For What It's Worth

There’s something happenin’ here

what it is ain’t exactly clear

there’s a man with a gun over there

tellin’ me I got to beware

I think it’s time we stop, children

what’s that sound

everybody look what’s goin’ down

There’s battle lines being drawn

nobody’s right if everybody’s wrong

young people speakin’ their minds

getting so much resistance from behind…

What a field day for the heat

a thousand people in the street

singing songs and carrying signs

mostly say hurray for our side…

Paranoia strikes deep

into your life it will creep

it starts when you’re always afraid

step out of line the man come and take you away

(I think) It’s time we stop,

hey what’s that sound

everybody look what’s goin’ down

(From “For What It’s Worth” by Buffalo Springfield, 1966)

This song was released in 1966, just as the tumultuous late ’60s were revving up—hippies, “flower power,” anti-war protests (some peaceful, some not), riots, assassinations, the destruction of cities and domestic terrorism.

But close your eyes, maybe rearrange a lyric or two, and the song would be equally applicable to the latter stages of 2020.

What remains undoubtedly true is that “nobody’s right if everybody’s wrong.” 2020 has been an annus horribilus, indeed.

As Mark Twain frequently is credited with saying, “History doesn’t repeat itself, but it often rhymes.”

We currently are in the throes of a raucous presidential election, an ongoing COVID-19 pandemic and mass chaos and mayhem in many of our cities and towns. It is a time of uncertainty…at least outside the investment markets, which seem to be blissfully sailing along on the winds of an ongoing economic recovery, an expectation of further massive fiscal stimulus and seemingly perpetual easy monetary policy.

As investors, we have little to no control over what happens in either the investment markets or “the real world.” All we can seek to control is how we position our portfolios to accommodate whatever comes our way.

In late July, we published our Mid-Year Asset Allocation Outlook. Our views from then can be summarized as follows:

- Stocks over bonds

- U.S. and emerging markets (EM) over developed international Europe, Australia, Far East (EAFE)

- Under-weight in duration and over-weight in credit risk (the spread over Treasuries charged to a given company based on its perceived default risk) with a focus on quality (that is, on companies with stronger balance sheets, earnings and cash flows)

- Maintain appropriate asset class and risk factor diversification

As we move into November, where do we currently stand on these four points?

1. Stocks over Bonds

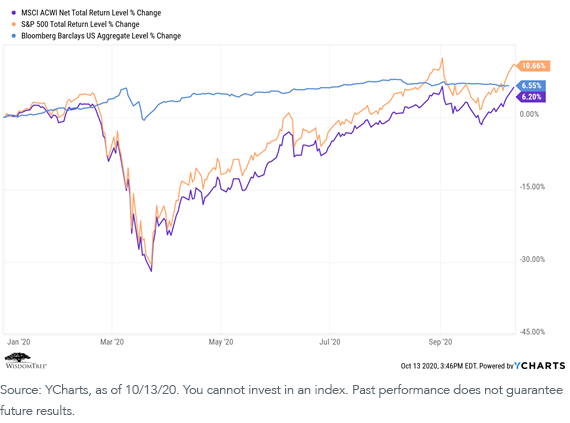

The following chart compares how stocks and bonds have performed over the course of 2020:

For definitions of the Indexes in the chart, please visit our glossary.

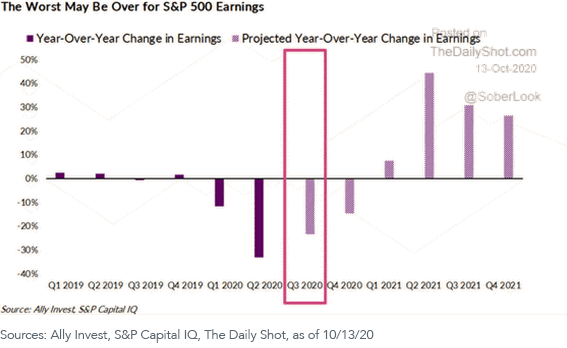

We see that bonds (as represented by the Bloomberg Barclays Aggregate index) dramatically outperformed during the worst of the downturn, but that stocks (as represented by the MSCI ACWI Index (total world market) and the S&P 500 Index (large-cap U.S. stocks) essentially have caught up to or passed the total return performance of bonds. Given the current level of rates and spreads and overall market conditions, we believe this outperformance will continue, especially now that the worst of the earnings information appears to be behind us:

2. U.S. and EM over Developed International (EAFE)

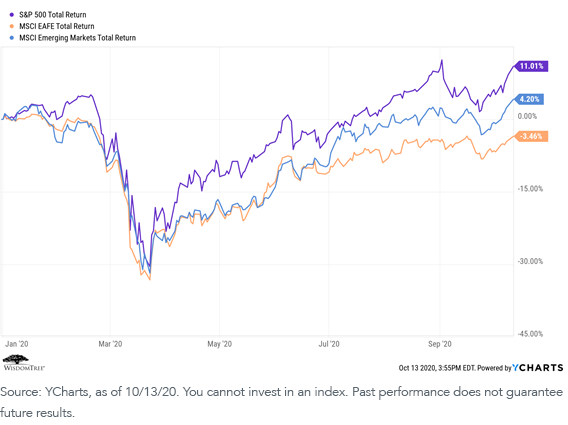

The following chart illustrates the YTD comparative performance of U.S. versus non-U.S. stocks:

As we expected, the U.S. (as represented by the S&P 500 Index) has outperformed non-U.S. (as represented by the MSCI EAFE Index), and emerging markets (as represented by the MSCI Emerging Markets Index) have outperformed the developed international markets (as represented by the MSCI EAFE Index). We believe the dollar may continue to slide generally downward (weaker), providing a tailwind to non-U.S. risk assets, and valuations look slightly more attractive outside the U.S. (especially in EM, over a longer time horizon), but we think the underlying fundamentals of the U.S. market and our more rapid economic recovery will keep the U.S. solidly out in front over the medium term.

3. Under-Weight Duration and Over-Weight Credit with a Focus on Quality

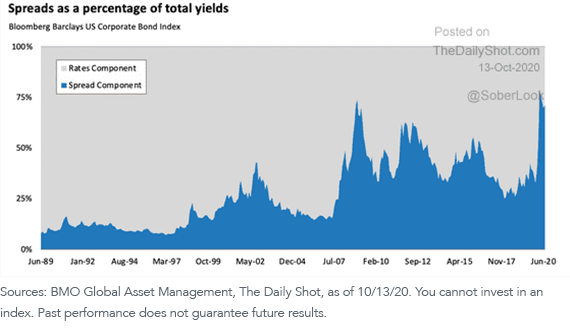

A couple of interesting charts illustrate while we still maintain this view. First is an illustration of how much of the corporate bond market’s yield currently comes from spreads versus underlying interest rates:

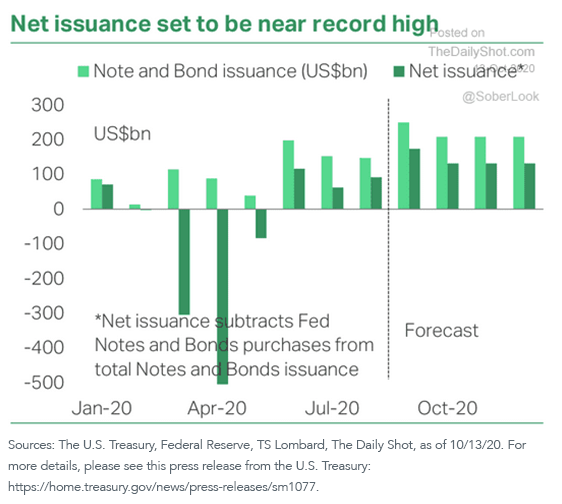

Given the low level of rates and an anticipation of further fiscal stimulus, we think the likely direction of rates from here is to “grind higher,” corporate spreads to “grind tighter” and the yield curve to steepen. With the 10-year Treasury currently trading at around 70–80 basis points (bps), even a small increase in rates would have a significant negative impact. This is what gives us pause about taking on excessive duration risk. In addition, there is a heavy load of new issuance in the pipeline:

The presence of the Federal Reserve within the corporate bond market continues to provide a strong technical backdrop, but the uncertainty of the virus’s evolution and the political response to it makes credit selection paramount in the coming months. There will be winners and losers, and focusing on issuers with positive cash flow profiles and the capacity to secure additional funding (relative to their peers) could serve investors well.

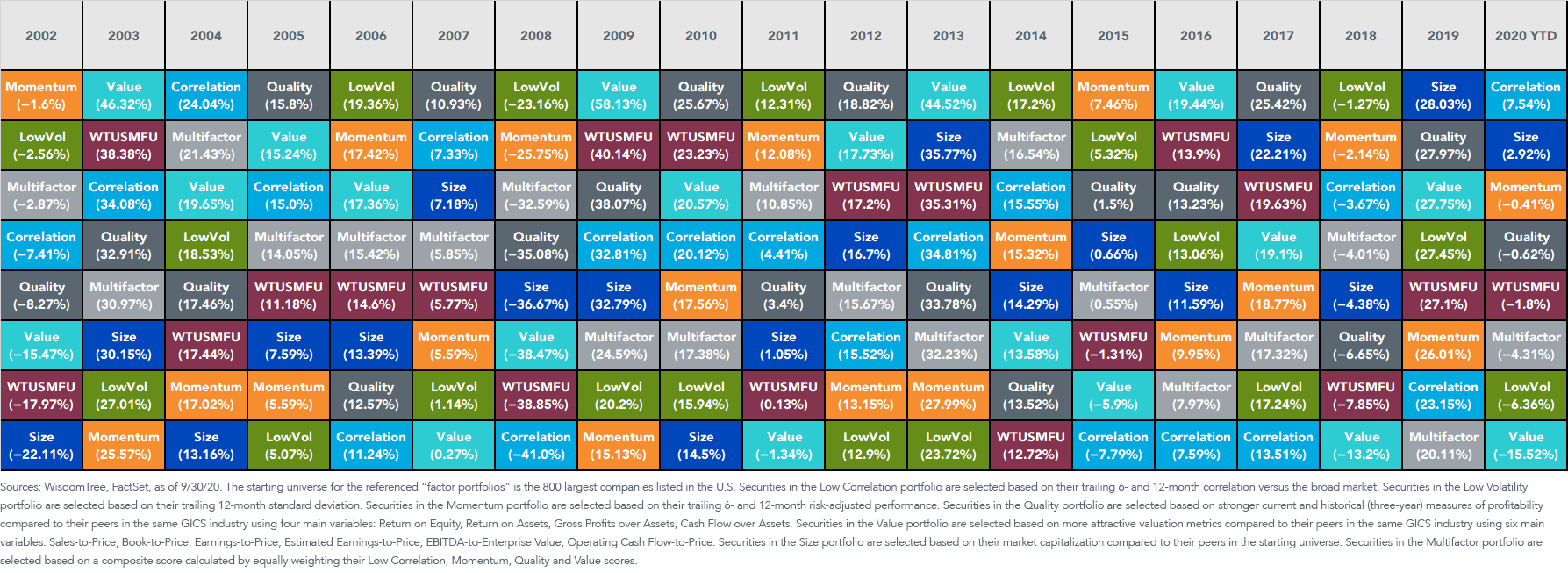

4. Maintain Both Asset Class and Risk Factor Diversification

We’ve written before about the importance of risk factor diversification. A quick glance at the WisdomTree “risk factor performance quilt” through the end of September illustrates this point nicely:

In summary, while political and social events have created an environment of high uncertainty, from an investment perspective we remain comfortable with our mid-year allocation recommendations.

If you agree with us, we have a variety of actionable ideas that may be of interest. For financial professionals to view, we also offer an array of Model Portfolios that may fit your longer-term outlooks or complement existing portfolios you are managing.

Right now, there seems to be little question that, “There’s something happenin’ here. What it is ain’t exactly clear.” But if you build your portfolios to weather all storms, you may be less inclined to be “always afraid.”