both the relatively straightforward – such as bitcoin’s incredible volatility and its lack of operating history – and the complex – such as potential changes in the Bitcoin protocol and the threat of a 51% attack. We will continue to discuss these risks in future publications.

In our view, gold is not going anywhere anytime soon. With thousands of years of human history behind it, gold should retain an important role in the global financial system.

But we see opportunity for bitcoin to satisfy many investors’ desires for another gold-like asset. This investment thesis particularly resonates, as global money supply skyrocketed with the government responses to COVID-19. If the purchasing power of fiat currencies drops with this increased money supply, the purchasing power of both gold and bitcoin could increase substantially.

This is also one reason why WisdomTree expects that more commodity-oriented strategies will include bitcoin or exposure to bitcoin (e.g., via bitcoin futures) in the future as regulation opens the door for it.

2. Potential for exponential growth

The strong historical returns of bitcoin demonstrate exponential growth. Of course, bitcoin has had incredible volatility on its way to those returns. This volatility, however, may be symptomatic of assets where different paths create wildly different outcomes.

The exponential nature of the payoff rests on future adoption of bitcoin. While its use has risen among institutions and the retail investor segment, we think we are still in the early innings. Bitcoins are held by a smaller fraction of the global population than other assets. Bitcoin technology is rapidly developing. Numerous financial institutions and consumer-facing financial technology (fintech) companies are incorporating bitcoin into their services. And given the declining new supply of bitcoins that becomes available—and, according to the existing Bitcoin protocol, a fixed final number of 21 million bitcoins that ultimately will be in circulation—rising demand creates potential for very strong price increases.

Another way to think about this thesis—the future is unpredictable. Based on its known characteristics and growth rate, it certainly seems possible that bitcoin could be an important part of the financial system in the future. With the potential for bitcoin to achieve this sort of adoption and high returns, the risk-reward calculus may justify an allocation today—even a small one.

3. Low correlation to other asset classes

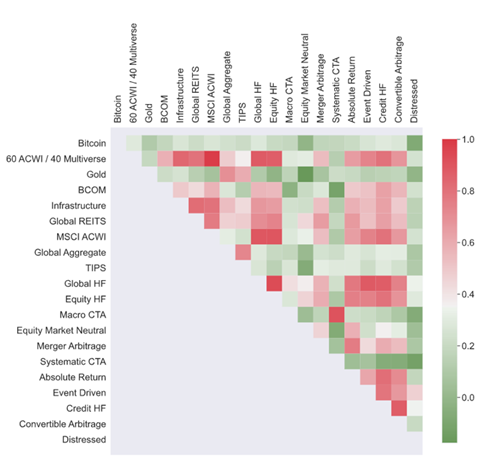

Finally, bitcoin has historically demonstrated a very low correlation to other asset classes.

The chart below demonstrates the historical correlation for an approximately seven-year period. While we do not have a very long history with the asset, we believe this low correlation can persist given the differing investment theses versus stocks and bonds.

Given the low correlation, a relatively small allocation to bitcoin can improve the risk-return profile of a portfolio. The more bitcoin that is used in institutional portfolios, however, the more its correlation with other popular asset classes will rise in overall risk-on, risk-off type sentiment. We started to see some of this behavior in the March 2020 stock market decline, where the price of bitcoin declined as well.

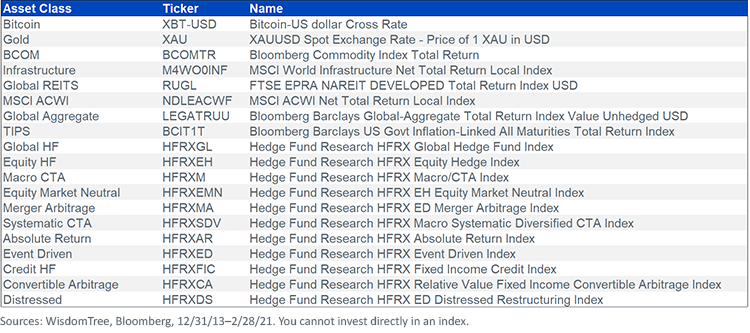

Asset class name is represented by the following Indexes:

Please see the glossary for more definitions of Indexes.

So, what is the optimal allocation?

Similar to any asset allocation, that answer will depend on different individual circumstances, but bitcoin can be worth allocating to. Deciding how best to implement an allocation is a challenge.

In future publications, we will dig in further on this question and suggest some methods that might make sense.

Two important additional notes:

First, we are only talking about bitcoin here, not other cryptocurrencies. The use cases and investment propositions (or lack thereof) for different cryptocurrencies vary widely.

Second, with any asset, the price at which you buy matters. Without well-tested fundamental valuation metrics, it is hard to evaluate current price levels in bitcoin. The same could be said for gold, although with bitcoin, the volatility raises the stakes on this question.

Again, we will not have all the answers, but we hope our commentary will serve as a helpful guide as you evaluate this developing asset class going forward.

Important Risks Related to this Article

Please note WisdomTree Asset Management, Inc. does not offer any bitcoin products.

This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Unless expressly stated otherwise, the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

Will Peck serves as Head of Digital Assets. In this role, he oversees WisdomTree’s digital asset, crypto and blockchain initiatives. These initiatives include crypto asset management products, tokenization and WisdomTree’s digital wallet offering, WisdomTree Prime. Previously, he served as Head of Strategy and Emerging Technologies for WisdomTree. Prior to WisdomTree, he worked in investment banking for Bank of America Merrill Lynch covering a range of financial services companies. Will serves on the Board of Directors of Securrency, Inc., a technology company focused on blockchain-based financial services infrastructure. He graduated cum laude from Harvard University.