2020: A Year for Storytellers

The backbone of any investment is a good story.

Even quant investors rely on stories—stories of efficient markets where riskier stocks should outperform less risky stocks or where behavioral biases lead investors to systematically undervalue low multiple stocks.

The term “story stock” is commonly attributed to growth stocks—often in technology and biotech—that are on the cutting edge of innovation but have negative earnings today.

2020 was a historic year for the outperformance of story stocks.

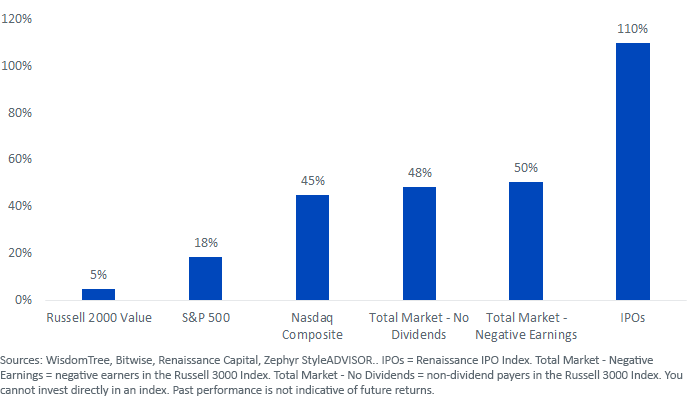

The Russell 2000 Value Index is heavily exposed to regional banks and small-cap industrial businesses—in many ways, the opposite of story stocks. This Index was up just 5% in 2020, severely lagging stocks with negative earnings (up 50%) and recent initial public offerings (IPOs) (up 110%).

2020 Index Performance

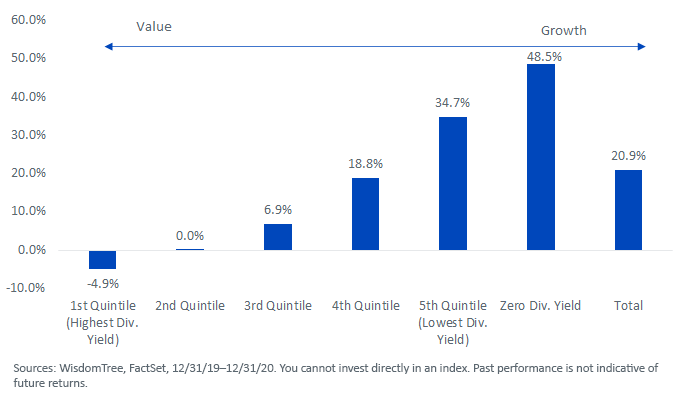

Another way of illustrating this trend: The chart below dissects the Russell 3000 Index constituents into dividend yield quintiles. There was a clear pattern of investors favoring low-yielding or non-dividend-paying companies over the more value-titled high-dividend payers.

Russell 3000 Index Performance

Dividend Yield Quintiles

Let’s make two simplifying statements to explain in part why these story stocks took off in 2020:

- Risk-free rates plummeted from 1.91% at the start of 2020 to as low as .51%

- After the initial dramatic dive in risk assets in the spring, investors began to look beyond the COVID-19 pandemic to a faster-than-anticipated return to trend GDP

These statements tell us that the economy should recover in a relatively short period, and interest rates appear to be accommodative for the foreseeable future—a combination that should significantly lower the cost of capital for most businesses.

Growth stocks generally benefit more from this reduced cost of capital compared to value stocks. The reason is that more value from growth stocks comes from cash flows further out in the future, making them more sensitive to fluctuations in discount rates.

Value for Rising Rates

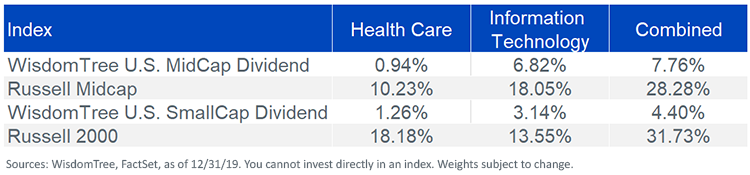

WisdomTree’s mid- and small-cap dividend strategies had effectively no exposure to 2020’s skyrocketing story stocks.

Mid- and small-cap Health Care and Information Technology companies were each up more than 35% in the Russell benchmarks. Most of these companies are unprofitable, and even fewer of them pay a dividend.

Sector Weights

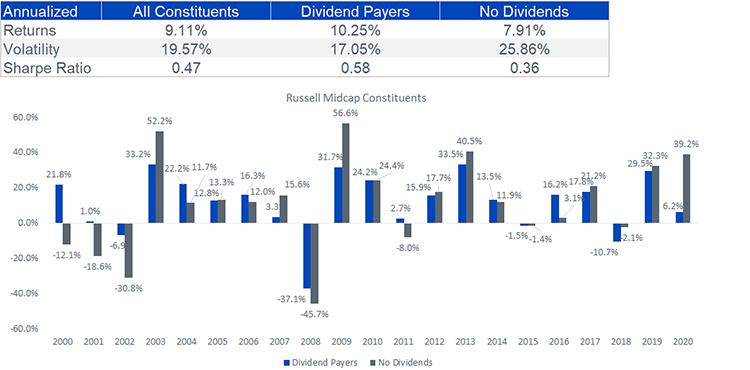

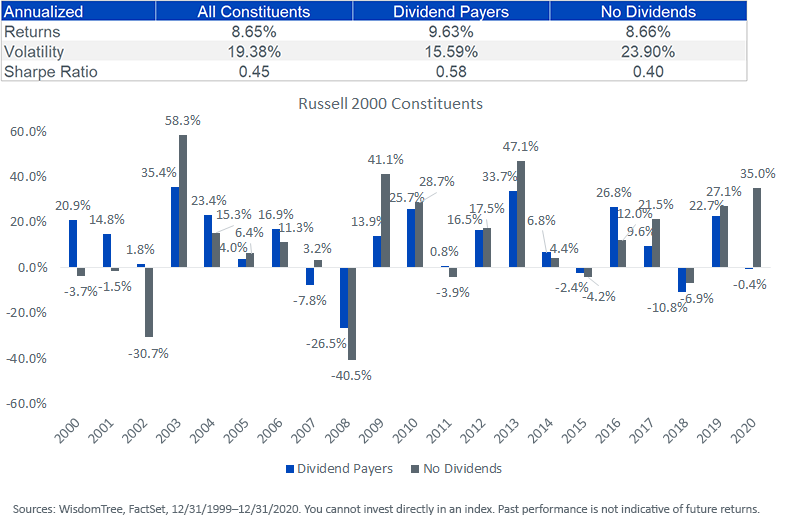

Over the long run, we have the data to support that mid- and small-cap dividend payers tend to outperform non-dividend payers and tend to do so with significantly less volatility.

Following a year where non-dividend payers outperformed dividend payers by more than 30% in both markets—the widest margin in the past two decades—investors may want to consider that the interest rate environment that was a tailwind to growth stocks in 2020 is unlikely to reoccur in 2021, and it may become a headwind should rates continue to rise.

Russell Midcap Index

Russell 2000 Index

For definitions of indexes in the charts please visit our glossary.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.