Yes, It Does Matter

I’m little, but I’m loud

I’m poor, but I’m proud

I’m countrified and I don’t care who knows it

I’m like a banty rooster

In a big, red rooster crowd

I’m puny, short and little, but I’m loud

I’m puny, short and little, but I’m loud…

(From “I’m Little But I’m Loud” by “Little” Jimmy Dickens and Boudleaux Bryant, 1969, covered by Martina McBride, 1997)

In WisdomTree parlance, “size” refers to small-cap stocks, both domestically and internationally. As most advisors probably know, size was identified in the original iconic French & Fama researchas a “risk factor” that could be used to identify promising investment opportunities over reasonable time horizons. The other two original identified factors were value and the excess performance of stocks over the risk-free rate.1

This research was instrumental in the creation of WisdomTree, and many of our Indexes and accompanying ETFs have size and/or value tilts built into them. In a recent blog post we focused on the value factor; here we will focus on size.

How has the size factor performed over time? The short answer is reasonably well, until the last several years when large-cap stocks (led by the mega-cap tech stocks) dominated performance:

But notice something interesting about the above chart—going back to the 1980–1982 recession (U.S. recessions are marked by the grey bars), small-cap stocks (the Russell 2000 Index) have beaten large-cap stocks (the Russell 1000 Index) in every economic recovery period coming out of those recessions.

We see this seemingly happening again as we slowly pull ourselves out of the pandemic-induced recession of the first two quarters of 2020. Here is the same graph over only the past four months (i.e., the beginning of the third quarter):

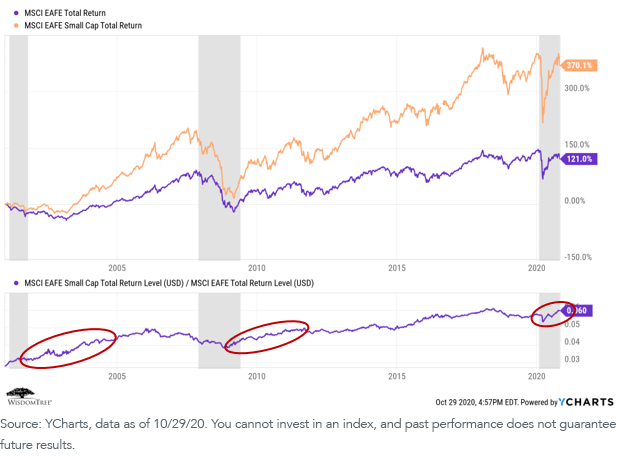

This is not simply a U.S. phenomenon. Here is a comparison of developed international large caps (the MSCI EAFE Index) versus small caps (the MSCI EAFE Small Cap Index) since 2000:

Not only have developed international small caps outperformed on an absolute return basis over a 15-year common investment period (a function, we believe, of it being a less efficient asset class and, therefore, offering a better opportunity to generate “alpha”), but they dramatically outperformed as we exited the 2000–2002, the 2008–2009 and the 2020 U.S. recessions (marked by the gray bars).

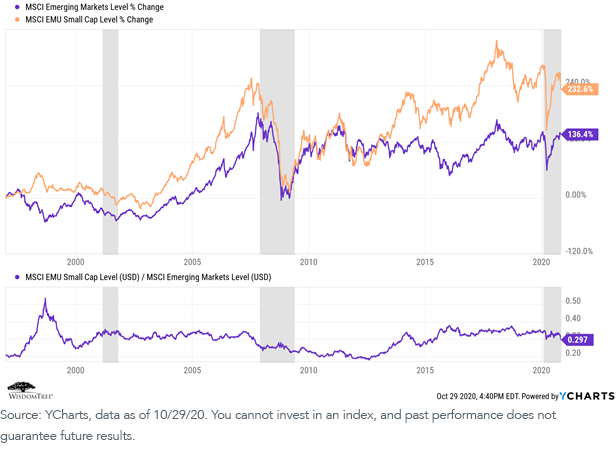

We see somewhat similar absolute return results if we compare emerging markets large-cap stocks (MSCI EM Index) to emerging markets small-cap stocks (MSCI EMU Small Cap Index):

There is less correlation between performance and economic recovery in the U.S. (the gray bars indicate U.S. recessions) because EM small-cap stocks generally are more dependent on economic conditions in their home countries—one of the reasons we like them as diversifiers in a global portfolio.

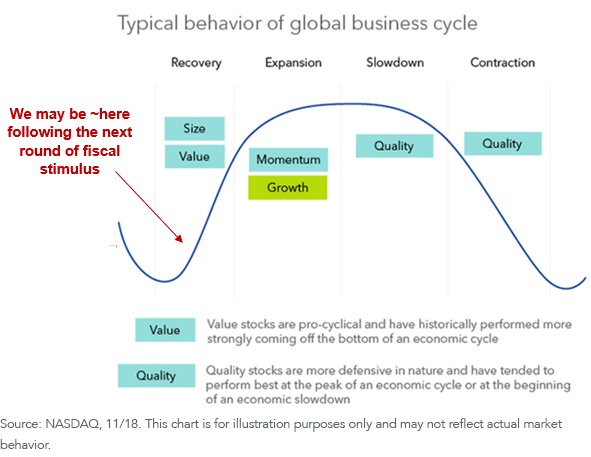

If advisors believe, as we do, that there will eventually be another round of massive fiscal stimulus in the U.S. (the size and shape still to be determined), then we may have the ability to “relaunch” an economic recovery. As we have illustrated in previous blog posts, this has historically been a positive market regime for small-cap (and value) stocks:

From valuation, market momentum and economic regime perspectives, we believe we might be entering a market phase when small-cap stocks make a long overdue comeback. If you agree, WisdomTree offers several domestic, international and emerging markets ETFs that employ disciplined and explicit size “screens” and tilts.

We also have a variety of ETFs that take on more “implicit” size tilts because they screen for factors such as earnings, dividends or quality—factors that frequently result in lowering the market cap size of the index that underlies a given ETF. Each of these strategies tends to perform differently under different economic and market regimes, and we encourage readers to visit our website to gather more specific information.

In addition, financial professionals can access a variety of our Model Portfolios by registering on the WisdomTree website. Many of these models employ an explicit small-cap tilt in their asset allocations and portfolio construction (security selection).

It may be time, once again, for small-cap stocks to start singing “I’m little, but I’m loud.”

1Later evolutions of this research added two additional risk factors—momentum and profitability. See, for example: https://www.sciencedirect.com/science/article/abs/pii/S0304405X14002323.