Ramping Up Reform in Brazil

With an impressive professional background and academic pedigree, Mr. Levy represents the reform agenda that we believe Brazil needs. As Treasury secretary in Lula’s administration1 from 2003 to 2006, Mr. Levy helped effect a dramatic improvement in Brazil’s fundamentals that ushered in a golden age of growth for the country’s economy. No stranger to difficult tasks, he has the potential to help Brazil turn the corner. With government largesse clearly in need of restraint, Mr. Levy has announced that he will target fiscal surplus over the coming years to help improve fundamentals and increase business confidence.2 In our view, his appointment represents an acknowledgment by the administration that change is necessary. In recent years, the market had grown increasingly skeptical of Mr. Levy’s predecessor, Guido Mantega. This lack of confidence translated into a reversal of investment flows and a weakening of Brazil’s currency, the real.

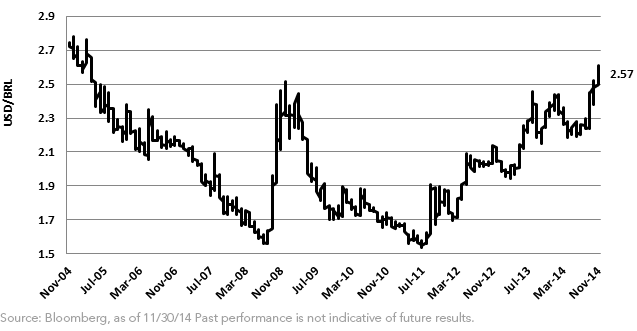

While transformation will clearly not occur overnight, in our view Brazil continues to represent a long-term opportunity for investors. Today, interest rates are among the highest in the emerging markets in both nominal and real terms. Additionally, the Brazilian real is trading at levels not seen since 2005.3 While the Bovespa Index is higher year-to-date, most U.S. investors are sitting on losses due to weakness in the currency.4 Cheap assets can continue to get cheaper, but we are more constructive on Brazil, given the governments focus on fundamentals. Should additional reforms have the intended effect, we believe the government can avoid an embarrassing credit rating downgrade and markets can trade higher.

In our view, investors should consider increasing allocations to the Brazilian real and locally denominated Brazilian bonds. While improvements will continue to occur over time, we believe that at current valuations investors are being adequately compensated for these risks. With a tacit acknowledgment from the government that change is needed, we believe that reformers such as Finance Minister Levy will help improve investor confidence and lift Brazilian asset prices over time.

1Luiz Inácio Lula da Silva, president of Brazil from 2003 to 2010.

2Source: Bloomberg, as of 11/27/14.

3Source: Bloomberg, as of 11/30/14.

4Source: Bloomberg, as of 11/30/14.

With an impressive professional background and academic pedigree, Mr. Levy represents the reform agenda that we believe Brazil needs. As Treasury secretary in Lula’s administration1 from 2003 to 2006, Mr. Levy helped effect a dramatic improvement in Brazil’s fundamentals that ushered in a golden age of growth for the country’s economy. No stranger to difficult tasks, he has the potential to help Brazil turn the corner. With government largesse clearly in need of restraint, Mr. Levy has announced that he will target fiscal surplus over the coming years to help improve fundamentals and increase business confidence.2 In our view, his appointment represents an acknowledgment by the administration that change is necessary. In recent years, the market had grown increasingly skeptical of Mr. Levy’s predecessor, Guido Mantega. This lack of confidence translated into a reversal of investment flows and a weakening of Brazil’s currency, the real.

While transformation will clearly not occur overnight, in our view Brazil continues to represent a long-term opportunity for investors. Today, interest rates are among the highest in the emerging markets in both nominal and real terms. Additionally, the Brazilian real is trading at levels not seen since 2005.3 While the Bovespa Index is higher year-to-date, most U.S. investors are sitting on losses due to weakness in the currency.4 Cheap assets can continue to get cheaper, but we are more constructive on Brazil, given the governments focus on fundamentals. Should additional reforms have the intended effect, we believe the government can avoid an embarrassing credit rating downgrade and markets can trade higher.

In our view, investors should consider increasing allocations to the Brazilian real and locally denominated Brazilian bonds. While improvements will continue to occur over time, we believe that at current valuations investors are being adequately compensated for these risks. With a tacit acknowledgment from the government that change is needed, we believe that reformers such as Finance Minister Levy will help improve investor confidence and lift Brazilian asset prices over time.

1Luiz Inácio Lula da Silva, president of Brazil from 2003 to 2010.

2Source: Bloomberg, as of 11/27/14.

3Source: Bloomberg, as of 11/30/14.

4Source: Bloomberg, as of 11/30/14.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in Brazil are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.