A Post-Election Economic & Market Outlook in 10 Charts or Less

All aboard ha ha ha ha ha

Ay, ay, ay, ay, ay, ay, ay

Crazy, but that’s how it goes

Millions of people living as foes

Maybe it’s not too late

To learn how to love

And forget how to hate

Mental wounds not healing

Life’s a bitter shame

I’m going off the rails on a crazy train

I’m going off the rails on a crazy train

(From “Crazy Train” by Ozzy Osbourne, 1987)

OK, so the election is sort of behind us—a great deal rests on the outcome of the dual Senate runoff elections in Georgia in early January. If the Democrats win both of those seats, they will control the presidency and both houses of Congress, and policy and legislative decisions going forward may take a very different turn than if there is a “divided government.”

In the meantime, whatever the outcome, Americans will have to deal with the current and expected economic and market regimes. Over the past few months, we’ve published a Market Insights paper, a Mid-Year Outlook and a follow-up asset allocation blog post that summarized our views prior to the election.

But where do we see things going from here now that the election is (for the most part) behind us? In other words, regardless of the political landscape, what will the next Administration and Congress be handed from an economic and market perspective?

This is a blog post and not a position paper, so we will be succinct and focus on what we believe are the five primary economic and market signals that may provide perspective on where we go from here: GDP growth, earnings, interest rates, inflation and central bank policy. The caveats to these signals, of course, are the future course of the coronavirus pandemic and corresponding federal, state and local responses, and the outcome of the ongoing fiscal stimulus negotiations.

But those are “known unknowns.” Let’s focus on what we can currently observe.

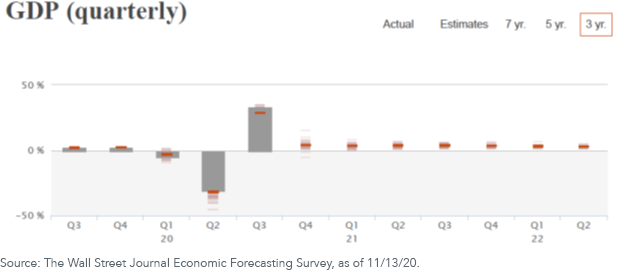

GDP Growth

The consensus forecast from The Wall Street Journal calls for a continuation of the current economic recovery, with anticipated year-over-year growth rates of roughly 3%–3.5% through 2021 and into 2022:

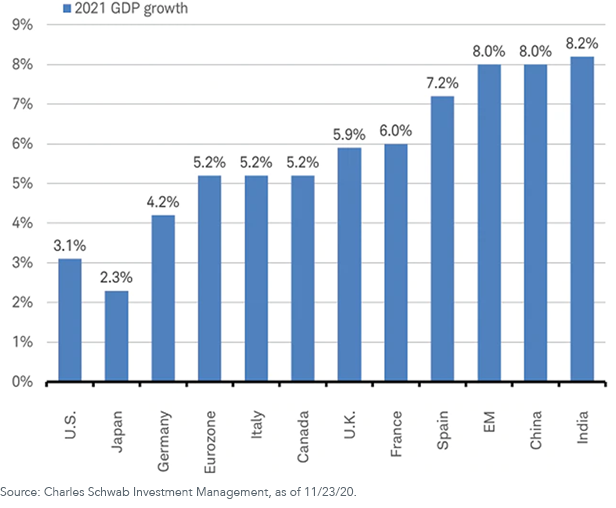

The outlook is even more positive for most non-U.S. economies:

Translation: A generally positive environment for “risk on” assets.

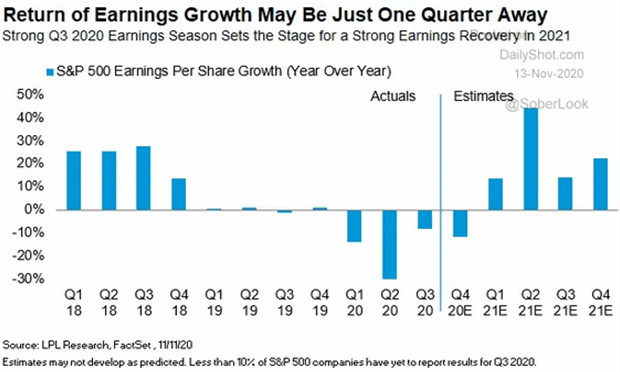

Earnings

After the horrific (but priced in) second quarter earnings numbers, the consensus is for steady improvement through 2021:

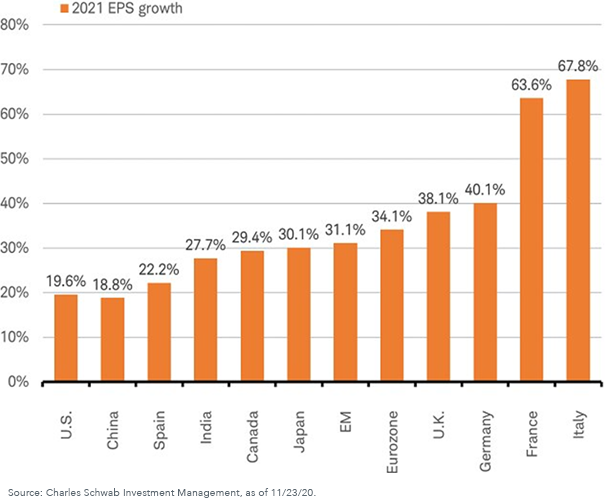

Again, the outlook for earnings outside the U.S. is even stronger (based, in part, on the fact that the U.S. came out of the initial pandemic-induced recession faster because of higher stimulus levels):

Translation: A generally positive environment for “risk on” assets.

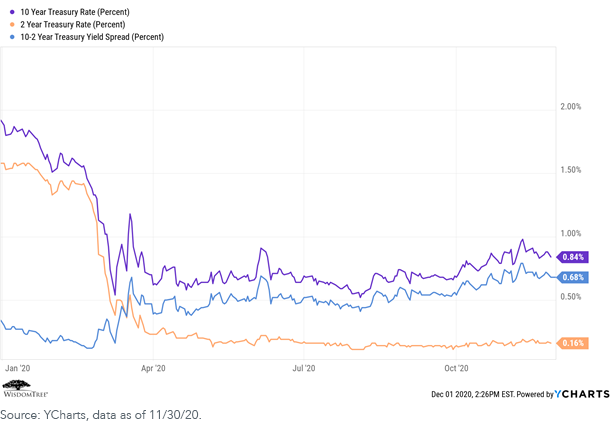

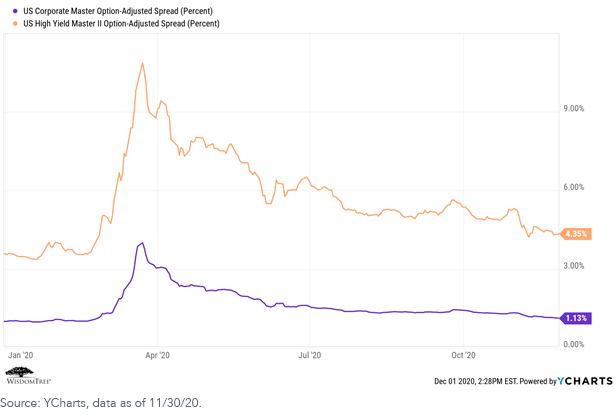

Interest Rates and Spreads

We maintain our outlook that (a) rates may grind higher from here as the economy improves and inflation picks up marginally, (b) the yield curve will continue to steepen, (c) we generally remain in a “lower for longer” rate environment and (d) credit spreads have retraced most of their “blow out” in the early days of the pandemic, but still have potential to move lower:

Translation: We maintain our positioning of being under-weight duration and over-weight credit, with a focus on quality security selection, especially in high yield.

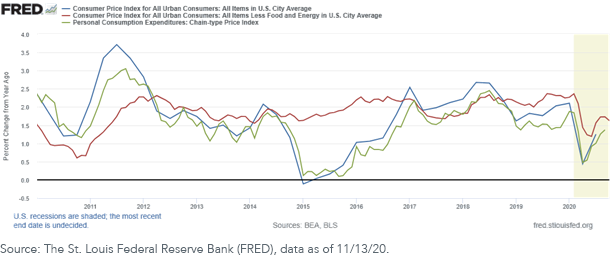

Inflation

There are pockets of higher inflation in specific sectors or industries (food, automobiles, suburban home prices, etc.), but the overall inflation picture remains largely benign (remember that the historical Fed “target” rate for inflation was ~2%):

Translation: A generally positive environment for “risk on” assets.

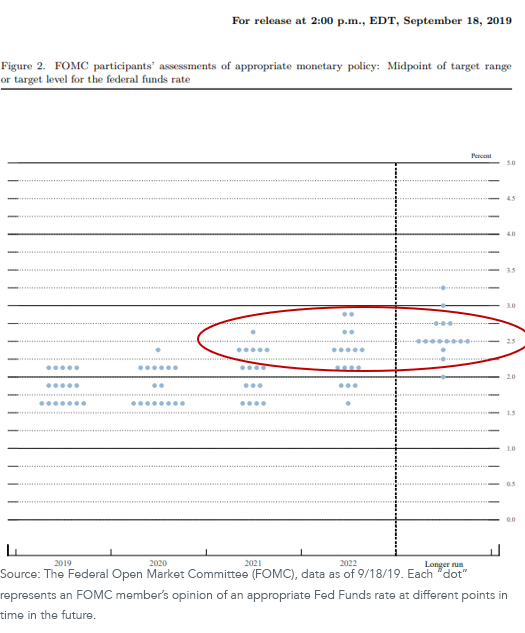

Central Bank Policy

The Fed consistently has signaled that it will remain “accommodative” into the foreseeable future, and it is willing to let inflation “run hot” if it means allowing the economy to continue to recover:

Translation: A generally positive environment for “risk on” assets.

Conclusion

When focusing on what we believe are the primary market “signals,” we conclude that 2021 will enjoy a generally positive economic and market environment. Our caveats to that conclusion are (1) uncertainly regarding the coronavirus and governmental response, (2) the outcome of the Georgia Senate races, (3) the outcome of fiscal stimulus negotiations, (4) current valuations, which in many areas are very high by historical standards and therefore perhaps unsustainable, regardless of the market environment, and (5) currently unforeseeable “unknown unknowns” (e.g., U.S.-China relations, Iran, etc.).

So, while we are cautiously optimistic in our outlook for 2021, we continue to recommend focusing on a longer time horizon and the construction of “all-weather” portfolios, diversified at both the asset class and risk factor levels, so that your portfolios can handle whatever may come their way…even an unforeseen “crazy train.”