I'm Still Standing

And did you think this fool could never win

Well look at me, I'm coming back again

I got a taste of love in a simple way

And if you need to know while I'm still standing

You just fade away

Don't you know

I'm still standing better than I ever did

Looking like a true survivor, feeling like a little kid

And I'm still standing after all this time

Picking up the pieces of my life

Without you on my mind…

(From “I’m Still Standing,” by Elton John and Bernie Taupin, 1983)

We have asked the question before—whether or not it was time for value investing to come back—and we’ve also discussed different reasons that may explain its rather lengthy underperformance. As we await the final election results (which we may not know until early December), it seems an appropriate time to revisit this question. Is now the time that value comes back?

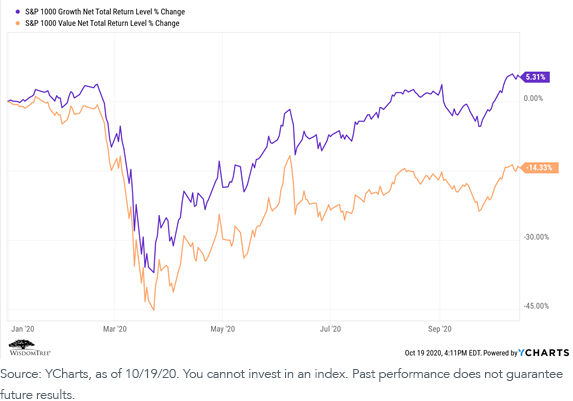

Let’s begin by reviewing YTD performance of growth versus value:

For definitions of indexes in the chart, please visit our glossary.

It is also important to remember that the growth index has been utterly dominated by a small handful of mega-cap tech stocks (e.g., Facebook, Amazon, Netflix, Alphabet [Google], Apple and Microsoft).

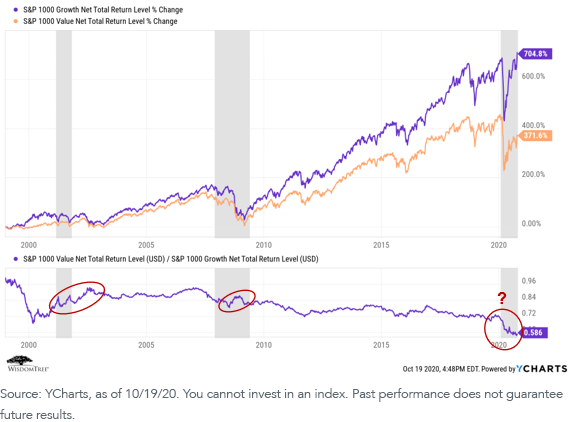

If we accept that the economy is slowly recovering (with uncertainty, given the “third-wave” spike in the number of new COVID-19 cases), and that the market is expecting an additional massive fiscal stimulus bill (regardless of the election outcome), then it is worth reviewing again how value stocks have historically performed relative to growth stocks during economic recoveries:

Historically, value stocks outperformed during periods of economic recovery (e.g., after the 2000 “tech bubble crash” and the 2008–2009 financial crisis), but we see dramatic underperformance in this most recent period of economic recovery. Again, the dominance of the mega-cap tech stocks in driving recent market performance cannot be overstated, and it distorts the seemingly gaping performance dispersion between growth and value stocks.

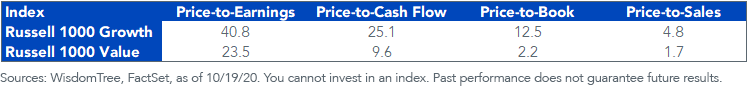

What about valuations? Compare the valuations of the Russell 1000 Growth Index to those of the Russell 1000 Value Index:

By almost any metric you choose, value stocks look dramatically more attractive than growth stocks from a fundamental valuation perspective. Remember, what you earn on an investment over the longer term is very much dependent on how much you pay for it today. Unless “this time it’s different” (which it almost never is), then normal market cyclicality suggests that value is due for a comeback.

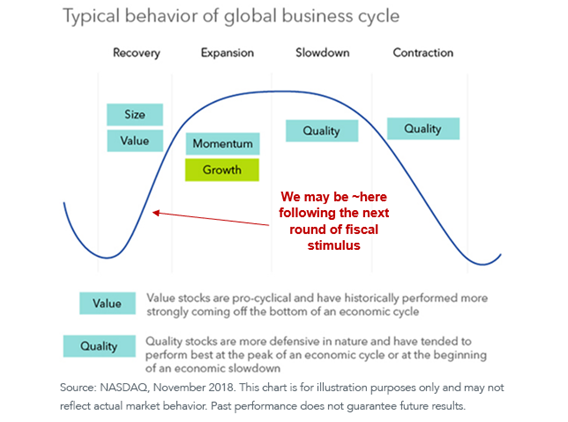

Finally, let’s revisit the economic regimes when value (historically) has done best:

For definitions of terms in the chart, please visit our glossary.

The details of any fiscal stimulus package will be very dependent on the election outcome. But regardless of the outcome, we do expect another round of massive fiscal stimulus, which should give a boost to the economic recovery, at least in the short term. We believe that the stimulus may reset the economic recovery stage back down to where we point to in the chart—historically, a good time for value.

Value may be set up for what we believe is a long-overdue comeback, and many of the WisdomTree product strategies and model portfolios are, in our opinion, well-positioned to capitalize on that value recovery.

Value investing may, once again, prove to be “still standing.”

Important Risks Related to this Article

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.