DOMESTIC CORE EQUITY

Most indexes and the exchange-traded funds (ETFs) that track them weight stocks by market capitalization—a method that assumes price and market valuations are always the best measure of true value. But, when company, sector or market valuations don’t reflect the true underlying value, you may not only be paying higher prices but also taking on higher risks—and typically with far less reward. WisdomTree pioneered Modern Alpha® ETFs and the concept of weighting by earnings to help solve this challenge.

Why Weight by Earnings

At WisdomTree, we combine the promise of active investments with the benefits of ETFs to create Modern Alpha® ETFs that are built for performance.

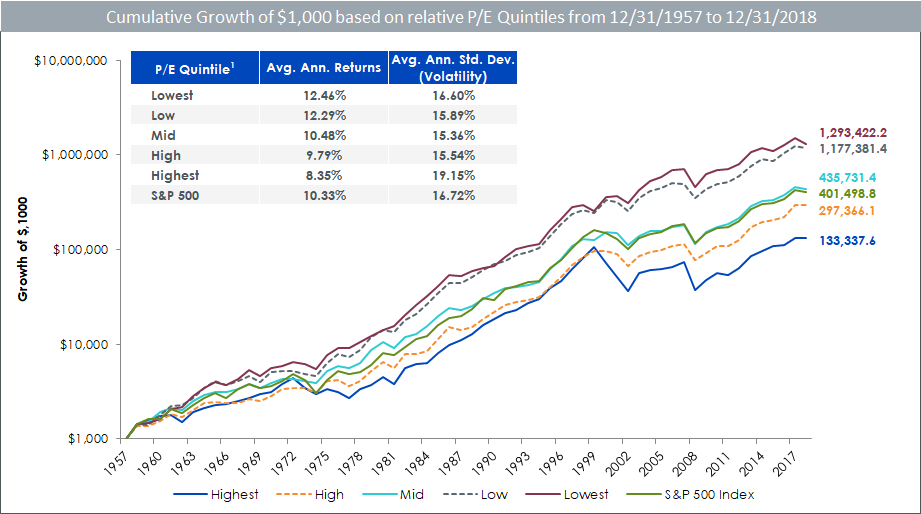

We believe fundamentals like earnings are a better indicator of underlying value than stock price alone. And, we believe that stocks with higher earnings—and therefore lower price-to-earnings (P/E) ratios—can outperform others. In the chart below, Wharton Professor Jeremy Siegel, a senior WisdomTree Advisor, demonstrates that stocks with lower P/E ratios outperformed those with higher P/E ratios.

At WisdomTree, we weight by earnings because we believe it can help lower the P/E ratio for the given market, manage valuations and magnify the effects that earnings have on risk and return characteristics.

How We Weight by Earnings

Our Modern Alpha® approach combines the performance potential of active management and the benefits of a passive index approach with all the structural and cost advantages of ETFs to create strategies designed to perform. For our earnings ETFs, we weight companies by the earnings they generate rather than by market cap. As you can see in the hypothetical example below, using the same initial investment and the same three stocks, the earnings-weighted portfolio has a P/E ratio that is more than 20% lower than the market cap weighted portfolio. We believe this can help enhance performance and reduce risk.

Source: WisdomTree. Hypothetical example for illustrative purposes only. Does not reflect an actual investment.

Rebalancing Based on Valuations

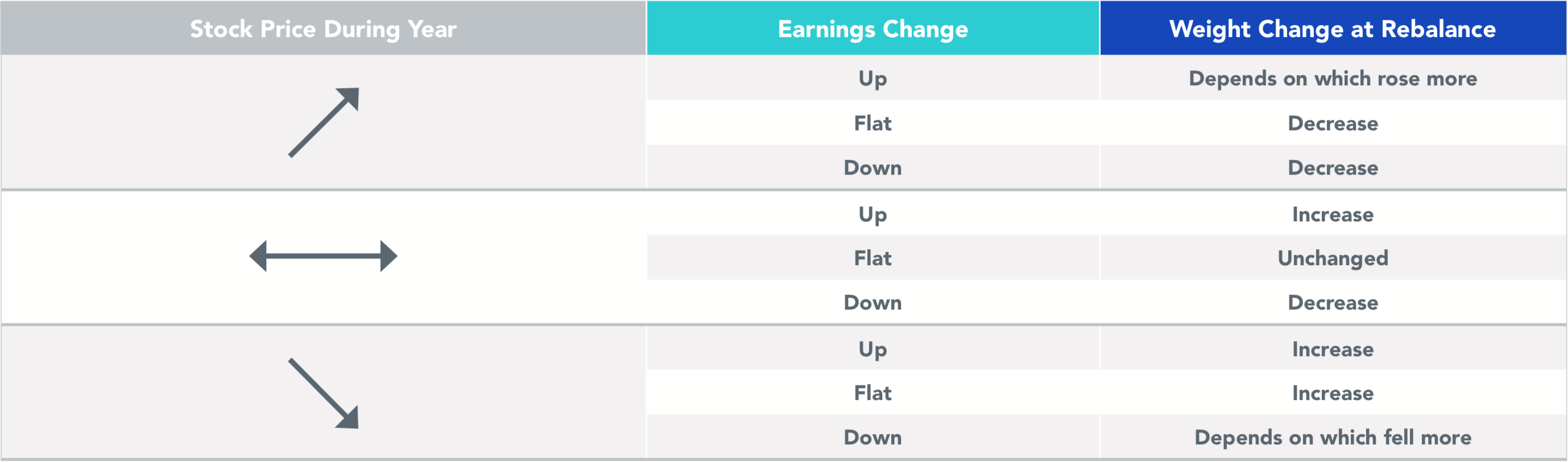

Perhaps the most important piece of our Modern Alpha® approach is the regular rebalance.

Periodically, we not only adjust weights back to relative value, but we also eliminate any companies with negative earnings. We believe this is critical to maintaining lower P/E ratios and helping ensure that investors don’t overpay for the markets.

Source: WisdomTree hypothetical illustration.

Our Domestic Core Equity Family

WisdomTree’s Modern Alpha® core earnings-weighted strategies combine the performance potential of active investments with all the advantages of ETFs. They are designed to help lower the price of the markets and magnify the effects that earnings have on risk and return.