Trust Your Brain Not Your Gut

Why wise investors are staying the course.

The combination of a global pandemic and volatile markets is creating understandable anxiety for investors. One day, the promise of new government action sends stocks soaring 10%; the next day, fresh panic sends them down even further. In these challenging times, what’s an investor to do?

Your brain probably knows the correct answer is: nothing. But your gut may be telling you to sell. And that reaction is understandable. As human beings, we can’t help but respond emotionally when large pieces of our retirement savings seem to disappear overnight.

It’s important to remember that the uncertainty and anxiety you’re feeling is normal. Then take a deep breath and read on for some wisdom about what the current stock market volatility means for you, and for your future.

Using History as a Guide

Smart investors know that when the stock market has taken a tumble in the past, it has always bounced back. And the more stocks fall, the greater the returns in years to come. Think of it this way: no recession lasts forever, so when stocks hit bottom, there’s no place to go but up.

Of course, we can’t know what the bottom is, and we don’t recommend trying to time the market. But we can look at past market drops and see what happened afterward.

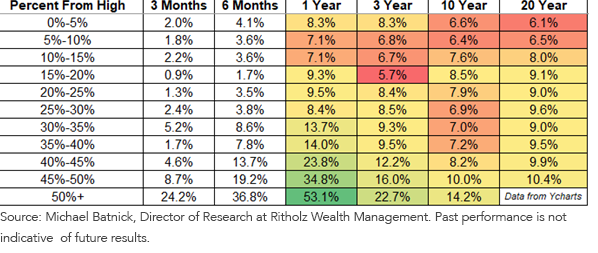

The chart below shows average annual returns from the S&P 500 since 1950, organized by how far stocks dropped from their high. In almost every case, once stocks lose 20% of their value, the long-term returns improve with every subsequent drop. For example, when stocks drop 30%–35% (a major, recession-level correction), the average one-year return after that drop is 13.7 percent.

Average Annual Returns of the S&P 500 since 1950

If you sell when stocks are falling, you won’t participate in those gains. Granted, it may take a few years to recoup your losses—but your nest egg investments are a long-term play.

Looking more closely at the longer-term performance of stocks vs. bonds, you can see that as time periods grow longer, stocks’ outperformance becomes more consistent.

Percent of Time Stocks Outperform Bonds/Bills

Stocks outperformed bonds and T-bills in a majority of 5-and 10-year periods, the overwhelming majority of 20-year periods and every 30-year period on record.

Stay Calm, Stay Invested

Market downturns happen, but they don’t last forever. We don’t know when the markets will bottom, but history shows us that stock markets have always bounced back over time for patient investors.

Seen in that light, a bear market is actually the best time to keep investing, because you can buy in to the future economy at a bargain price. It’s fine to acknowledge the pain in your stomach right now. But smart investors will listen to the voice in their brain and stay invested.