2020 Resolution: Strengthen Your Core Equity Allocation

In 2007 WisdomTree launched its U.S. Core Equity Index family of four earnings-weighted Indexes that challenged the market cap-weighting status quo.

To this day, the Core Equity Index family is constructed with the conviction that market capitalization does not provide the best estimate of a company’s fundamental value.

These Core Equity Indexes weight companies by their proportionate share of the Earnings Stream®—and each company’s weight is calculated based on the dollar amount of its earnings relative to the total earnings generated by Index constituents over the trailing 12 months.

In WisdomTree’s view, market cap weighting can leave investors overly exposed to areas of the market where fundamentals don’t justify prices. We believe that just as noisy share prices can provide a flawed measure of value, simply accepting a company’s reported earnings at face value can result in suboptimal allocations for investors.

Since its inception, our Core Equity Index family has weighted constituents by their core earnings, which adjust reported net income to arrive at a more relevant measure of company earnings from continuing, regular operations.

WisdomTree recently licensed core earnings data from New Constructs, a technology-driven fundamental data provider. New Constructs combines expertise from its accounting background with cutting-edge technology to parse through financial filing complexities in seeking to calculate a more accurate measure of profitability. The attributes of the New Constructs core earnings dataset were recently featured in a Harvard Business School and MIT Sloan paper.1

2019 Rebalance Results

Our U.S. Core Equity Index family includes the Total Market (WTEI), LargeCap (WTEPS), MidCap (WTMEI) and SmallCap (WTSEI) Indexes.

The Indexes rebalance every December according to a disciplined and consistent methodology.

We can credit several foundational tenets in the methodology for the group’s strong track record of outperformance.

Earnings Weighting & Relative Value Rebalancing

Weighting by earnings typically lowers the price-to-earnings ratio (P/E) of the index. It does this by removing the role that stock multiples play in determining a company’s value. This process is designed to reward companies that have generated more earnings growth than price appreciation with a larger weight in the index, and vice versa. In contrast, a market cap-weighted index assigns the largest weight to the company with the greatest price appreciation, without considering any fundamental growth.

Exclusion of Negative Earners

Eliminating unprofitable firms over the trailing 12 months typically lowers the P/E ratio and helps increase the quality of the index. This constraint is especially powerful in the small-cap segments of the market, where unprofitable firms tends to be most prevalent.

The results of the December 2019 rebalance demonstrate this well.

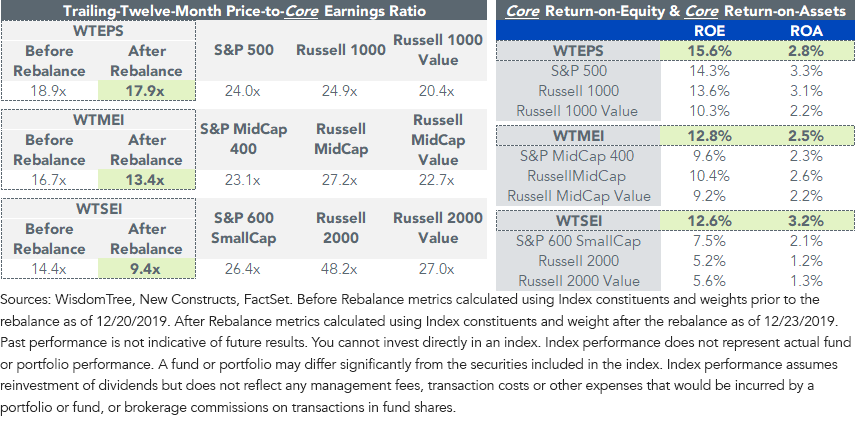

The P/E ratios decreased across our Core Equity Index family for the 13th consecutive year, and all Indexes are currently priced at significant discounts to their benchmarks (figure 1).

WisdomTree’s Core Indexes also exhibit high quality characteristics, with aggregate levels of Return on Equity (ROE) and Return on Assets (ROA) above or in line with the market capitalization weighted performance index benchmarks.

Figure 1: Valuations & Profitability

For definitions of Indexes in the chart, please visit our glossary.

We believe earnings weighting offers a compelling alternative to market capitalization weighting, and our U.S. Core Equity Indexes have the solid performance history to support our earnings-weighted approach.

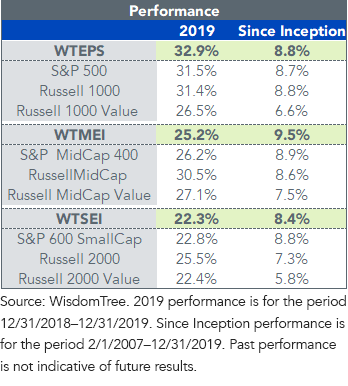

Since inception, our Indexes have delivered returns above or consistent with their market-cap weighted performance benchmarks (figure 2). Importantly, the Core Equity Index Family has amassed this track record over a period in which growth-style investing has generally outperformed value. Given our valuation-sensitive methodology, it is quite impressive that the returns of our Indexes have beaten or been on par with their market cap-weighted benchmarks.

Having just closed out a decade of growth outperformance, it’s prudent to examine recent market shifts and what we believe they may mean for the 2020s.

Value investing2 began closing the gap to growth investing3 in August 2019. Since then, value stocks have surpassed their growth counterparts by 3.9%, with the S&P 500 Value Index returning 13.5% compared to 9.7% for the S&P 500 Growth Index.4

We believe these earnings-weighted, value-tilted strategies are positioned to outperform, especially if the value tide continues to turn.

Figure 2: Performance of the Core Equity Index Family

WisdomTree Core Equity ETFs

Our U.S. Core Equity Funds seek to track the price and yield performance before fees and expenses of our eponymous indexes.

Our U.S. Total Market Fund (EXT), from which our market cap-specific Funds are derived, tracks the performance of profitable companies within the broad U.S. stock market, weighted by earnings.

Our U.S. LargeCap Fund (EPS) tracks the 500 largest companies within EXT, while our U.S. MidCap (EZM) and U.S. SmallCap (EES) Funds track the remaining 75% and 25% in market capitalization of EXT, respectively, after the largest companies are removed.

Our earnings-weighted Funds can add value over market capitalization peers lacking a corrective mechanism to reduce exposure to overextended valuations. EXT, EPS, EZM and EES can be a smarter and more valuation sensitive way, in our view, for investors to achieve broad-based market exposure at the core of their U.S. equity exposure.

Unless otherwise stated, data source is WisdomTree, FactSet as of 12/31/2019.

1Ethan Rouen, Eric C. So and Charles C. Y. Wang, Core Earnings: New Data and Evidence (1/9/20). Harvard Business School Accounting & Management Unit Working Paper No. 20-047, October 2019.

2A style of investing with the primary objective of selecting companies with low valuations.

3A style of investing with the primary objective of selecting companies with the high fundamental growth.

4Source: S&P Global for the period 8/30/19–1/6/20.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read each Funds' prospectus for specific details regarding the Funds' risk profile.