Investors Turn to ETFs During Market Stress

A common narrative is that this decade-long bull market was driven by passive exchange-traded fund (ETF) flows that pushed valuations of large-cap growth stocks higher. Some say a bear market revitalizes the case for mutual fund managers.

The argument goes like this: Mutual fund managers can hold cash (perhaps to meet redemptions), and this cash cushion might provide protection during market drawdowns. Faster-moving markets also could allow them to catch changing market trends if they are more nimble.

But is there evidence that times of volatility are good for mutual fund managers?

The last difficult year for the market was 2018, particularly during the fourth quarter when the S&P 500 declined 13%.

The SPIVA Scorecard produced by Standard & Poor’s looks at how mutual funds perform against passive indexes. Here are a few summary quotes from the 2018 Scorecard to assess whether or not volatility actually helped mutual funds1:

- “Amid the market volatility, 2018 was the fourth-worst year for U.S. equity managers since 2001; 68.83% of domestic equity funds lagged the S&P Composite 1500® during the one-year period ending Dec. 31, 2018."

- “For the ninth consecutive year, the majority (64.49%) of large-cap funds underperformed the S&P 500. The figures highlight that heightened market volatility does not necessarily result in better relative performance for active investing."

- “Similarly, small-cap equity managers found it more challenging to navigate 2018’s market environment compared with 2017’s rangebound market movements.”

Brutal.

While mutual fund managers believe volatility will shake faith in passive instruments, the evidence points to investors moving toward ETFs during tough periods.

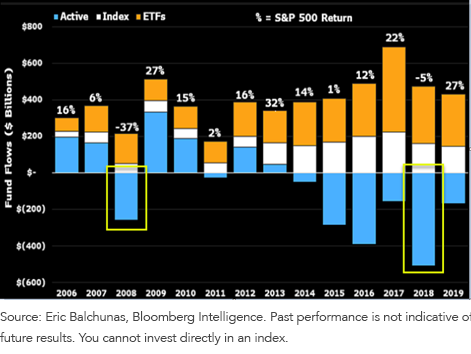

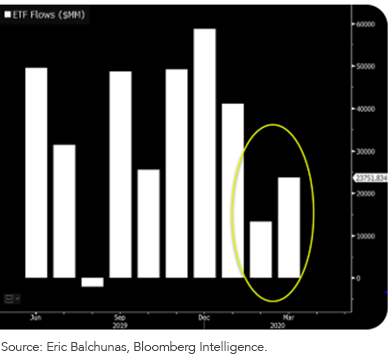

The two charts below are from ETF industry expert Eric Balchunas at Bloomberg Intelligence. Here’s what they show:

- In 2008, when the S&P 500 was down 37%, there was more than $200 billion in outflows from traditional mutual funds and a similar corresponding set of inflows to index funds and ETFs. This was the last major bear market, and investors embraced ETFs.

- During the 2018 sell-off, the outflows from mutual funds were even larger, and it was a positive inflow year for index funds and ETFs once again.

- In 2020, investors have again embraced ETFs during the volatile first quarter with more inflows. We’ll have to wait to see the flows from active mutual fund managers since there is less transparency into their activity.

Figure 1: Net Fund Flows into Different Investment Vehicles

Figure 2: Positive ETF Fund Flows over the Past Year into 2020

Why Do Investors Embrace ETFs during Market Downturns?

ETFs are efficient vehicles to get exposure to the market. Just as important, ETFs provide tax-efficient exposure to the market.

Down years are painful for all investors. But because active mutual funds have to sell long-held positions to meet redemptions, investors get a double whammy with capital gains distribution bills coming due from other investors selling their mutual fund shares. Those who continue to hold on are stuck with the tax bill.

ETFs, through the in-kind transfer of securities during the creation-redemption process, have more control over their tax lots and often don’t produce much, if any, capital gains. ETFs also trade on an exchange, and on average only about 10% of those shares that trade on an exchange require a creation or redemption (or trading within the fund). This means that the exchange listing is not only providing an extra avenue of liquidity but also reducing the frequency of turnover within the ETF funds, thereby reducing the likelihood of capital gains.

The ETF structure has proved to be resilient in times of crisis. It not only provides real-time pricing throughout the day, even for those asset classes that don’t have transparent pricing, it provides investors with a tax-efficient vehicle that has another source of liquidity when times get tough.

WisdomTree provides a suite of Modern Alpha® ETFs that focus on fundamentals and relative value opportunities in the market, which is what many turn to active mutual fund managers for. With embedded capital gains from long-held positions coming down because of the recent sell-off, now is a great time to review portfolios to see if there are opportunities to upgrade longer-held positions.

1Source: Aye M. Soe, Berlinda Liu and Hamish Preston, “SPIVA U.S. Scorecard,” S&P Dow Jones Indices, 3/11/19.

Important Risks Related to this Article

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided in this material are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.